Despite all the groundbreaking efforts by the government, the good days of the Chinese economy remain far away. Private and public companies are moving towards a record-high corporate bond default. A corporate bond is issued by a corporation in order to raise finances for a variety of purposes, like supporting ongoing operations, merger & acquisitions (M&A), or to expand the business. The term is usually applied to long-term debt instruments with a maturity of at least one year. Many Chinese companies went default on bonds with bond yields being very high. Bond yields witness a rise when the value of the bond goes down. The value goes down when the demand is less.

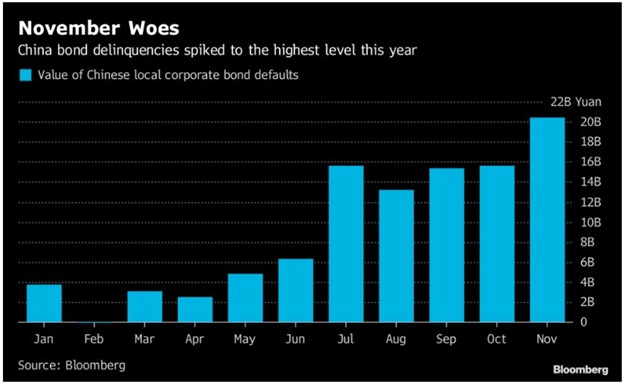

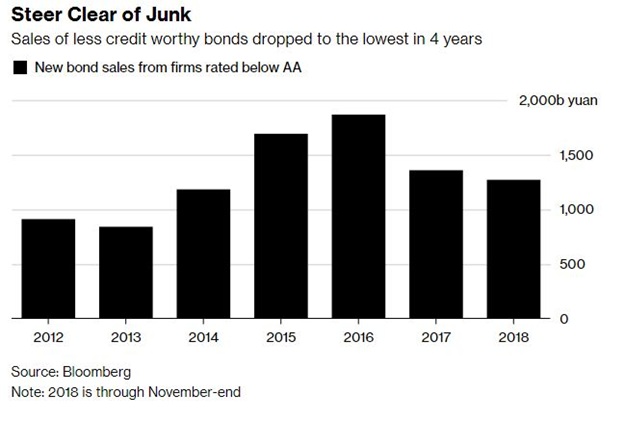

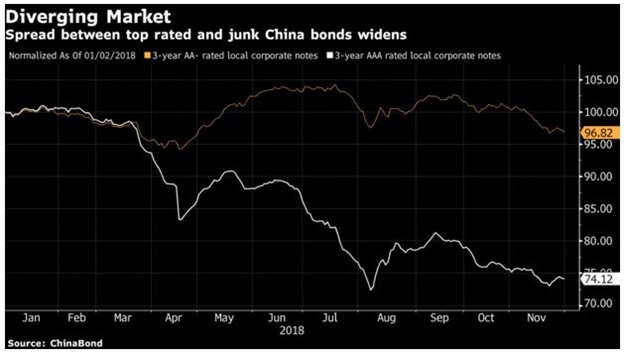

According to data compiled by Bloomberg, so far this year, the Chinese companies have gone default on bonds worth 20.4 billion Yuan (3 billion dollars) of public bond payments. In the year, 2016, the default on bonds was worth 20.7 billion Yuan but it soon is set to be crossed this year. Moreover, at this pace, the defaults by the end of the year would be almost five times that of last year. Sale of junk bonds reached a four year low to the level of 2014 and the gap between the sale of top-rated bonds and junk bonds has become the highest in the last two years. The Chinese economy is slowing down despite the repeated government efforts to pump more money in the system by easing out credit. Last month People’s Bank of China (PBOC) announced to provide 10 billion yuan (1.4 billion dollar) credit support for the purchase of bonds but it seems that it did not work.

“Defaults will stay elevated next year because the Chinese economy is expected to slow and off-balance-sheet lending has been shrinking,” said Yang Hao, analyst at Nanjing Securities. “The funding environment has yet to improve significantly for certain corporations,” he added.

The investment risk appetite in China has decreased significantly this year because the bonds rated below AA were sold at 1.27 trillion Yuan in the last 11 months of this year which is the lowest in last four years. AA+ rated bonds worth 3.28 trillion Yuan have been sold this year which is 40 percent more than the total sale of last year. This shows that investors’ confidence in the Chinese economy is declining since the last two years as the sale of junk bond is moving southwards. The wide gap between top-rated bonds and junk bonds shows that investors are interested in squeezing out profit from top performing corporations but are skeptical about China’s economic performance. “Though regulators have rolled out a slew of supportive measures, defaults will continue to be “normal” in 2019 if companies fail to address inappropriate debt structures and high levels of share pledging,” read a report by Industrial Securities Company.

Reputed credit rating agencies are downgrading Chinese firms at an unprecedented rate. Most of the money invested in the domestic corporate bond market is from local investors because the bulk of international investors prefer government-linked securities ever since China boosted access to its bonds in recent years. Earlier, the bonds issued by the Chinese government used to be significantly low as compared to that of the United States or Japan. The companies are also facing problems in refinancing the maturing debts because the banking system in China is heavily state-dominated. The state-run Chinese banks are not willing to lend to private companies because they fear bad debt issues in the future due to a slowdown in economic growth.

The Chinese economy is in huge problems over the last few years. It no longer holds the tag of the fastest growing major economy in the world. The Chinese economy is heavily dependent on exports, and with countries across the world imposing high tariffs on imports, the global trade war is bound to hurt China. Donald Trump has vowed to balance the trade relations between two countries, which he claims are significantly skewed in the favor of China. International investors are no longer risking on China as they don’t find Chinese companies able to give good returns in such a protectionist environment. Global investors are pulling money out of China to invest in US government bonds and in other markets like India and Indonesia because investors expect better returns from these economies. The economy of India is driven by domestic consumption rather than exports, so it is bound to grow even in the midst of a global trade war. Domestic consumption accounts for almost two-thirds of the Indian GDP, and a combination of structural reforms in the economy and a burgeoning middle class will only help it grow further.