Before answering the question why Swamy chose to Attack Raghuram Rajan, here’s a Disclaimer: This is going to be a long article. Request everyone to read it.

Lets get a few things straight, saying that “writing about Dr. Raghuram Rajan, is an uphill task”, is a huge understatement. Honestly, writing this article is a very uphill task; because throwing out popular opinion is not right, writing an article about a stalwart like Dr. Rajan should be extremely fact based, even before giving merit to what Dr. Swamy says. While, the statements given by Dr. Swamy are just a trigger, the pot has been boiling for some time now. With Dr. Rajan in the last few months of his tenure; its quite amusing that Dr. Swamy needed to blurt out; maybe he intends to block his re-appointment or express his dissent towards it or maybe he is indeed directed to act accordingly; we may never know.

Let first build a context; starting with what Dr. Swamy lashed out over Dr. Raghuram Rajan saying QUOTE:

“In my opinion, RBI Governor is not appropriate for the country. I don’t want to speak much about him. He has hiked interest rates in the garb of controlling inflation that has damaged the country,” he told reporters in Parliament House. The governor’s actions have “led to collapse of industry and rise of unemployment in the economy”, he said. “The sooner he is sent back to Chicago, the better it would be,” he added.

These comments have gotten everyone in a tizzy and has stirred a hornet’s nest. There are News articles all supporting Rajan for his commendable job as RBI Governor. Well, our page has always been supportive of Dr. Swamy; however, we have immense respect and gratitude for Dr. Rajan. After this, Dr. Swamy wrote a letter to the Hon., Prime Minister asking him to sack Raghuram Rajan. The two key points mentioned in the letter were, that Dr. Rajan used WPI as a measure of inflation and second (an absolute stupid one) that he renews his Green Card so he is ‘mentally not Indian’. The second statement made by Dr. Swamy is absolute childish, so someone to sit there and make decision which shape the entire nation and saying his is not Indian; is absolute gibberish. Given, that there is no point in the second argument rationally lets ignore it as a child’s rant.

Frankly, Dr. Raghuram Rajan ‘s stature overshadows some the most stalwart Politicians, Economists, Speakers and even past RBI Governors. After his predecessor, Dr. Subbarao he would be the most outspoken. For the benefit of our readers, we have posted Dr. Rajan’s CV in the notes to article, have a look at it as well. Both he and Dr. Subbarao became RBI Governors when Central Banks of the world were in a turmoil and global banking system were and are in a Crisis mode. Having said that, we do find merit in what Dr. Swamy says.

Before jumping the gun on “Oh! Come on you are Sanghi / Right-winger” read through and make your call.

As of now, every business news outlet is up in arms in defense of Dr. Raghuram Rajan; which is a safer route to adopt. It is similar to saying look at the NPA Scam, one more UPA creation. However, we are taking a hard line calling a spade a spade and believe things are not rosy on Dr. Rajan’s side. There is merit in the fact that, Dr. Rajan has been extremely hard on banks; in fact hard would not be right word, but I would say, there has been a lack of Surgical Approach in solving the banking crisis. However, I believe, we should not get carried away with either Dr. Rajan or Dr. Swamy. We need to take a pragmatic look at the issue at hand.

Having said that, now it is important for us and you to understand what is RBI’s mandate or say what the Job Description of Dr. Raghuram Rajan. It is best summed up in speech by Dr. Subbarao’s speech in May 2011 as under:

RBI has a mandate that is wider than is typical of central banks. The preamble to the RBI Act, 19342 describes its main functions as “…to regulate the issue of Bank Notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage.”

This preamble indicates the two core functions of the Reserve Bank:

(i) issue of currency; and

(ii) monetary authority.

The Act also entrusts other functions to the Reserve Bank such as:

- regulation of non-bank financial institutions,

- management of foreign exchange reserves,

- management of sovereign debt – by statute in respect of central government and by agreement in respect of state governments, and

- regulation of forex, money and government securities markets and their derivatives.

