- India’s Sensex stock index on Friday (September 24) clocked its quickest time to gain 10,000 points to breach the historic 60,000 barrier.

- The growing trust of the domestic and global investors to pump their money into Indian markets is a solid endorsement of PM Modi’s economic policy.

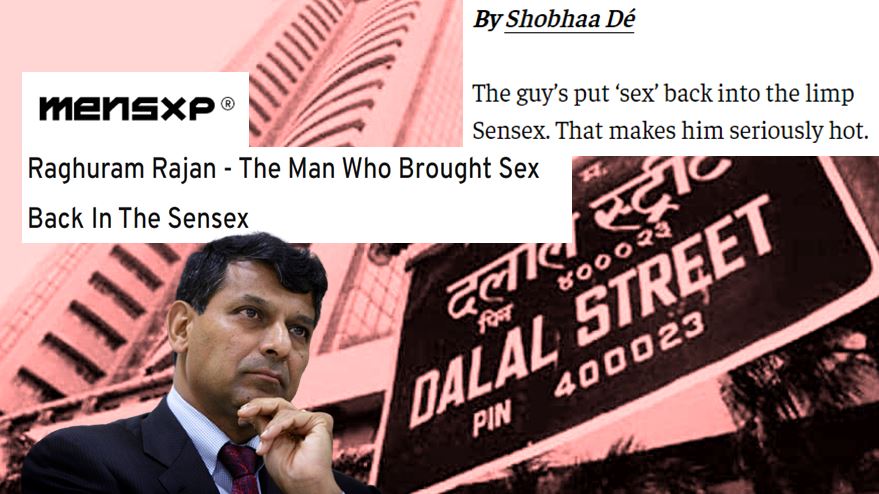

- In 2013, MensXP, published an article titled, “Raghuram Rajan – The man who brought sex back in Sensex” and dubbed him as the economic messiah of the country.

- As a thumb rule, one should understand that whenever gossip magazines start advising people in the matters of economics or investment, understand that the opposite is going to happen.

India’s stock exchange keeps making record highs and it is all because of Modi government’s visionary approaches.

The Olympics might be over, but India’s benchmark Sensex stock index continues to set new sprint records. Sensex on Friday (September 24) clocked its quickest time to gain 10,000 points to breach the historic 60,000 barrier. Sensex climbed as much as 448 points to hit a record high of 60,333 while Nifty 50 touched an all-time high of 17,947.65.

The Sensex stock index took merely 167 trading sessions to reach 60k from 50k, while previously, it had taken on average 931 sessions for a 10k point move. It is also pertinent to note that India is now the world’s sixth-largest stock market, overtaking France for the first time in market capitalization.

Sex in Sensex? Raghuram Rajan? Who?

The historic bull run comes as a reminder to call out the doomsayers turned economists and liberal publications who had notoriously claimed that India would dig a hole for itself if the Modi government comes to power or a certain highly overhyped economist would leave the country.

In 2013, MenxXP, one of the darling publications of the wokes of the country carried an article titled, “Raghuram Rajan – The man who brought sex back in Sensex” and dubbed him as the economic messiah of the country. The article painted the former RBI governor as the one prophesized to steer the country into a utopian world of economic prosperity.

While the article did not talk much about economics, which was a relief – it did talk about the sex appeal of Rajan and quickly corroborated it with the working of Sensex. Only if the markets worked on looks and appearances.

The article read, “Rajan has the ladies swooning because he cares for his looks as much as numbers. That he has a full crop of hair at 50 and clean-cut facial features when most other men are fat and bald only add to his sex appeal.”

As a thumb rule, one should understand that whenever gossip magazines start advising people in the matters of economics or investment, understand that the opposite is going to happen.

Jhunjhunwala giving it back to the liberal media

Rakesh Jhunjhunwala, the Big Bull of D-Street sounded optimistic, unlike the liberal economists of the country, and remarked that it was just the beginning of something special.

“We are just at the threshold of what I think is going to be one of the largest (stock market) bull runs in India ever. India is changing and many people are investing in the change,” the 61-year-old billionaire investor said before adding, “Dil hai ki manta nahi, bazar hai ki rukta nahi (The heart never agrees and the market never stops),”

Reported by TFI, when the liberal cabal had been targeting the Modi government, Jhunjhunwala swam against the current and lauded Modi government for its economic management whilst acknowledging its efforts in introducing major reforms in the agricultural, mining, labor, and power sectors — the effect of which will be seen later.

The statements by Jhunjhunwala prove that despite the opposition parties and the liberal cabal collectively clamoring to demonize the government, the market remains unaffected and unperturbed, all the while standing in solidarity with the trustable central regime.

A carefully crafted welfare state

Narendra Modi in his second innings as the Prime Minister is dishing out important welfare decisions at breakneck speed which in turn is helping the stock index perform admirably.

Take recent examples like abolishing the highly delusional UPA era retrospective tax regime to introducing Production Linked Incentive (PLI) schemes for 10 of the most vital sectors of the economy to bringing ‘Real Estate Regulation and Development Act’ to amending Insolvency and Bankruptcy Code – there has been no dearth of administrative reforms.

Speaking of PLI, India’s merchandise exports in August touched $33.14 billion, 45.17 percent higher than a year ago and 27.5 percent over the pre-pandemic level of August 2019. The government’s make in India and as a corollary, ‘Aatmanirbhar Bharat’ push to become the factory of the world has been received well by the globe. And the PLI scheme has had a pivotal part to play in the rise in exports.

