Despite all the groundbreaking efforts made by the government, the good days of the Chinese economy are slipping away. Private and public companies are moving towards a record-high corporate bond default. A corporate bond is issued by a corporation in order to raise finances for a variety of purposes, like supporting ongoing operations, merger & acquisitions (M&A), or to expand the business. The term is usually applied to long-term debt instruments with a maturity of at least one year. Many Chinese companies defaulted on bonds with high bond yields. Bond yields rise when the value of the bond goes down with low demand.

Given the record high bond defaults, analysts downgraded or issues sell ratings to 84 mainland listed companies. Previously in the second week of last month 345 billion dollars were wiped out of Chinese markets just by a single sell rating on one stock. The Shanghai composite index lost 4.4 percent of its valuation in a single day due to a rating downgrade. As per an analysis by Bloomberg, this is the highest down gradation in the month of March since 2011.

Earlier the Chinese state used to come to the rescue whenever there was some slippage in bond markets. But given the fact the the Chinese government does not want a bubble to be formed, it is reluctant to help this time. “The strong indication that the state is interested in curbing overheating has probably invited some rethinking here,” said Jingyi Pan, market strategist at IG Asia Pte Ltd. in Singapore. “Concerns over growth have added more momentum to these downgrades,” he added.

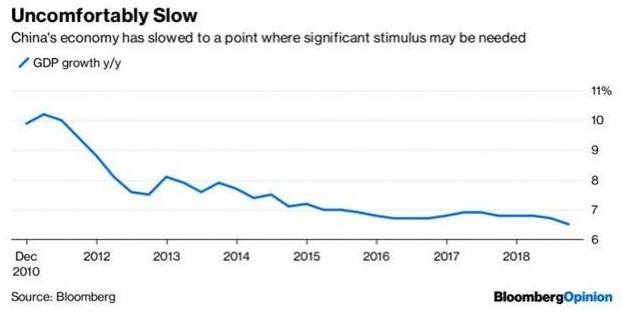

The investors are no longer optimistic about the Chinese growth story. The country has posted quarterly growth of 6.5 percent in the September quarter. This is the lowest quarterly growth in the decade and China has never been in such a bad condition since the global economic slowdown of 2008-09.The Chinese economy is downward trajectory but still, the official government data projects 6-7 percent GDP growth. There are few takers of Chinese growth story now, the economists and analysts across the world questioned official growth figures released by the Chinese government. The slowdown in real estate which contributes to more than 25 percent in the GDP is the real reason that there are no takers of Chinese official data.

The trend in the last few months gives a clear indication that the Chinese growth story is over. For almost 4 decades, the Chinese economy registered near double-digit growth but now it is not able to sustain the same. In fact, a research paper published by Brookings Institution argues that the provincial authorities in China inflated growth figure for nine years. The paper’s analysis covers the period of 2008 to 2016 and it was found that the communist government inflated the growth figure by 2 percentage points. Therefore the actual size of the Chinese economy is one-seventh (almost 16 percent) smaller than what is being claimed by The National Bureau of Statistics of China.

Global investors are pulling money out of China to invest in US government bonds and in the markets of other economies like India and Indonesia because they expect better returns from there. The economy of India is driven by domestic consumption rather than exports, so it is bound to grow even in the midst of a global trade war. But the Chinese economy is facing a double whammy as domestic consumption is slowing down and exports are poised to take a hit due to the trade war. The control freak communist regime needs to make some outstanding efforts to redeem the China’s economy.