Even as the Reserve Bank’s statutory mandate is wide compared to that of other central banks, what really sets us apart is the key role the Reserve Bank has had in driving India’s development agenda.

Against this background, in simpler term the RBI is entrusted with three tasks:

- Regulating interest rates

- Regulating banks

- Managing exchange rates

- Managing and monitory currency

We have decided to make this article in 2 parts. Covering as under:

Part 1: Covering Inflation and Interest rates

Part 2: Dealing with NPA crisis, sustainability and lack of surgical approach in solving the issue

We are critical of Dr. Raghuram Rajan ‘s certain policies, however, we must applaud the degree of transparency he has brought in the system. The level of database available now is phenomenal. In fact, there is more clarity on Indian banking system, the reports published by RBI are phenomenal. We have too much to learn from the man. Yet, we believe some issues are misplaced; and lets take on one-by-one.

Part 1: Covering Inflation – Dr. Swamy vs. Dr. Rajan

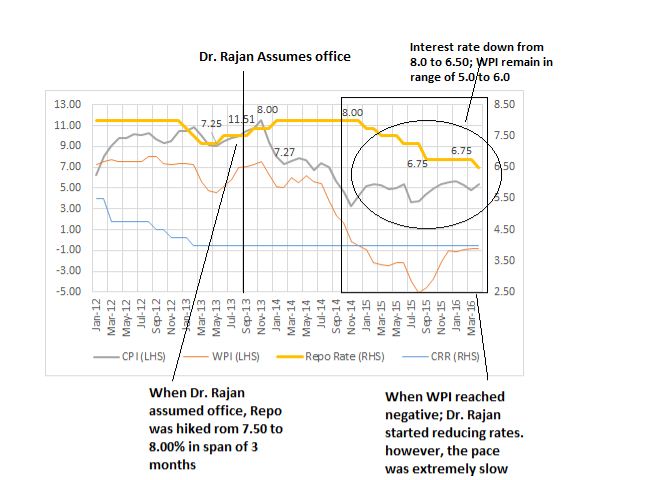

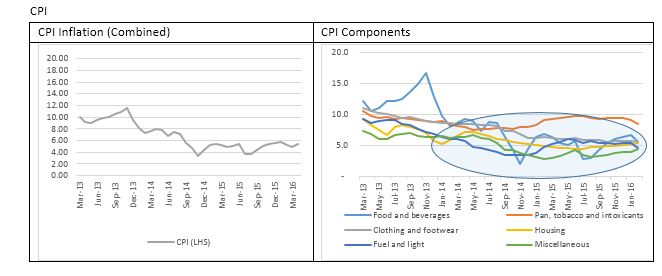

Dr. Raghuram Rajan assumed office in Sep 2013. This is just about 8 months prior to NDA’s victory. It can be seen that when Dr. Raghuram Rajan assumed office the CPI was in double digit. As soon as he came to office in Sep 2013, he raised the interest rate from 7.50% to 8.0%. This was followed by a prolonged period of no-reduction of interest rate. In fact, the inflation slowed down drastically with WPI hitting the negative zone. This negative zone triggered a serious of reduction. However, these reductions were always a small measure.

It is pointed out by Dr. Swamy that Dr. Raghuram Rajan changed the measure of Interest for RBI from WPI to CPI which led to focus on CPI. Having gone over the definition of both WPI and CPI, we find merit in what Dr. Swamy says; as CPI measures only few aspect.

