Pakistan’s Stock Exchange (PSE) has shed 8 percent of its value since the 14th of February 2019, the day the dastardly terrorist attack on a CRPF convoy took place. Following the death of, the prospect of escalation between India and Pakistan increased. Any further conflicting situation is expected to hurt Pakistan most and therefore foreign Institutional Investors started pulling money.

Pakistan’s stock exchange with trading floors in Karachi, Lahore and Islamabad has plunged by 3,025 points or 7.46 percent since February, 14 to close on 37,518 on Wednesday. On the other hand Bombay Stock Exchange shed only 205 points or 0.57 percent of value since the day of attack on CRPF convoy.

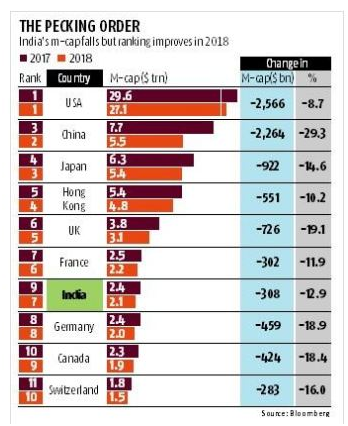

As of February 2018, the total market capitalization of Pakistan is 84 billion dollars compared to 2.1 trillion of India. Therefore the market capitalization of India is almost 25 times more than that of Pakistan. The Indian stock market is the seventh largest in the world behind US, China, Japan, Hong Kong, United Kingdom, and France.

Pakistan fears that any full-fledged war which the poor country could not afford. The economy of the country is in deep trouble with only 7 billion dollars of foreign exchange reserves. The country could finance imports of less than two months with this amount. International Monetary Fund, the global lender to which Pakistan is going to solve the balance of payments crisis, for 13th time in the last four decades, will be apprehensive to lend if the country goes to war.

FATF, the global terror financing watchdog, which has put Pakistan on ‘grey list’ criticized the country for not being able to act against JeM and other terrorist organizations operating within the borders of the country. In any war situation, the country will be vulnerable to being ‘blacklisted’. The United States has already voiced against IMF loans to Pakistan if the money is used to pay back China. US President Donald Trump has supported India’s right to self-defence in the wake of Pulwama attack.

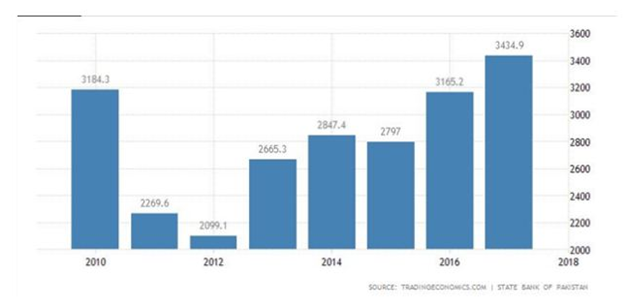

Foreign Direct Investment (FDI) in the country touched a six month low of 132.2 million dollars in January 2019. This is a 59 percent drop from the 319.2 billion dollars received in the previous month, reported the State Bank of Pakistan. In the first seven months of the fiscal year 19 (the Pakistani fiscal year is from July to June), FDI dropped by 18 percent to 1.45 billion dollar compared to 1.76 billion dollar in the same period of the previous fiscal year.

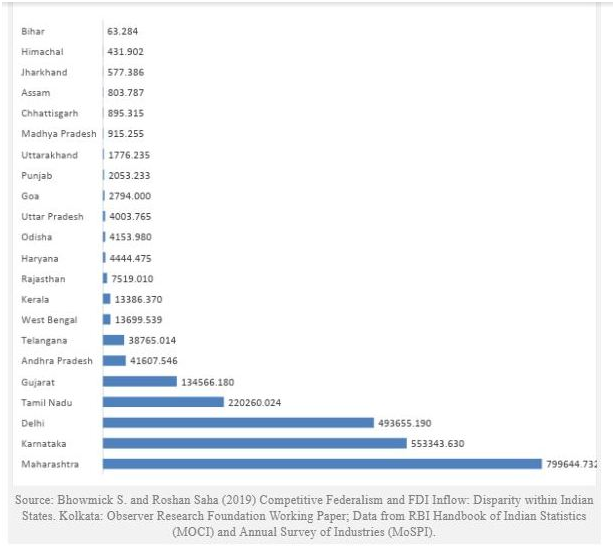

The FDI received by Pakistan last year is around 3 billion dollars. In an average year, India attracts 10 to 20 times more FDI than its western neighbor. In the fiscal year 2017-18, at least four Indian states (Maharashtra, Karnataka, Delhi and Tamil Nadu) received more FDI than Pakistan. Maharashtra received 11 billion dollars in FDI which is almost four times that of Pakistan. Karnataka received around 7.7 billion dollars which is two and a half times the amount invested by foreign entities in Pakistan. Delhi received 7 billion dollars in the fiscal year 2017-18, more than double of the amount received by Pakistan. Tamil Nadu attracted FDI almost equal (3.08 billion dollars) to that of Pakistan’s.

As Pakistan is at the brink of war, the economy of the country is in doldrums. The GDP growth of Pakistan is estimated to be to hit nine-year low in the ongoing fiscal year (July-June). India on the other hand is fastest growing economy in the world with estimated rate of 7.3 percent in the current fiscal year.