Charting a strategy for long sustainable growth — the Modi mantra

When the Modi government took charge, it decided not to pump prime the economy to steer growth– something that was done extensively by the Congress government and led to skyrocketing inflation. Instead, the Modi government pushed for reforms, reined in the inflation rates and patiently waited for a natural and sustainable cycle of growth.

The results of that effort are starting to show. And this time around, not only has the Modi government kickstarted this period of growth, but it is also politically strong enough to remain in power and safeguard the growth numbers.

Bank of America in its recent report stated that India sits at the cusp of a multi-year Capex cycle. The brokerage firm believes India could be staring at a Capex cycle similar to that seen between the financial years 2002-03 and 2011-12.

Read More: India to experience at least a decade of good growth, thanks to PM Modi

Rising FPIs, increased GST collection, rising FDI numbers

Moreover, bullish at the health of the economy and expecting rich future dividends, foreign investors are continuing to bet on the Indian market. Reportedly, within the first ten days of September, Foreign Portfolio Investors (FPIs) have poured in a net sum of Rs 7,605 crore in the Indian markets. While Rs 4,385 crore was pumped into equities, the rest, Rs 3,220 crore was pumped in the debt segment during September 1-9.

While the foreign investors continue to pump the liquid cash, on the domestic front, the GST collection for August crossed the one lakh crore mark after doing so in July as well. The gross GST revenue collection stood at Rs 1,12,020 crore which is 30 per cent higher than the previous year – indicating that the economy was indeed recovering at a faster pace.

Despite the UN Conference on Trade and Development report stating that global FDI flows plunged by 35 percent due to COVID, FDI in India increased by 27 percent to USD 64 billion in 2020 from USD 51 billion in 2019.

Small-time investors putting money in the stock markets

The pandemic brought in a lifestyle change across the country. People started to look for new avenues to invest their money – passive income became the keyword across the masses. As a result, the mutual funds market of the country has considerably increased with equity schemes of fund houses like Quant Mutual Fund, ITI Mutual Fund, PPFAS Mutual, seeing a mass influx of small-time investors.

The assets under management of Quant witnessed over five-fold rise during January-July 2021. The AUM of ITI Mutual Fund rose over 100 per cent to Rs 1,879 crore and PPFAS Mutual Fund’s AUM also nearly doubled to Rs 14,318 crore.

India to be a $5 trillion economy by 2024 – Goldman Sachs

A recent global strategy paper by Goldman Sachs however estimates that India’s market cap will increase to $5 trillion by 2024. The paper attributes that the ambitious dream of the Modi government can be realized through the slew of IPOs coming in the future and the unicorn culture that is producing one mega-giant after another. The report also stated that India might soon expand its market value by $400 billion

The staggering Unicorn culture

2021 has been a sensational year for the Indian startup ecosystem, which has surpassed all projections — both in terms of the number of unicorns and the funding raised. According to a YourStory report, in July 2021 alone, the Indian startup ecosystem raised almost $10 billion (including a mega-round of $3.6 billion raised by Flipkart) and added three new unicorns to its cap. This was more than the entire amount raised in 2020.

The Indian startup ecosystem is the third-largest in the world with more than 40,000 companies and around 44 unicorns. A whopping 21 startups have made it to the list in the first 8 months of the year. India witnessed the first health tech, social commerce, crypto and e-pharmacy unicorn this year. BharatPe, Mindtickle, UpGrad and CoinDCX have been the recent entrants in the month of August.

Managing crisis masterclass – the IL&FS saga

Reported by TFI, the GoI recently extended the contract of Uday Kotak as the non-executive chairman of debt-ridden Infrastructure Leasing and Financial Services Ltd (IL&FS) group by another six months. IL&FS at one time threatened to be India’s Lehman moment, capable of triggering a collapse in the economy.

However, the Modi government with its all ‘hands on the deck’ approach quickly accessed the gravity of the crisis and jumped in with its resources.

Uday Kotak was appointed by the government as the head of the lender’s board which also included Tech Mahindra Vice-Chairman, Managing Director and CEO Vineet Nayyar, former Sebi chief G N Bajpai, former ICICI Bank chairman G C Chaturvedi, former IAS officers Malini Shankar and Nand Kishore to help the troubled company wade through the rough waters.

And as of today, the debt-ridden company had settled over Rs 43,000 crore out of the total debt of over Rs 99,000 crore. With this, the organization has registered an increase of Rs 5000 crore in its debt recovery target.

Market trusts the current regime

Unlike China, where the government is clamping down on the entrepreneurs and not showing any incentive to save a large behemoth like Evergrande, the Indian government continues to do the opposite. The stock market took notice of it and understood that there was a government in place that no matter what, will continue to back it. The mutual faith in each other has led to the exponential gains we have observed today.

Read More: Evergrande topples, crushes China’s markets under its weight

All the indicators suggest that the Indian economy is recovering at a miraculous pace and if nothing, the growing trust of the domestic and global investors to pump their money into Indian markets is a solid endorsement of PM Modi’s economic policy.

The aim of a 5 trillion-dollar economy by 2025 cannot be achieved without an influx of huge cheap capital in the country, and investment will come only when there is a stable government, conducive taxation environment, structural reforms in the Land and Labor sector. Fortunately, the Modi government is ticking most of the boxes so far.