The single rate GST structure, similar to the kind Congress had proposed, failed miserably in Malaysia and the newly elected Prime Minister, Mahathir Bin Mohamad, announced that he would scrap the 6% GST rate. The Indian government and policymakers were smart enough to rule out the single rate GST proposed by the Congress Party. Had the BJP government implemented a single rate GST, India’s GST would have met the same fate as that of Malaysia’s. A single rate would have caused inflation in essential commodities like food, medicine, essential services etc., and the elites of the country would have benefitted, because in a single rate GST, as Arun Jaitley rightfully said ‘Hawai chappal and Mercedes car would have been taxed at the same rate.’

In a bid to test the efficacy of a single rate GST structure as compared to the multi-slabbed GST structure that we have currently, Rightlog.in has calculated the prices of goods and services in the following 8 categories:

1.) Food Items

2.) Clothes & Apparels

3.) Automobile

4.) Education

5.) Medicine & Hygiene

6.) Cosmetics

7.) Consumer Electronics

8.) Services

Please note that we are considering a single standard tax of 18% on all items, as proposed by the Congress party.

When GST rate is capped at 18%, this Govt would have learnt its lesson belatedly.

— P. Chidambaram (@PChidambaram_IN) November 10, 2017

We have taken sample representatives from each section (the number of sample representatives depend on the respective categories) in order to calculate the price difference. For instance, a midrange car worth Rs. 5,50,000 to represent cars, onion to represent vegetables and sanitary napkins to represent personal hygiene.

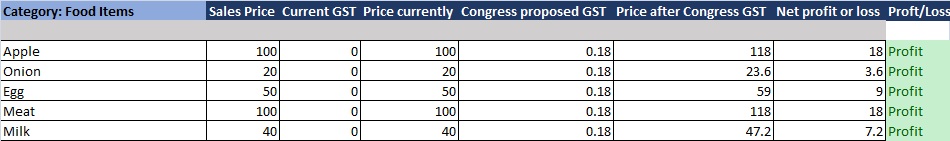

Category 1: Food items

Current GST rate: 0%

Assumption: Since Congress has proposed a single rate GST structure, we assume that they would apply the same to food items as well.

As we can see, had the Congress model been implemented, it would have caused massive food inflation (the prices of food would have gone up) and poor people and the middle class would have suffered the most from this. The Congress party, despite all its pro-poor posturing, simply did not consider poor people and the tax ridden middle class in its proposed GST model.

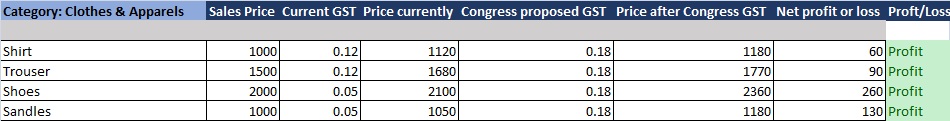

Category 2: Clothes & Apparels

Current GST rate: 5% and 12%

Again, the verdict is loud and clear. Under the Congress proposed model, all of these items would have been taxed at 18% GST, while under the current setup, shirts and trousers are taxed at 12% GST rate and shoes and other footwear at 5% GST rate.

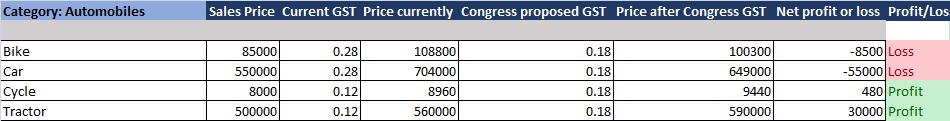

Category 3: Automobiles

Current GST rate: 12% and 28%

When automobiles are taken as the sample category, all these items would have been taxed at 18 % as compared to the 28% tax that applies to cars and bikes currently. However, cycles and tractors are put under the 12% GST bracket. Hence, while people would have saved a decent amount while purchasing a car or a bike, they would have lost quite a lot of money on the purchase of cycles and tractor.

Some points to consider: A family purchases a car or a bike once in five or six years, so even if they must pay more tax on it, the overall burden is so insignificant that it would not be a major problem. Cycles are the vehicles of the poor and the underprivileged, while tractors are their lifelines. The Congress structure does come across as a very rich favoring setup, very suit-boot-ki-sarkaarish.