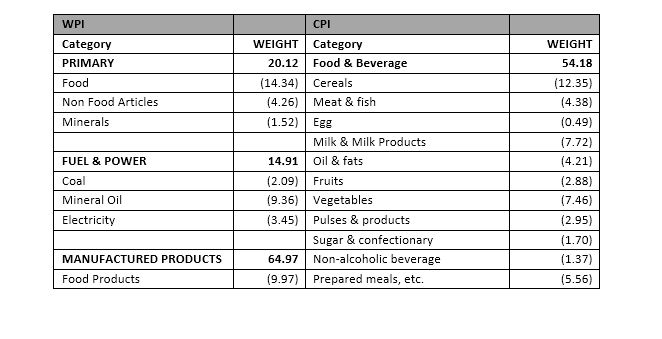

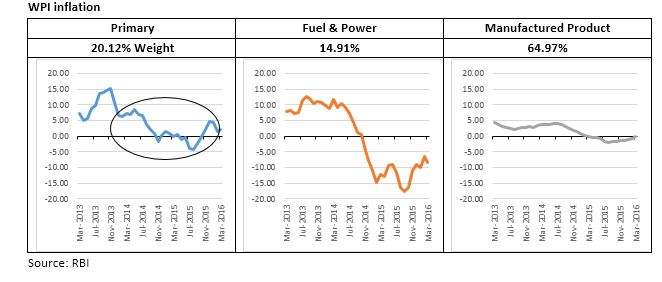

The following table shows a comparison between WPI and CPI

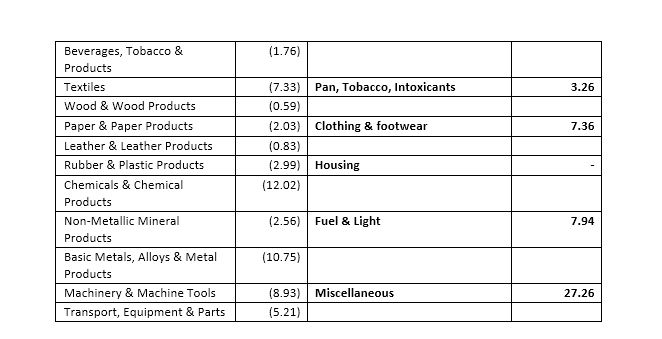

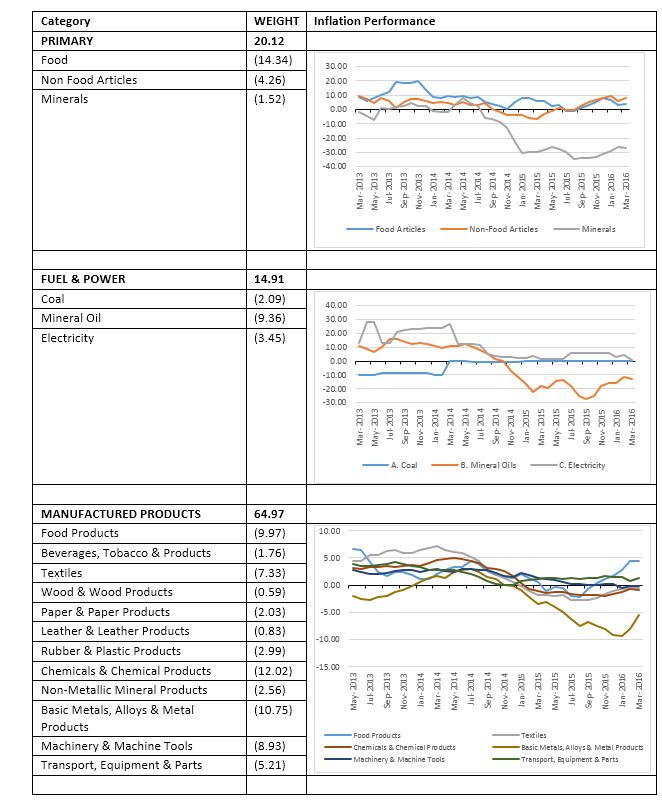

However, let’s look at the components of inflation, importantly

WPI inflation

GETTING INTO MORE SPECIFICS OF WPI

If we look at the above table, the WPI measures the entire economic activity of the nation, while CPI focuses on fewer products which measures inflation in the hands of end user. In fact, in CPI the Food, Beverage and Pan related is 57.4%; while in WPI it is 26.1%. This itself is a huge distortion for measuring Inflation in the context of nation. The CPI gets impacted to a huge extent by Supply-side distortions. For example agricultural commodities have a huge gap in what Farmers receive and what we pay. The entire CPI does not capture manufacturing products which are also purchased or even services which are rendered which see an inflationary impact. In fact, Mr. Ridham Desai in an interview rightly had pointed out that WPI is real measure of inflation. It is a producer price index. To see how Producer Price index impact, lets do a Dosa Economics vs. Pencil Economics. Hope, the reader have heard about Dosa Economics, if not watch the video on YouTube where Dr. Raghuram Rajan talks about Dosa economics.

Dosa Economics vs. Pencil Economics

Dosa Economics functions on CPI while Pencil Economics on WPI. So lets try Pencil Economics.

- Suppose you are manufacturer of Pencils; and now, you are selling a high-end Pencil at say Rs 10 per unit while your all costs are Rs. 8.50, so you as a manufacturer are Rs. 1.50 per unit.

- When we say your WPI is negative means that there is overall reduction in the prices, so Pencil is getting sold at say Rs. 9.00 per unit and your cost of Rs.8.50 reduces to Rs. 8.00 per unit.

- Now, you would say the input prices of Pencil should also reduce; you are spot on there. But, the cost of Rs. 8.50 includes fixed costs such as rent, salaries, and importantly INTEREST.

