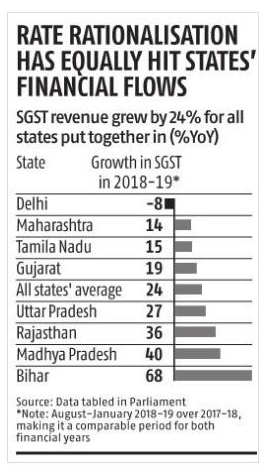

The positive impacts of GST are visible within just one and a half months of implementation. The greater revenue of consumer states like Bihar, Uttar Pradesh, and Madhya Pradesh used to bag a small proportion of indirect taxes because indirect tax laws were skewed towards manufacturing states. But since the implementation of GST, the collection of State Goods and Service Tax (SGST) has grown exponentially. SGST revenue has grown by 24 percent for all states put together but the growth was highest for poorer states like Bihar and Madhya Pradesh where collection grew by 68 and 40 percent respectively. For the wealthier more industrialized states, revenue grew at less than 20 percent. However, the Central government is compensating these states for any revenue shortfall.

“As GST design stabilizes, poorer states will have greater revenue growth as they are net consuming states. Tax base will increase more for the consuming states, compared to producing states,” said Pinaki Chakraborty, professor of economics at the National Institute of Public Finance and Policy. However, this is not a common pattern across the country as the revenue for the some states like Punjab and Kerala is lower despite their being consumer states.

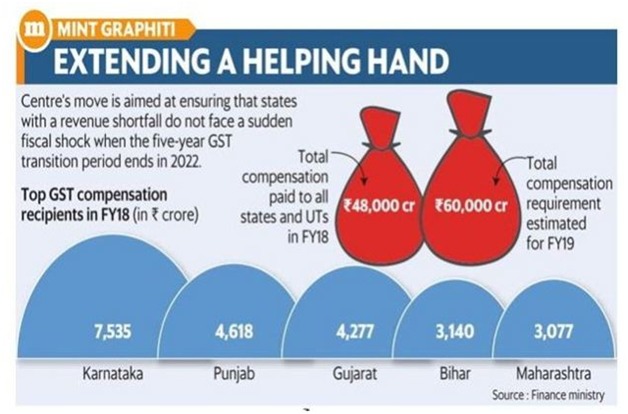

The constitution already has had a provision for compensation to the states for 5 years after the implementation of the GST. So, the Centre is set to compensate the states till June 2022. But the Modi government in order to make GST the best example of cooperative federalism wants the indirect tax reform to succeed without taking a toll on states’ revenues. The 15th Finance Commission which has an operational duration of 2020-25 will prepare a blueprint for additional compensation to states. So, the compensation period will extend to June 2025 with three years of additional compensation. The central government has planned to create a ‘backstop facility’ to compensate the states in case of any shortfall during GST collections.

Considering 2016-17 as the base year, the Centre will compensate the states in case of any shortfall in GST collection for the next five years with 14 percent of annual growth as per collections that year. Last year, the central government compensated all the states and union territories with a total amount of 48,000 crore rupees. The compensation for this year would be even higher because this time full fiscal year is in consideration instead of 9 months in the last fiscal year.

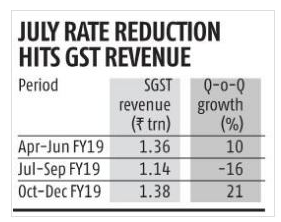

The rationalization of taxes in July during the previous year has impacted the revenue growth of states. The State Goods and Service tax (SGST) fell by 16 percent quarter on quarter (Q-o-Q) for the July to September quarter. The SGST for the second quarter was FY 19 was 1.14 trillion rupees compared to 1.36 trillion rupees for the previous quarter. However, the revenue grew to 1.38 trillion rupees for the third quarter which is 21 percent higher compared to the same quarter of the previous year.

The highest revenue shortfall was witnessed in the state of Punjab which agreed to subsume 3 percent cess on farm produce under GST. Tamil Nadu, Maharashtra, Delhi, and Goa also witnessed revenue shortfalls. But at the same time, consumer states like UP, Bihar, West Bengal and northeastern states registered a jump in the indirect tax collection. These states are relatively poor and hence increased tax collection will help them increase capital expenditure and welfare spending. On the other hand, the Centre will take care of the states in which revenue witnesses a decline. Therefore, GST is a win-win game for all the states as well as the central government.