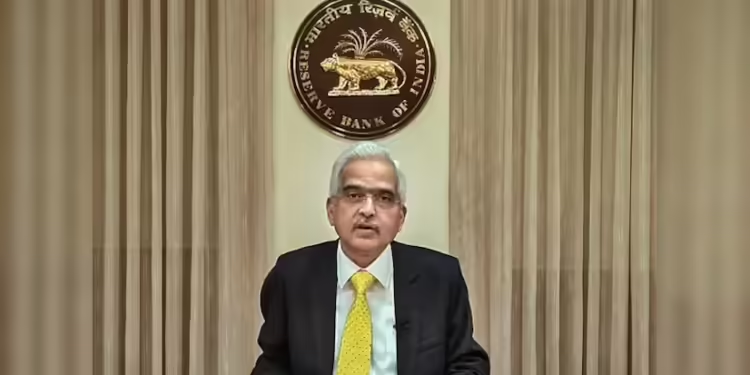

“The Pied Piper will play the tune and the RBI will follow. The Inevitable outcome will be that the RBI’s reserves will be used for government doles. Yet another institution will diminish.” Some six years ago, this was the statement made by former Congress leader Kapil Sibal on the appointment of Shaktikanta Das as the Governor of the Reserve Bank of India.

Back then, the ruling PM Modi-led govt was dealing with the impacts of demonetisation, GST implementation and huge NPAs. Fast forward to 2024, things have changed remarkably. India’s financial health is better and the challenges that became a central issue for battle are being tackled smoothly. The cause of this change is undoubtedly, Governor Shaktikanta Das who is set to retire next month, if he doesn’t get another extension. But talking about the successful term of his, it is prudent to trace the history of his appointment and the clashes that took place around the Governor’s appointment.

Since the first days of the Modi govt in 2014, the Centre tried to boost the economy by taking some bold steps. But the dynamics between the RBI and the govt brought the then RBI Governor Raghuran Rajan and the govt face-to-face. Strictly speaking, it is often in favour of the economy to have a slight tussle over the economic issues like rate cuts between the Governor and the govt. This actually proves beneficial to control inflation.

But the antagonism between Raghuram Rajan and the Modi govt escalated further. While Raghuram Rajan was sceptic in repo rate cuts until the inflation was controlled, the govt wanted to ease the rates to trigger the financial transactions to boost economy. The friction ended with the succession of Urjit Patel in 2016.

At that time, it was believed that with him, the govt will get along well, but he resigned nine months prior to his completion of tenure. Although, Patel managed to keep inflation stable during his tenure, the repo rate, NPAs and policy decisions became key issues that soured his relationships with the govt. He resigned citing personal reasons but it was widely seen as a resulting slugfest between the Centre and Central Bank.

Later, the govt came up with the name of Shaktikanta Das. The Congress, opposition and some economists cane down heavily upon his appointment. They argued that his two predecessors were notable economists and he holds a degree in History and has experience as a bureaucrat. Besides, he as Economic Affairs Secretary came at the helm to defend the demonetisation and steer the monetary situations back then. So, it was stipulated that Das was getting a reward and with lack of a tag of economist, he would “dance to the tune of the govt.” However, six years down the line, Das has astonishigly defied the popular hypothesis.

Forex at all time high under Das?

Under his leadership, the forex reserve of the Central Bank rose to an all time high crossing $700 billion. With a $311 billion expansion, his tenure witnesses the biggest expansion of forex followed by $200 of Dr YV Reddy. This must be counted as a huge achievement as in June 2024, India’s forex reserves were 101 per cent of external debts.

This unprecedented work has earned him an A+ grade in Central Bank Report Cards for two consecutive years 2023 and 2024. Moreover, he has proved to be a master in implementing the Monetary Policy Committes (MPC) framework which was created by his predecessor Urjit Patel. He used it effectively to steer the Indian economy away from inflation by monthly analysis of repo rate.

One of his greatest achievement was how he managed to smoothly run the economy during the Covid-19 pandemic when the world was facing the headwinds. This becomes even more significant given the fact that in last four years, India had seen demonetisation and GST, the biggest structural reform in taxation that daunted the economy.

Through out the pandemic era, India did comparatively better than rest of the world. Similar success was witnessed when the war between Russia and Ukraine started. Since the european countries witnessed the ramifications of war, the sanctions on Russia led to the rise in prices of oil rampantly. The economic headwinds were again defied by India at the skilled hands of Das.

Moreover, one of his biggest achievement is narrowing down the NPA, which has been the biggest issue to which his two predecessors grappled with. As per the June Financial Report this year, the gross NPA declined to 12 year low. It stood at 2.8 per cent at the end of fiscal year 2024. But this is not it as he is also striving to bring a major change by rolling out a framework of Expected Credit Loss (ECL).

Currently, banks keep aside a fund to level the losses only after they happen. But under the ECL that Das wants to bring, the banks will need to be proactive and set aside such funds before the loss would happen. For this, the banks will have to make an estimate of credit default. This would be done through analysing trends of past default while predicting future risks.

This is worth mentioning here that under Das’ administration this has already been rolled out for NBFCs in 2020. Hence, the journey so far has been impressive for Das as his role in keeping economy resilient and Rupee stable has been commendable. As his tenure ends, it is highly expected and is also desirable that he gets an extension, which if happens will make him the longest serving RBI Governor in India’s history.