- Thus, the manufacturer was earlier making a profit of Rs. 1.50 per unit, and now he is making Rs. 1.00 per unit.

- Simply put, why would a manufacturer of Pencil put a new plant, and if profit is reducing the manufacturer shall not indulge in any expansion, because he has no incentives for expanding; further .

- One might argue, he should innovate and find a better margins, but to innovate you need to go through R & D which requires money. With a reduction in the cash flow in hand to the manufacturer from Rs. 1.50 to Rs. 1.00, the manufacturer will start pushing bank for reducing the rate of interest.

- However, with a higher provisioning norms the Bankers hands are tied as bank’s profits are getting wiped off with NPA provisioning and RBI is not reducing the rates. Given this situation the manufacturer would not do any expansion, in fact he will be thriftier and try to stop spending.

- So, in the end we are in a difficult cycle; with no major growth.

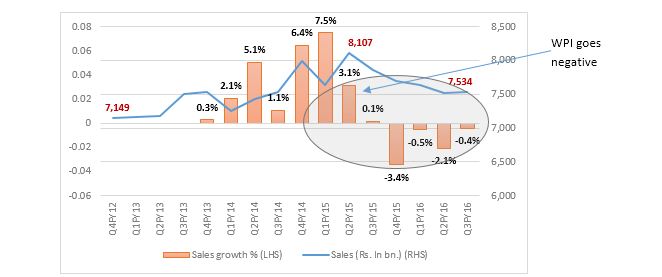

To explain this, lets put out few numbers of deterioration of financing capacity of companies in India, as published by RBI. RBI publishes an average of 2740 companies in India (large companies, which drive the businesses for all companies). Now, we conducted an analysis of key numbers on an overall basis from Q4FY12 to Q3Fy16. The findings were quite startling as you can see from the charts below:

- The sales have been down every Quarter for the last 5 quarters in fact they are negative. In fact, the total sales in Q4FY12 was Rs. 7149 bn , which has seen marginal uptick inQ3FY16 to Rs. 7534 bn. If we average our sales to per reported company, the sale average per entity has remained constant at Rs. 275.37 cr. This has led to huge on industry. The havoc lies here.

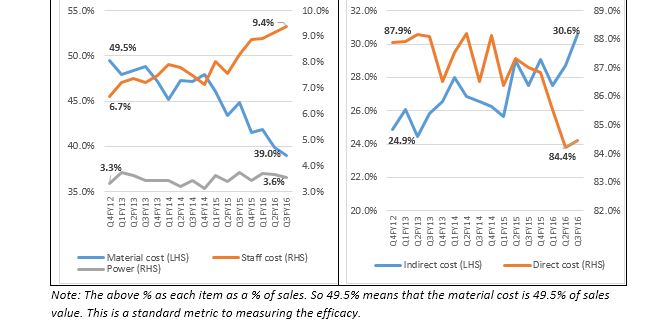

- As pointed out in the Pencil Economics, the direct material cost has declined, however the Salary and wages cost has remained stable and at the same time, the Power cost has remained constant.

