The core objective of a business is to earn profit, and in their eagerness to do this, they follow varied market instruments like mergers, acquisitions, and amalgamations. Profits depend on the base expansion of customers and capital. But the democratization of the market and competition around has limited that scope. So, companies in a race to establish their monopoly are trying to expand through acquisition, and this market domination zeal is costing them a lot.

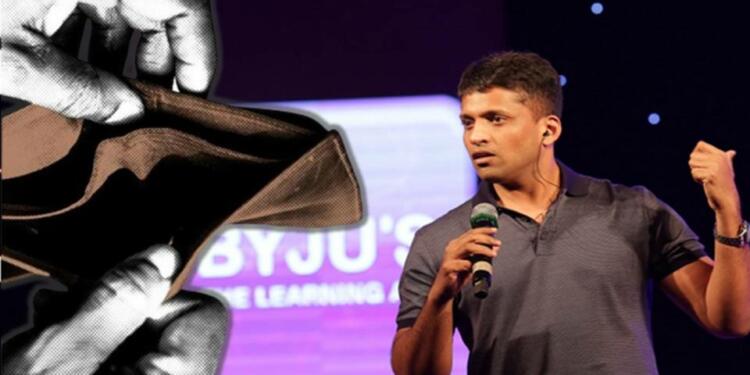

BYJU’s delays payment to Akash deal

According to news reports, BYJU’s has sought an extension from Blackstone and other former stakeholders of the tutorial chain Akash Education Services. BYJU’s spokesperson informing about the delayed payment said, “Akash is our most successful acquisition to date and we are very proud to have them in our fold. The acquisition process of Akash is fully on track and all payments are expected to be completed by the agreed-upon date which is August 2022”.

“Along with all our group companies, we continue to be perfectly poised to provide access to quality education in all learning segments from early learning to exam prep and career success,” the spokesperson added.

It is pertinent to note that last year BYJU’s had made a deal with Aakash Educational Services Limited (AESL) at $950 million in cash and stock payments. The deal is said to be one of the largest buyouts by any start-up. Earlier, the largest buyouts were Snapdeal’s purchase of Freecharge for $400 million and Flikpkart’s purchase of Myntra for an estimated cost of $300 million.

Also Read: Energy Drinks: A Classic case of inventing a problem to sell the solution

Product of the digital revolution

BYJU’s, the multinational educational technology company, was founded in 2011 by Byju Raveendran and Divya Gokulnath. The current valuation of the company is USD 22 billion and has over 115 million registered students. Entering the age of digitalisation, BYJU’s growth trajectory was mostly inclined toward the online education model. Coinciding with India’s own digital revolution, the company made a global presence in a very short period of time.

The technique of teaching students with 10-20 minutes of digital animation videos made significant improvement in the learning experience of pupils. The company is now focusing on developing BYJU’s Future School, which will, according to the company, ‘inspire kids all over the world to fall in love with learning’.

The success in a very short span of time has provided the company with a huge funding base and the valuation of the company is estimated to be around $22 billion. A huge inflow of money has also provided the company with manoeuvring capacity for acquisitions.

Buyouts and buoyancy

Early market success and huge money inflow helped the company to acquire many budding start-ups and in the spree of buyouts, dozens of them were acquired. The major buyouts of the company are:-

| Acquired companies and their domain | Buyout Year |

| ● Vidyartha, a data-driven platform offering customized learning guidance. | January 2017 |

| ● TutorVista and Edurite from UK-based Pearson. | July 2017 |

| ● Math learning platform Math Adventures.

| July 2018 |

| ● US-based educational gaming company Osmo for $120 mn. | January 2019 |

| ● WhiteHat Jr, which teaches coding to children, for $300 mn. | August 2020 |

| ● Virtual simulations startup LabInApp. | September 2020 |

| ● Doubt clearing platform Scholr. | February 2021 |

| ● Tutoring firm HashLearn. | May 2021 |

| ● Aakash Education Services for $1 bn. | April 2021 |

| ● US-based digital reading platform Epic for $500 million. | July 2021 |

| ● Great Learning, professional and higher education player for $600 mn. | July 2021 |

| ● Whodat computer vision start-up working on augmented reality products | August 2021 |

| ● Gradeup, one of India’s largest online exam preparation platforms in September 2021. | September 2021 |

| ● US-based Tynker, a leading K-12 creative coding platform in September 2021 | September 2021 |

| ● Austria-headquartered GeoGebra that provides collaborative mathematics learning tools in December 2021 | December 2021 |

If we analyze the above-mentioned chart, then it can be said that the frequency of buyouts increased immensely after the Pandemic. The complete lockdown and online education program would have provided the company’s strategists with the idea that the education market will now completely shift to virtual mode. This forecast was announced by many other Indian companies. But the lifting of lockdown restrictions and ease of the pandemic wave brought businesses back to normal in offline mode.

So, the investment dried up in buyouts and the shift of business to offline mode limited the sources of revenue. The expectation of business to shift the whole education system into virtual mode had a break and huge buyouts started to pose financial constraints to the company.

Also Read: In a decade or two, Parle will be forced to stop producing Parle-G

Recently, Gaurav Munjal the cofounder of Unacademy indicated the same and said that the company needs to focus on profitability as ‘the funding winter is here’. BYJU’s, which was sustaining and expanding its businesses with a huge spring of funding, now has to face the winter. The shift of business to offline mode has now started to reflect in the company’s strength.

The acquired subsidiary of BYJU’s has now started to shorten its strength to manage the financial difficulties. According to a report, BYJU’s subsidiaries Toppr and WhiteHat Jr. have laid off at least 600 jobs combined. The layoff is reported to be attributed to the payment delay of AESL acquisitions. It is pertinent to mention that in the last year BYJU’s has acquired at least 10 edtech startups and the total transaction value of them is estimated to be $2.5 billion. But the reopening of schools, colleges, and coaching centres have dried up the revenues and the company is facing a huge payment crisis.

The extensions of payment dates and layoff of employees suggest that the mass expansion strategy of the company seems to be failing. In an effort to establish its monopoly, the company expanded its business and incurred a huge burden of payment. Now, facing a winter of funding inflows, the company seems to be in huge trouble. The pathway of BYJU’s can be equated with the SAHARA groups. As SAHARA expanded its business in projects like Aamby Valley City, Sahara Movie Studios, Air Sahara, and hockey sports, Filmy wrote its downfall story. BYJU’s also expanded its businesses in unreasonable manners and is now facing the same kind of financial difficulties.

Support TFI:

Support us to strengthen the ‘Right’ ideology of cultural nationalism by purchasing the best quality garments from TFI-STORE.COM