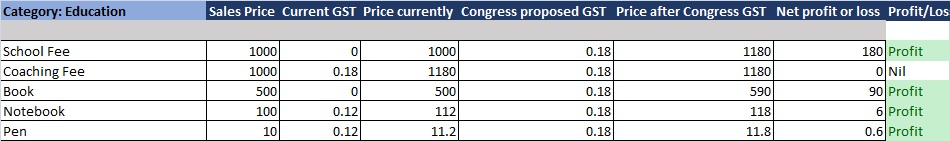

Category 4: Education

Current GST rate: 0%, 12% and 18%

In the current GST setup, school fees and books are taxed at 0%, notebooks and pens at 12% and coaching fees at 18%. In a flat tax rate structure, this flexibility would not have existed, thereby taxing both school fees and coaching at the same 18% tax, disregarding the essential fact that school education is a fundamental right and coaching is clearly a luxury.

The verdict is that there would have been zero gains at best, and huge losses in almost every representative section.

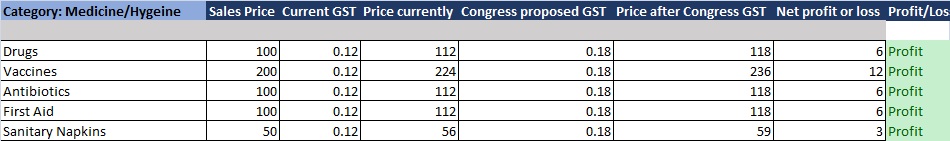

Category 5: Medicines and Hygiene

Current GST rate: 12% and 18%

Moving on to medicines, most of which are taxed at 12 %. In a flat tax rate they would have been taxed at 18 %, which would have made healthcare facilities costlier.

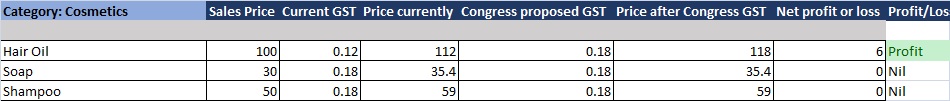

Category 6: Cosmetics

Current GST rate: 12% and 18%

Again, the takeaway is very similar. There would have been zero gains at best had we been following the Congress’ GST model, and losses in many representative sections.

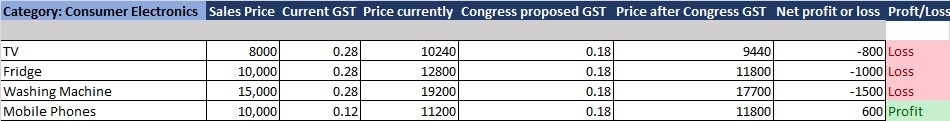

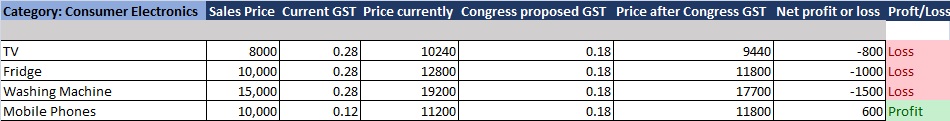

Category 7: Consumer Electronics

Current GST rate: 12% and 28%

Most of the consumer electronics are currently taxed at 28 % except mobile phones which have been kept under the 12 % tax bracket owing to their indispensability. The Congress proposed model seems to be winning here but then again no one buys a TV or a Fridge or an AC or a Washing machine every year. The life span of these products typically ranges from 5 to 7 years. Mobile phones on the other hands are more frequently purchased in which the current setup seems to have a clear edge as illustrated in the table above.

Category 7: Services

Current GST rate: 0% and 18%

All the essential services are taxed at 18 % currently. Electricity, which has been the cornerstone of the government’s policy, is taxed at O% making it a tax-free service in India. It reinforces the government’s dream of supplying 24*7 power to every household.

However, in the Congress proposed model, electricity would have been taxed at 18%, thereby making an essential service a costly service for most Indians.

Following the electricity example, railway tickets are taxed at a much lower rate of 5%, thereby bringing down the transportation costs for common people significantly. This is completely in sync with the “Antyodaya” ideology of Sangh ideologue Deen Dayal Upadhyay. Through multiple tax slabs, according to the need of the people and society, the government is fulfilling its “Antyodaya Mission”.

Conclusion

Had the government followed the Congress proposed model, its Antyodaya dreams would have remained unfulfilled. The GST model proposed by Congress is an elitist model at best in which essential commodities and luxury goods would have been taxed at the same rate. The Malaysian government which brought GST with single tax rate model in 2015 scrapped it in 2018. Congress party should have taken a leaf out of the Malaysian example and have done some course correction, but they stuck to the same old tune, crooning it like a trained parrot at the mere mention of GST.

The only thing the Congress party has learnt in its last four years in the opposition benches is to oppose every move by the present government. The grand verdict is out- the Congress model of GST would have been a failure of gargantuan proportions.