This has led to a reduction in direct cost, but is sharply offset by rise in Indirect costs. As we can see in the charts below the while there is a fall in direct costs, the indirect cost which are fixed in nature have risen sharply.

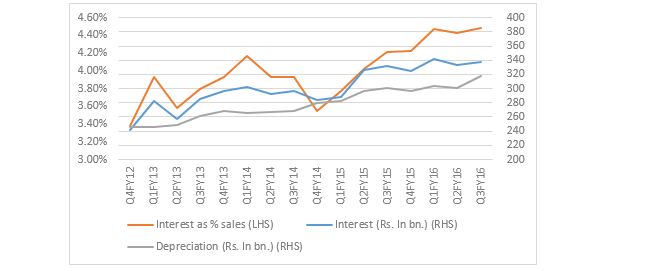

2. The third and the most important part is Interest cost. The interest cost has increased from Rs 241 bn to Rs. 338 bn. The average interest cost per company has increased from Rs. 9.30 cr., to Rs. 12.34 cr.; while there has been a 110 BPS increase in Interest cost as a % of sales from 3.38% in Q4FY12 to 4.48.

Now, you would say interest would have increased because of new debt. Hence, we added depreciation as a measure to the chart. The depreciation cost has in totality increased from Rs. 246 bn to Rs. 317 bn; while on average basis increased from Rs. 9.45 cr., to Rs. 11.60 cr.

The key highlight here is the average rate of growth of interest has been 8.1% while depreciation growth has been 6.7%; pointing to a fact that there has been hardly any major capex, in fact the companies are paying interest rate probably on their working capital limits.

3. The third and the most important part is Interest cost. The interest cost has increased from Rs 241 bn to Rs. 338 bn. The average interest cost per company has increased from Rs. 9.30 cr., to Rs. 12.34 cr.; while there has been a 110 BPS increase in Interest cost as a % of sales from 3.38% in Q4FY12 to 4.48.

Now, you would say interst would have increased because of new debt. Hence, we added depreciation as a measure to the chart. The depreciation cost has in totality increased from Rs. 246 bn to Rs. 317 bn; while on average basis increased from Rs. 9.45 cr., to Rs. 11.60 cr.

The key highlight here is the average rate of growth of interest has been 8.1% while depreciation growth has been 6.7%; pointing to a fact that there has been hardly any major capex, in fact the companies are paying interest rate probably on their working capital limits.

The above charts and underlying data shows there is a tremendous pain in the industry. The companies in India are choked for liquidity. In fact, the SME segment has been worse hit. I go to various banks because of my profession as an investment banker and see that things have become very bad for the Borrowers. Bankers today are unwilling to lend without collateral.

Having said all the above, we have seen Dr. Raghuram Rajan multiple focusing on Quality of Balance Sheets, Financials be it for the companies, banks or the Government.

Both Mr. Narendra Modi and Dr. Raghuram Rajan inherited a broken financial regime. The CAD was higher, currency was hitting lows, inflation was higher.

In this crisis, both of them have managed to build a quality financial for the country; we are already Current Account surplus nation. In this scenario, we have fixed the Quality problem in India. Quality of India’s financials as well the quality of Indian banks. Now, is the time to go for growth.

We are not calling for growth to be driven only by rate cut by Dr. Raghuram Rajan; but also uptick in Public spending by the government. We believe, there is headroom for about 50 BPS to 100 BPS rate cut; which should be followed by targeted government spend. This shall be critical in achieving real growth in the economy.

