In 1971, the Wanchoo Committee was set up to deal with the colossal amount of undisclosed income and the issue of increasing tax base in India. The committee was the first one to suggest Demonetization of high denomination notes. Although nothing much was done on that report in those days, Demonetization in 2016 did act as a trigger to increase the tax base in India. There has been substantial increase not only in tax returns but also number of people paying taxes. It is thus an established fact that increase in tax base has been one of the greatest successes of the current government.

The Central Board of Direct Taxes (CBDT) recently released data on direct collections in October 2018, highlighting how direct tax mop up has increased specifically in the last two-three years.

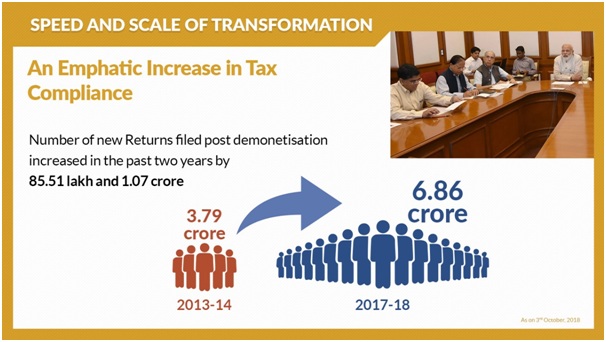

Increase in Tax Returns and Tax Payers-

There has been a remarkable rise in various direct tax parameters seen as follows-

- Number of Direct Tax Returns Filed– Increase of more than 80%. 3.79 crore in FY 2013-14 to 6.86 crore in FY 2017-18.

- Number of Persons Filing Returns-Increased by about 65% during this period from 3.31 crore in FY 2013-14 to 5.44 crore in FY 2017-18.

- Number of Tax Payers– Increased by 40% from 5.27 crores in FY 2013-14 to 7.41 crores in FY 2017-18

One of the reasons for this rise has been the trigger of demonetization that forced individuals to declare unaccounted income, as well as to enter into formal sector by registration of businesses and declaration of turnovers.

Total Direct Tax Collections-

There has been increase in the total direct tax collections. In FY16, the direct taxes collected were 7.4 lakh crores. This increased to 8.4 lakh crore in FY17, the year of Demonetization. The next year FY18 saw collections increase to around 10 lakh crores. Thus, a healthy growth of 14% and 18% was seen in FY17 and FY18 respectively. This type of growth in direct taxes has never been seen. However, the true picture is seen in the individual categories of direct taxes like income tax.

Income Tax and Other Direct tax Collections-

The largest amount of undisclosed income has come forward in the income tax category. The tax collections have increased from around 2.8 lakh crore in FY16 to 3.4 lakh crore in FY17, a jump of 21% in a single year. This is significant because in the preceding years, the growth used to be around 8% per year. This remarkable jump in income tax collections reflects positively on Demonetization.

Similarly, one more category under direct tax category is of Other Direct Tax which consists of reassessments, penalties, fines and tax on the income disclosed under Income Disclosure Schemes. We see that for two years preceding demonetization, the other direct taxes collected were around 2100 crores while two years after demonetization, the collections increased more than ten folds to around 27000 crores, showing the response to the income disclosure schemes.

We have compiled the tax numbers in a table shown below. For comparison, we have taken two years before Demonetization and two years after Demonetization. Notice the jump in the tax figures, especially in the Other Direct Taxes.

DIRECT TAXES | ||||||||

FINANCIAL YEAR | (i) Personal Income Tax | % Increase | (ii) Corporate Tax | % Increase | (iii) Other Direct Taxes | % Increase | Total Direct Taxes | % Increase |

FY 14-15 & FY 15-16 | 553,409 | 39% | 882,153 | 19.72% | 2174 | 1133% | 1,437,736 | 27.84% |

FY 16-17 & FY 17-18 | 769,501 | 1,056,123 | 26827 | 1,852,451 | ||||

Increase in Tax Buoyancy

Tax buoyancy is an indicator of how much are the tax revenues growing in comparison to the growth of GDP or National Income. Thus, when we say tax is buoyant, it means the tax revenues are increasing faster than GDP. The buoyancy factor indicates how well is the economy is placed in collecting taxes.

The direct tax buoyancy factor was barely 0.80 in FY16 but jumped up significantly to 1.81 in FY18 showing the relative growth of tax revenues to the growth of GDP. A bigger jump was seen in the buoyancy factor for personal income tax from 0.8 in FY16 to 2.20 in FY18. Thus, a healthy picture is seen in the tax collections, a direct result of Demonetization.

There are two ways to change behaviours in an economy- persuasion and pressure. An economy sometimes requires a shock treatment to ensure a required behaviour from individuals. Demonetization served that very purpose which is reflecting in the tax compliance. Coupled with other measures like GST, tax reforms and use of technology, this move directly impacts the Ease of Doing Business. This increased tax mop-ups will ensure this money is spent in the useful sectors like roads, railways, ports, health, education and social security. An increase in tax base ensures the government receipts are more evenly spread on a larger population as opposed to the current tax base of barely 4%.

Justice Wanchoo may not have lived to see the implementation of his report. But the Modi government did ensure that his suggestions were implemented properly.