Sri Lanka, currently, is facing a huge debt crisis and it is attempting to somehow save its economy. The country needs help from India instead of predatory China, which is responsible for Sri Lanka’s economic crisis. India, however, is providing aid to the neighbour country. But little does it know that there are many Sri Lanka’s in the making in India itself.

Indian states suffering from a debt crisis

Some states of India which witnessed the revenue deficits in the last few years are currently facing a debt crisis with debts hovering around 40% of the respective gross state domestic products (GSDPs). Notably, the percentage of debt is double the level of what can be afforded, as per an expert committee.

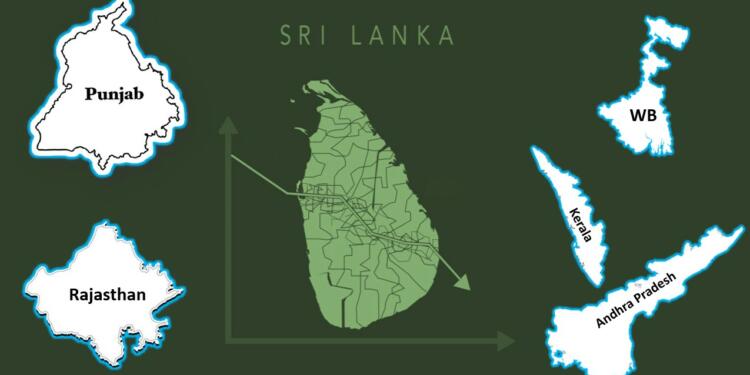

The aggregate debt of states broke the 15-year record of 31.3% of GDP in FY21 and is approximately at the same level in FY22. As per the respective budget estimates, “States with the highest debt-GSDP ratio in FY22 are Punjab (53.3%), Rajasthan (39.8%), West Bengal (38.8%), Kerala (38.3%) and Andhra Pradesh (37.6%). All these states receive revenue deficit grants from the Centre.”

While twenty seven out of thirty one states and UTs witnessed an increased debt ratio by 0.5 to 7.2 percentage points on year in FY21, these five states have the highest debt ratio.

The reason behind this is while the numerator (liabilities) kept rising dramatically, the denominator (nominal GDP) was declining in FY21. Despite this, Maharashtra (20%) and Gujarat (23%) maintained tolerable levels of debt-GSDP ratios in FY21, as reported by the N K Singh-led Fiscal Responsibility and Budget Management (FRBM) Committee.

Punjab tops the list

According to the latest Reserve Bank of India report on state finances, “Punjab topped the states with the highest debt-to-GSDP at 49.1% in FY21, 6.6 percentage points more than a year ago. This is the worst debt ratio for the state since 1991; the high debt level is the result of years of fiscal profligacy such as farm loan waivers, free electricity to large sections of consumers, among others.”

It is thus evident that Punjab’s annual debt servicing liability is equal to its annual gross borrowings. Hence, no resources are left for contribution to development. Reportedly, the state has been performing badly to meet its capital expenditure targets. While it achieved only 42% of the target in FY21, it performed worse in FY20 and achieved only 10% of the target.

Apart from Punjab, Rajasthan’s economic crisis also increased in FY21 with the increment in liabilities of the state by 7.2 percentage points to 42.6%. These states have led the Centre’s debt burden to reach a 16-year peak of almost 62% of GDP.

“Any recovery in the growth rate (nominal GDP estimated to grow 17.6% in FY22) will bring down the debt-GDP ratio. If the Centre and the states adopt the kind of macroeconomic fiscal framework that they adopted in the last budget (more growth-inducing CAPEX), the combined debt level could come down to around 80% in five years or so. It happened between FY04 and FY10,” said N R Bhanumurthy, vice-chancellor of Bengaluru Dr B R Ambedkar School of Economics University.

What are the state governments doing? From Bhagwant Mann to Gehlot and Mamata Banerjee, the Chief Ministers are occupied with communal politics and are least concerned about the economic crisis being faced by the state. If no actions are taken soon, the central government will have to pay for the repercussion and it could affect the Indian economy badly.

Hatsoff to your dallagiri