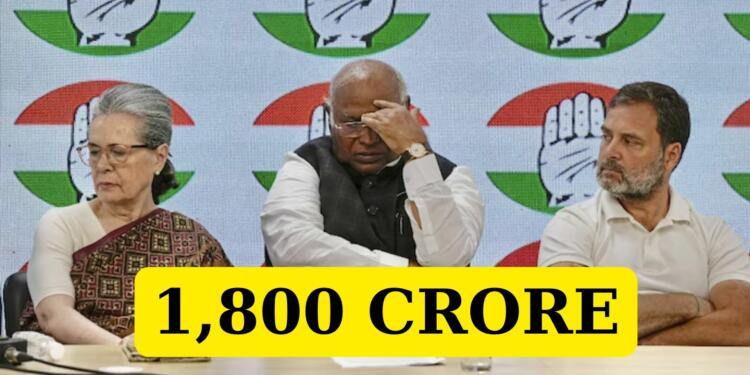

The recent developments surrounding the Congress party’s tax notice from the Income Tax Department have escalated into a significant political and legal battle. Following the rejection of its pleas by the Delhi High Court, the party finds itself embroiled in a contentious issue just ahead of the upcoming Lok Sabha polls. The notice of over Rs 1,800 crore has sparked allegations of “tax terrorism” by the BJP and accusations of selective targeting by the opposition.

Events Leading to the Tax Notice

The Income Tax Department initiated reassessment proceedings against the Congress party for the assessment years 2017-18 and 2020-21. This move followed allegations of financial irregularities and discrepancies in the party’s tax filings. In response to the tax reassessment proceedings, the Congress party filed petitions challenging the initiation of re-assessment for the aforementioned years. The party contended that the reassessment was unwarranted and politically motivated.

The legal battle culminated in the Delhi High Court, where the Congress’s pleas were rejected. The court upheld the Income Tax Department’s decision to proceed with the reassessment, dealing a blow to the opposition party’s legal defenses. Subsequent to the court’s ruling, the Income Tax Department served a notice to the Congress party, demanding over Rs 1,800 crore for the assessment years 2017-18 and 2020-21. The notice included penalties and interest, adding to the financial woes of the already beleaguered party.

The Tax Notice

The tax notice served to the Congress party by the Income Tax Department carries significant financial implications and has ignited a fierce political debate. The tax notice demands a staggering sum of over Rs 1,800 crore from the Congress party. This amount pertains to the assessment years 2017-18 and 2020-21, encompassing a substantial period of financial scrutiny. In addition to the principal tax amount, the notice includes penalties and interest, further exacerbating the financial burden on the Congress party. The imposition of penalties and interest compounds the party’s woes, adding to the already substantial financial strain.

Congress Party’s Response

In response to the tax notice, the Congress party has vehemently criticized the Income Tax Department’s actions and framed them within the context of “tax terrorism.” The Congress party has alleged that the tax notice is a politically motivated move orchestrated by the ruling Bharatiya Janata Party (BJP) to stifle opposition voices. By characterizing the tax notice as an act of “tax terrorism,” the Congress seeks to portray the BJP as resorting to underhanded tactics to undermine its political adversaries.

Also Read: Congress in Crisis: The Fallout of Vikramaditya Singh’s Resignation

Accusations of BJP’s Financial Irregularities

Alongside its condemnation of the tax notice, the Congress has launched a counteroffensive, accusing the BJP of financial impropriety. The party alleges that the BJP has engaged in malpractices, including the “electoral bonds scam,” through which it purportedly amassed substantial funds. By highlighting the BJP’s alleged financial irregularities, the Congress aims to shift the focus onto its rival’s purported misconduct, deflecting attention from its own tax woes.

Resistance and Defiance

Despite the daunting financial burden imposed by the tax notice, the Congress party has adopted a stance of defiance. Party leaders have declared their unwavering commitment to continue the electoral campaign unabated, signaling a willingness to confront the challenges head-on.

The party’s refusal to be cowed down by the tax notice underscores its determination to persevere in the face of adversity.

Political Implications

The tax notice served to the Congress party carries significant political ramifications, influencing its electoral strategies and shaping the broader political landscape in several ways. The tax notice diverts attention away from the Congress party’s electoral agenda and core issues affecting the electorate.

Instead of focusing on policy proposals and governance matters, the party is compelled to dedicate resources and energy towards defending itself against the tax allegations.

Perception of Financial Mismanagement

The tax notice may tarnish the Congress party’s image in the eyes of the electorate, casting doubts on its financial management capabilities. Voters may perceive the party as financially irresponsible or corrupt, potentially eroding its credibility and trustworthiness.

Strategic Response

The Congress party may recalibrate its electoral strategies in light of the tax notice, seeking to mitigate its negative impact on voter perceptions. This could involve emphasizing issues of transparency and accountability in governance, as well as aggressively countering allegations of financial impropriety.

Opportunity for Opposition Unity

The tax notice may galvanize opposition parties against the ruling Bharatiya Janata Party (BJP), fostering greater unity and cooperation among political adversaries. Opposition parties could rally behind the Congress, framing the tax allegations as part of a broader pattern of authoritarianism and repression by the BJP-led government.

