Bank credit to Non-Banking Financial Companies (NBFCs) has successively declined in the last four financial years. However, the credit to NBFCs in the first seven months of this fiscal year has increased by 13.3 percent in comparison to the last fiscal year. NBFCs are a major source of credit for the Micro, Small and Medium Enterprises (MSMEs) and therefore, the decline in loans to NBFC resulted in the credit crunch for MSMEs. NITI Aayog Vice Chairman, Rajiv Kumar has identified credit crunch to MSMEs as a major reason behind the economic slowdown in FY 17 and FY 18.

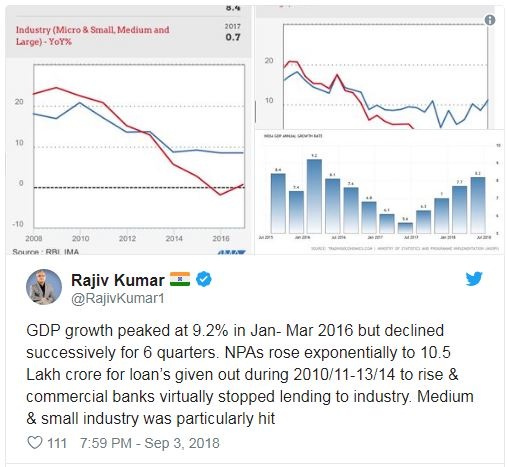

“GDP growth peaked at 9.2 per cent in January to March 2016 but declined successively for six quarters. NPAs rose exponentially to Rs 10.5 lakh crore — for loans given out during 2010-11 to 2013-14 — and commercial banks virtually stopped lending to industry. Medium and small industry was particularly hit” said Kumar. RBI started asset quality review (AQR) in December 2015 to ensure that lending practices become healthy. But in the cleaning process, banks were forced to slow down lending to NBFCs and thus lead to a credit crunch for MSMEs.

However, the bad days for NBFCs and Micro, Small and Medium Enterprises are over. The credit to NBFCs in the first seven months of this fiscal year has increased by 13.3 percent in comparison to the last fiscal year. The total bank credit to NBFCs in FY 18 was 4.96 trillion rupees while it stood at 5.62 trillion rupees in the first seven months of this fiscal year. The bank credit growth to NBFCs will end the woes of MSME for which NBFCs are a major source of loans. On the other hand, big companies may have many other sources of capital such as foreign direct investment, foreign portfolio investors (FPIs), foreign institutional investors (FIIs), debentures, and equities. But companies in the MSME sector are largely dependent on loans from banks and NBFCs for capital requirements. The hawkish policy for the cleanup of NPAs made loans scarce and this led to a slowdown in the economy and especially, the MSME sector.

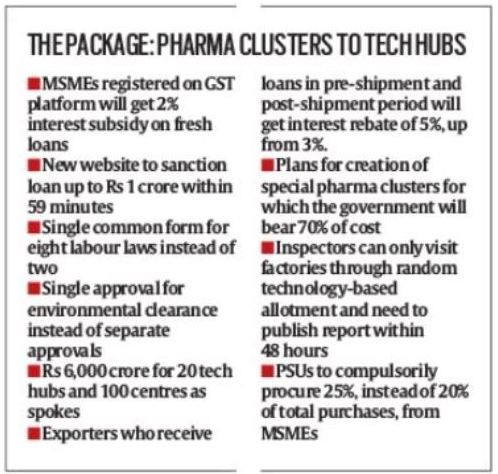

The double-digit economic growth which India envisions is not possible without the growth in the MSME sector. Micro, Small and Medium Enterprises is the second largest employer in the country after agriculture. The MSME sector was in doldrums due to credit crunch after banks tightened purse strings. The vast population of India could not be employed without the revival of the MSME sector. Therefore, the Modi government is making serious efforts for the revival of this sector. On Diwali this year, the government announced many steps to support the MSME sector including faster approval of licenses, easier and cheaper credit mechanism etc. The MSMEs registered under GST will get 2 percent interest subsidy on new loans. The government also launched a website named psbloansin59minutes.com to provide easier and time bound access to loans for MSMEs. “Yeh naya Bharat hai, isme bankon ke baar baar chakkar lagana khatam (This is New India, here you don’t need to go to banks again and again for loans),” said PM Modi while addressing MSME players from across the country.

Modi government has suggested the RBI to ease the bad loan resolution rules for the MSME sector. The MSME sector is performing better than the large companies. Bad loans in the MSME sector is at 11.5 percent while in large companies it stands at 19.5 percent. Now, RBI is set to extend the timeline for the stress recognition.