Today the clamor for farm loan waiver has taken the center stage. In fact, the Maharashtra Govt., led by Hon. CM Devendra Fadnavis is under fire from not just its unfriendly ally Shiv Sena but from all of the opposition. Moreover, with the BJP in UP already promising Farm loan waiver to farmers of UP and Captain Amarinder Singh tweeting that he shall work on providing loan waiver to farmers; has created an air of uncertainty over the leadership in the States. I believe this noise for the Farm loans is an issue which needs to be addressed.

Given the Budget constraints at various states, I believe the Farm Loan waiver proposed by the States can lead to a hit in the overall Fiscal Deficit situation.

Having said that there will be stretch in the State’s fiscal situation, I believe there is need of Loan Waiver, but it should not be in its traditional sense as proposed by the States or its ministers.

Today, as per Maharashtra Budget Document speech, “At present, 31.57 lakh farmers out of 1.36 crore farmers are in debt at present and due to this they face the risk of going out of the ambit of institutional credit. If a farmer is to get crop loan in future, then it is necessary to repay his debts. It is estimated that the total institutional indebtedness is 30,500 crore.” Another news article said the value of overdue farm loans is ~Rs. 20,000 cr. One of the key reason for the farmer loan problem is a 2 year dry spell in rains in the state. Yes, some loans would have being misused, but assuming all the Rs. 30,500 cr., is misused is an over-statement.

Hence, a scheme for One Time Settlement of Farm Loans with the Banks needs to be worked out. I am speaking here of institutional credit i.e. loan from banks and registered Micro-finance bodies, registered money lenders, among others. If, INR 20,000 cr., worth loans are overdue means there will be issues with the further debt-taking ability of the farmers as per RBI regulations, once an account has slipped out of order, the bankers would first require the account to be made ‘in order’ i.e. pay overdue interest & principal and then give further lending. However, the farmers who are in trouble for the past 2 years, will find it difficult to try to bring the account “in order”.

Moreover, once an account is in trouble, given the present RBI restrictions, bankers would not take additional exposure; as it is the public money which is at stake here. So, farm loan waiver from state entails, Banks being compensated for the loss made. While, banks have already provided for the loans as per extant RBI guidelines, foregoing anything will not be recommended. Further, people or common man or even will blame Government even if they give blanket waiver saying “there was misuse and the Govt is setting a bad precedent”.

One must also consider that in the event that debts are not re-worked, the farmers will have to move to either non-institutional money lenders or sell their produce at dirt cheap prices to middle-man. So, there is multi-party and multi-pronged problem here. Each aspect is necessary to understand here, before one tries to solve the problem.

With this background, I believe / propose a Solution as detailed here-onwards. Just like we are facing a multi-dimensional and multi-time problem, solution needs to be multi-pronged. The debt-crisis is today and we cannot leave an injury hemorrhaging and try to give some other medicines. First the bleeding needs to be controlled and then other life-saving drugs / method need to be applied. The government, say Maharashtra Govt., is currently leaving the bleeding and coming up with other medicines. Mind you, I am not saying we should not do these long term activities. The Government needs to work on both fronts.

Hence, a via-media needs to be worked out which is beneficial to:

- Farmers

- State

- Banks

The government needs to work on a workable solution which not just serves the banks. Accordingly, I suggest a following approach for the Bank Loan System.

STEP 1: Diagnostic analysis of the farm loans:

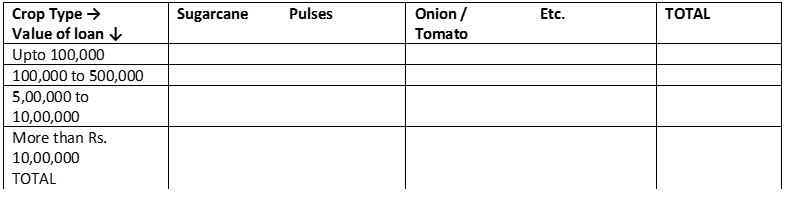

The Government needs to appoint agency to conduct a detailed diagnostic analysis of the Farm Loans. The loans should be bucketed into categories as under:

The above data should further be divided into marginal land holders, large land holder, extent of crop damage, insurance claim availability if any. This should form a basis for working out a solution. Again region-wise stress should also be assessed; based on actual visit to farms, understanding their end-market and viability.