Mobilization of Support Base

The Congress party may leverage the tax notice to mobilize its support base, rallying sympathizers and activists in defense of the party’s integrity. Appeals to party loyalty and solidarity could help bolster grassroots support and energize volunteers ahead of the upcoming elections.

Also Read: Yatra or Drama? Legal Limelight on Rahul’s Guwahati Clash

Appealing to Higher Courts

Following the rejection of its pleas by the Delhi High Court, the Congress party has the option to appeal to higher judicial authorities, including the Supreme Court of India. By petitioning the Supreme Court, the party can seek a review of the decision and challenge the legality and validity of the tax reassessment proceedings.

Legal Representation and Defense

The Congress party can engage legal experts and advocates to represent its interests in the ongoing legal battle. Experienced lawyers can formulate legal arguments, present evidence, and challenge the basis of the tax notice, thereby strengthening the party’s defense in court.

Asserting Procedural Irregularities

The Congress party may assert procedural irregularities or violations of due process in the tax reassessment proceedings. By highlighting any lapses in the conduct of the Income Tax Department or deficiencies in the assessment process, the party can undermine the legitimacy of the tax notice.

Public Advocacy and Awareness Campaigns

In addition to legal recourse, the Congress party can launch public advocacy campaigns to garner support and raise awareness about its legal battle. By mobilizing public opinion and galvanizing grassroots support, the party can exert pressure on authorities and influence the outcome of the legal proceedings.

Allegations of Selective Targeting and Bias

The Congress party alleges that the tax reassessment proceedings are politically motivated and aimed at harassing and intimidating opposition parties. By targeting the Congress party, the Income Tax Department is perceived to be acting at the behest of the ruling Bharatiya Janata Party (BJP), thereby undermining the principles of impartiality and fairness in governance.

Pattern of Selective Targeting

The Congress party contends that it is being selectively targeted by the Income Tax Department, while other political entities, including the ruling party, are spared similar scrutiny. This pattern of selective targeting reinforces perceptions of bias and partisanship within the tax administration, raising concerns about the integrity and independence of regulatory institutions.

Abuse of State Machinery

Accusations of abuse of state machinery and undue influence by the ruling party underscore broader concerns about the misuse of government agencies for political purposes. The alleged bias exhibited by the Income Tax Department reflects a broader pattern of institutional capture and erosion of democratic norms, posing a threat to the rule of law and constitutional principles.

Demand for Accountability

In light of allegations of selective targeting and bias, there are calls for greater accountability and transparency in the functioning of regulatory authorities. Civil society organizations, opposition parties, and concerned citizens demand an impartial investigation into the conduct of the Income Tax Department, with a view to upholding the principles of justice and equity.

Congress’s Stand and Future Course of Action

The Congress party, in response to the tax notice and subsequent legal battles, has adopted a resolute stance, emphasizing its commitment to continue the electoral campaign unabated despite the challenges it faces. Here’s an overview of the party’s stand on the issue:

Defiance and Resilience

The Congress party has demonstrated resilience in the face of adversity, refusing to be intimidated or deterred by the tax notice served by the Income Tax Department. Party leaders have reiterated their determination to persevere in the electoral arena, emphasizing their resolve to uphold democratic values and principles.

Unwavering Commitment to the Electoral Campaign

Despite the financial burden imposed by the tax notice, the Congress party remains steadfast in its commitment to the electoral campaign.

Party members and supporters are urged to rally behind the leadership and redouble their efforts to connect with voters and articulate the party’s vision for governance and development.

Assertion of Political Agency

By vowing to continue the electoral campaign unabated, the Congress party asserts its political agency and autonomy, signaling that it will not allow external pressures to dictate its course of action. The party’s stance underscores its resilience and determination to confront challenges head-on, projecting an image of strength and conviction to its supporters and adversaries alike.

Approach to the Supreme Court

In response to the Income Tax Department’s demands and the rejection of its pleas by the Delhi High Court, the Congress party is poised to escalate the legal battle by approaching the Supreme Court of India.

The Congress party will engage experienced legal experts and advocates to represent its interests before the Supreme Court. Legal counsels will formulate robust arguments, presenting evidence and legal precedents to challenge the validity and legality of the tax reassessment proceedings.

The party will file a petition before the Supreme Court, seeking a review of the Delhi High Court’s decision and relief from the tax demands imposed by the Income Tax Department.

Grounds for appeal may include procedural irregularities, violations of due process, and assertions of political bias and selective targeting by the tax authorities.

Emphasis on Judicial Independence

In its approach to the Supreme Court, the Congress party will underscore the importance of judicial independence and the rule of law in safeguarding democratic principles.

The party will advocate for a fair and impartial adjudication of the legal dispute, highlighting the need for accountability and transparency in the functioning of regulatory institutions.

The tax notice served to the Congress party has intensified the political discourse in the country, setting the stage for a contentious battle ahead of the Lok Sabha polls. As accusations fly and legal battles loom, the outcome of this saga remains uncertain. However, what is clear is that the implications of this episode extend far beyond mere financial penalties, shaping the narrative of electoral politics in India for the foreseeable future.