A few weeks ago, when it became evident that the new management at Yes Bank is not being able to attract any new investment for revival, the RBI- the bank regulator of the country- took over and placed restriction on withdrawal of cash from the bank.

After that, the government and the RBI was left with two options- either revive the bank or merge it with any public sector banks. Usually, whenever a private bank collapses, the government merges it with any large PSB, as happened in the case of PMC and several others before that. This is the easiest way forward for the government as well as for the management.

But with merger, the retail investors and the depositors were at risk, and most importantly, the faith of the people in private banking was bound to be lost. Therefore, the government chose the second way and roped in public and private players for the revival of the bank.

The government as well as the RBI is aware that despite the accumulation of huge NPAs and mismanagement by the promoter- Rana Kapoor, the bank has great brand value, given its first class service to customers.

The Modi government announced the plan for revival of Yes Bank on March 14 and announced that the moratorium will be lifted by March 18 and shares surged by 58 percent on March 17 after Moody’s upgraded the outlook of the company to positive from negative.

SBI, the largest public sector bank, decided to pick up 49 percent stake of the 255 crore shares for 2,450 crore rupees. Besides RBI, ICICI Bank, Kotak Mahindra Bank, HDFC and Axis Bank have also approved investment of Rs 1,000 crore, Rs 500 crore, Rs 1,000 crore and Rs 600 crore respectively.

Today, RBI announced to extend 60,000 crore rupees lifeline to RBI for the functioning. With the combined effort of RBI and the government, the Yes bank has become functional once again. As witnessed on 18 and 19, there is no mad rush among the depositors for withdrawal, which means that they have posed faith the revival plan of the union government, and expect the bank to recover the avalanche.

The revival of the Yes bank is very important for the story of the private sector banking in the country. After the government started liberalized the banking sector in 1990s, Yes bank became one of the big success stories in private banking, along with ICICI bank and HDFC.

In 1999, Ashok Kapur (ex-country head of ABN Amro bank), and Rana Kapoor (ex-head of corporate finance at ANZ Grendlays Bank) came together to start a non-banking financial company in partnership with Rabobank of Netherlands. Basically, two top level ex-bankers and some professionals wanted to start a new bank in partnership with a foreign entity.

Given the clout of Ashok Kapur and Rana Kapoor in global banking industry, the entity got banking license in 2004 and went for IPO in 2005. To go for IPO just after a year of establishing the business was something unheard in India; however, Kapur’s successfully listed the bank at the stock market. And in subsequent years, Yes bank became one of the flag-bearer of private banking in India.

However, in the last few years, the success stories of private sector banking like ICICI bank and Yes bank suffered many setbacks. And therefore, the revival of Yes bank was essential to restore the faith of common people private banking.

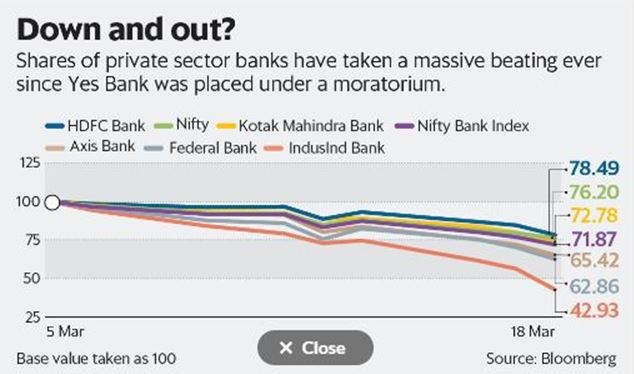

Since 5 March, when the Reserve Bank of India (RBI) put Yes Bank Ltd under a moratorium, the shares of private banks including better managed ones like HDFC, were on nosedive drive. With moratorium lifted and resumption of full operations by the bank from March 18, it is expected the other private banks will be able to recover.

The revival of Yes Bank was much required. Given the back to back failure of two private sector banks- Yes Bank and PMC Bank, this was bound to have domino effect on other private sector banks. In the last few days, it was witnessed that the depositors have started pulling out the money from private sector banks, especially the smaller ones like RBL bank, IndusInd bank.

From the banking history of last five decades- after Indira Gandhi government nationalized all major banks of the country in 1969- it is very clear that banking sector could not be left in the hand of the government. Today, the banking sector is the weakest chain of Indian economy with just one bank in top 100, and therefore, consolidation and privatization is the need of the hour of the banking.

But if the major private banks fail back to back, it will be tough pose the faith of the common depositor in the private banking. Therefore, the revival of Yes Bank is required not only to insure the depositor’s money, but also to restore the faith of the common people in private banking.