Now, lets combine the two, that there has been a fall in CPI, WPI in negative (which is a difficulty for long run) and fall in sales in economy, companies not delivering results, slow-down in capex and increase in interest burden. The claims of slowdown in capex etc., are not word-based in next article I will put adequate numbers for you to be convinced.

I will drive one point here, which will be elaborated in the next part, is that the highest growth in lending from banks has been “Mortgage Loans”. What does that mean? Well, it means one thing that banks are more concerned on Collateral property available rather than Project on hand; and two, that people / entrepreneurs / companies need to have collateral before they get any loans from banks. Frankly, the value of collateral for Manufacturing sector loans is anywhere between 20% to 40% of loan amount, depending on promoter net worth. Simply put, if you are going for Rs. 100 cr., loan for a project, you better have properties worth Rs. 20 to Rs. 40 cr., in hand excluding your project which can be given as collateral to bank; else even if your project is bankable, it might not go through.

Along with RBI data Research for the article, I have gone over lot of article written supportive of Dr. Raghuram Rajan. IN fact, latest support for Dr. Rajan is Digvijaya Singh. We believe this is adequate testament that its an easier thing to do is Support Rajan. I found these articles rather funny, frankly because these article were written by people sitting in their editorial rooms. In fact, most of the article don’t mention author except for Swarajay Mag one. The FirstPost article has FP staff, NDTV has some Varun Sinha who writes sensationally even company results news. Anyways, the main point here is: inflation in India is a supply side crisis (as mentioned above for 57% of CPI component, which won’t get solved even you reduce interest rates or not. Hypothetically, because your interest rate is less by 50 BPS we will not buy 5 KG of Potato instead of 3 KG. Taking interest rate only from a CPI perspective ignores the rest of the country. Again, the WPI is down because of an extreme bearish Commodity price cycle; and the CPI reduction to some extent is due to the same. Bearish commodity cycle is a continuous period of decline in the commodities such as metals (steel, iron ore, aluminum, copper), oil, etc. The prices in India would be lowered and WPI would anyways be lower, with or without higher rates of interest. Secondly, if there is a drought situation the prices of agriculture commodities will be higher; any we may need to import a few. Again, continuing with the Potato example, if we need 3 KG potato a week, even if the rate of interest is lowered but price of potato is higher due to it been imported, we may consume a bit lower on Potato. The point we wish to drive here is that its high time we be pragmatic. The reduction of inflation is combination of multiple factors covering:

- Decline in global commodity prices

- Tighter monetary regime

- Policy measures adopted by NDA government

There is an article in Hindu which says “If public sector banks, due to poor judgment or a few well-placed phone calls from political bigwigs, have given out loans to the wrong kind of corporate borrowers during boom years, do you expect the regulator to keep quiet about it?”. Seriously, is getting a loan from a bank that easy?? How many financing of Debt proposals have you done? It is fashionable nowadays to say that PSU Banks gave money just like that to XYZ. You make a phone call and get loan.

Please bear in Mind, we are neither in anti-Rajan or anti-Swamy camp. We are in camp, which sees fault in some of actions of Dr. Raghuram Rajan; and believe the economy could have done better with some rate cuts.

So, Dr. Raghuram Rajan, please loosen up a bit; we have seen Quality in India’s financials, lets go for Growth now.

PS: Part 2 will cover the NPA menace, Dr. Raghuram Rajan’s approach and What Next?

Annexure:

Understanding individual inflation components

Notes:

Central Bank Governance Issues : Some RBI Perspectives

(Comments by Dr. Duvvuri Subbarao, Governor, Reserve Bank of India at the meeting of the Central Bank Governance Group in Basel on May 9, 2011.)

https://www.rbi.org.in/scripts/BS_SpeechesView.aspx?Id=563

Raghuram Rajan CV: https://www.ifk-cfs.de/fileadmin/downloads/dbprize/2013/Rajan_CV_for_media_Sep2013.pdf

Some links supporting Dr. Raghuram Rajan