Look at the person sitting next to you. Anyone. They could be a shop owner, milk seller, friend, one of your parents, your fiancee, or your roommate. What are the similarities between you and them? For one, you both are sapiens and have similar features. Similar, not congruent. And that is where the debate about equal outcomes should die down. But proponents keep claiming that everyone deserves an equal share of society’s wealth. To ensure the fructification of their fantasy land, they are ready to go to any absurd extent possible. And that is how wealth tax made its entry into the economic literature. A 15-minute reflection on the concept is enough for anyone to move on to better thoughts. But, as they say, common sense is not so common.

Demand for wealth tax intensifies

As soon as COVID struck, the demand for punishing Indians for their competitiveness started to gain traction. Increased earnings by a few percent of individuals were being shown as a sign of something inherently and structurally wrong with the system. Articles on bringing back wealth tax regimes are being published. Even half-crooked surveys are there, claiming that as many as 80 percent of Indians want rich people to pay more tax. First of all, the survey includes the opinions of 3,231 people. That is an extremely small sample size, but our great media finds it worthy to publish and drive the narrative.

Coming back to the point, there are a few key arguments in favour of a wealth tax. Let’s look at them to find out why and how they are wrong. Firstly, a concise and precise definition of wealth tax would be helpful.

The term

Wealth tax is simply a tax on the assets that one currently owns. If an authority wants to collect wealth tax from someone, it has to take into account everything named after him or her. These include overall income, gems and jewellery, a house, shares, bonds, debentures, and other assets. After finding the total value of them on a particular date, the government asks the wealthy to pay for it. It’s different from income tax in the sense that you pay income tax only once, while wealth tax applies to any new assets you add to your financial arsenal.

Arguments in favour of wealth taxes and problems with them

Proponents of wealth tax have their reasons to love it. They claim that if not taxed properly, it could lead to the incessant accumulation of wealth. This argument is problematic on two levels.

Firstly, it assumes that the accumulated wealth is not the result of hard work. We have a simplistic belief that wealth is either the product of tyrannical control or is inherited. A part of that may have been true around three decades ago. But the assumption has eroded rapidly, especially with India’s push towards business in the last decade. We have billionaire startup founders who belong to middle-, low-, or lower-class families.

The second inherent assumption is that what these people accumulate, they only spend on themselves. You know, foreign tours, expensive parties, sitting on the beach with margaritas. The critics just fail to acknowledge that wealth has a tendency to trickle down the economic ladder.

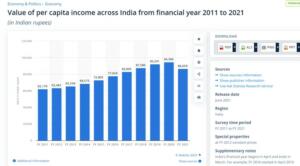

The other argument in favour of a wealth tax is that of inequality. In other words, a small percentage of the population is able to access a major chunk of resources, while a large section remains bereft of those resources. Studies after studies show that income inequality is a problem. According to the latest World Inequality Database, the top 10 percent of wealthy Indians have 65 percent of the country’s wealth. The corresponding figure for the bottom 10 percent is only 6 percent. During COVID times, the numbers got worse as the rich doubled their income while the per capita income of the average Indian dropped.

PC: Statista

Tax the rich

Their solution for this disparity is to just tax the rich. Going deeper into the argument will tell you that it relies on the modern concept of the welfare state. Taxing the rich translates to filling up the government’s coffers with more money. This money can then be used by the government to provide services that are mandatory under the welfare state regime. These include free food grain, a clean water connection, a subsidy on electricity, and other benefits. The economic logic behind it is that the government spending the money accrued by rich people creates a demand cycle, benefiting the national economy in the final analysis.

Sounds absolutely logical and commonsensical. Right? Of course, and that is the beauty of every rational—or should I say irrational—argument given by the left. It’s just that the solution only worsens the problem.

The effects are debilitating

What transpires in real life is that rich people start to refrain from relying on the government. It is not rocket science. These people are not always engaged in corruption, as the media would tell you. Apart from maintaining contacts, these people work more than 80 hours per week. They are hard workers, conscientious, and industrious. Now, if they are putting in so many hours in their work, they would definitely want a return on investment. That is how the human brain works, and that is exactly how industrial units work.

Most of them earn money to create more value. Their money creates more money only because the initial money has been invested in something more productive. This investment helps the population through new production lines, new jobs, and an increase in the area’s source of income.

Now, if they get to learn that the more money they earn, the government will be charging more taxes, what will be the impact on them? They feel disincentive to earn more and put money back in the economy. These people start to move to destinations that impose less tax, or in some cases, no tax. This phenomenon is called capital flight. The French wealth tax regime serves as a prime example of this phenomenon.

According to Eric Pitchet, the French wealth tax regime helped the government earn $20.8 billion between 1998 and 2006. Now comes the funny part. To earn this money, France missed out on $125 billion worth of investment. For context, in FY 2006, FDI in India was less than $10 billion.

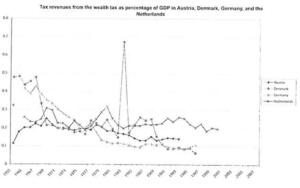

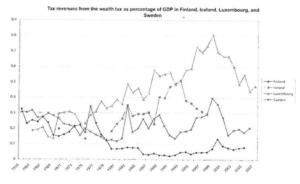

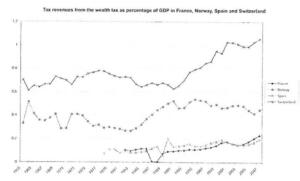

France is not the only country that has given its support to the concept. Austria, Denmark, Germany, the Netherlands, Finland, Iceland, Luxemburg, Sweden, Norway, Spain, and Switzerland are other major countries that have flirted with this concept. Most of them had to abolish it altogether. The reason is simple. The expectation was that wealth tax revenues as a percentage of GDP would increase. That did not transpire at all.

PCs: UVI

Reasons for failure

As you can see in these graphs, in more than 90 percent of cases, it even failed to cross the threshold of 1 percent. That is literally the definition of pathetic.

There are reasons for these failures. These are mainly logistical and technical reasons. One of them is the government not setting the appropriate rate, as they were aware of capital flight but also wanted to avoid it. Classic case of populism taking over common sense. Then there are estimation and liquidity-related issues.

Given how dynamic the market is, it is next to impossible to find out the accurate price of a particular item. Even if that issue is overcome, how will the wealthy pay their taxes? The big players keep their money in illiquid assets. Most of them just do not have enough cash to pay the authorities. In Austria, these problems resulted in high economic costs of collection, turning wealth tax into that toy that costs more than the child.

India’s tryst with wealth tax was and will always be a failure

In fact, this is the main reason why, in his 2015 budget speech, the late Shri Arun Jaitley decided to get rid of wealth tax in India. Before putting forward the proposal, he asked the audience. Shri Jaitley replaced it with a surcharge of 2 percent on those whose taxable income exceeded Rs 1 crore.

In addition to that, almost everything held by wealthy people is already taxed. These include tax on capital gains, gifts, shares, dentures, other financial instruments, and not to forget real estate. All in all, the maximum marginal rate of income tax on India’s super-rich is 42.74 percent. The room for more taxation is really cramped up, especially after the introduction of surcharges.

Even if we leave these rich people’s problems aside, a wealth tax only inhibits more people from contributing towards the nation’s development. Where will MSMEs go? They contribute 30 percent of our economy and more than one-third of total income tax collection. Basic common sense tells us that their owners can’t afford wealth taxes. Any such measure would simply short circuit India’s economic journey till date.

Despite clear evidence existing against it, the left keeps pushing for a wealth tax. This kind of tax is driven by envy on the part of the majority of common folks. Politicians and academicians push it only to get popular.