The final study should confirm which of the Farms are viable and which are unviable.

STEP 2: Carving out of loans

- Based on the above study, as mentioned above, the loans should be carved out into viable / sustainable and non-viable. Wherein the loans are of smaller ticket size and related to marginal land holders, they should be Waived off Completely. The value of such loan may be smaller, but number of farmers impacted shall be larger.

- The next portion should be a higher threshold limit of land and acreage holding, which shall be the basis for assessing the loan repayment.

STEP 3: Creating an Agriculture Asset Reconstruction Company (ARC)

- The Agriculture ARC shall in its purview have both farm loans, irrigation loans, farm mechanization loans and the food processing unit related loans. This agency should be aimed at Issuing The total value of debt is ~INR 30,000 cr., for Maharashtra.

- The ARC shall act like an ARC and shall Issue something called as a Security Receipt (SR) to the Bank for the value of ARC. An SR is like a Bond issued by the ARC to the Bank / Financial Institution for the debt / loan taken over by the company. The benefit of the same is that the ARCs have to foot-in only 15% of the debt. The balance 85% of the loan is paid via these SRs.

- Now, in this case the cash outgo for the ARC shall be only 15% of the value of Security Receipt (SR). So, say INR 30,000 cr., loans are to be re-structured, then the said government ARC shall be ~15% i.e. INR 4,500 The balance value shall be issued to the Bank via Security Receipt. As of now, I am unclear of the RRBs or Co-operative Banks can accept SR, however, if the same is not possible, adequate circular / notification allowing the same should be passed; paving the way for the SR.

- Now, let’s not confuse this scheme with waiver. This is a re-structuring mechanism which provides for a scheme of farm loan with cases which are viable to be repaid.

STEP 4: Fresh finance bit, separate NABARD Fund to ARC for additional finance:

- Now, the Security Receipts (SR) as above shall cover the current indebtedness of the farmer. However, these farmers would require separate fund which shall finance the farmers. Now, this shall require concerted efforts from NABARD.

- The monies should be financed from the said NABARD NBFC or an entity which shall be via NABARD or any other agricultural financing agency.

- This shall be a separate Fund which will intend to invest / provide loan to such Farmers. The monies so provided should be adequately monitored.

- The agency should collaborate with local agriculture colleges, agriculture experts and assess the overall viability of each produce and agency should be appointed to act as regional guardian for the sales & marketing of the produce.

- This would sound utopian, but the point is you cannot just give additional monies and hope the entity / farmers pay.

- The intention here is not the create more loans which tomorrow have to be again waived but creating a separate institutional credit facility to already indebted farmers.

- The

STEP 5: Who foots the bill?

- The overall funding requirement needs to be assessed. Each State needs to create its own State Farmers ARC.

- The equity capital should be contributed by the State and Central Government.

- The balance monies should be raised by way to TAX SAVING BONDS, which can be subscribed by retail or corporate investors carrying a coupon / interest yield of ~9.5%.

- Any investment in the bonds by retail or corporate shall be over & above the 80G limit of Income Tax, which provides everyone incentive to invest in the same whole hearted.

- Since, the government investment will be lower and their liability shall be contingent i.e. only a GUARANTEE, it will not lead to stretch in the Balance sheet of the State Government or Central Government.

- Additionally, changes in RBI regulations towards provisioning by banks for such debts should be worked out to ensure there is no untoward hit on the banks capital adequacy, as the bonds shall be more or less cash backed and coupled with a mix of Central & State Government guarantees.

A scheme in the above line needs to be brought out. There are various internal nuances which can be added; however, they shall require more detailed data and more assessment of ground situation. The government should work on long term structural changes in the Agriculture sector such as:

- Cold storage chains

- Polyhouse based production

- Community Farming

- E-commerce Aids

Efforts on both the front i.e. short & long term shall be key in making the Rural economy performance oriented.