While Coronavirus Pandemic is causing devastation around the world from Iran in Asia to Spain and Italy in Europe, and the United States further west, the Wuhan infection outbreak is reminiscent of the late nineteenth century European colonialization as far as the African continent is concerned.

While the European imperialists brought several epidemics to Africa, often deliberately, and depopulated it, the Wuhan virus outbreak has debilitated an already fragile African economy.

Now, rich countries including China are being asked to waive off, or substantially restructure, debts to African countries as the African economies have been hit hard by the Pandemic.

The entire world has announced lockdowns and other measures such as grouding airlines in order to prevent further exacerbation of Coronavirus. Africa is no different, and most of the African economies are currently limping in the face of drastic measures to break the chain of the spread of Coronavirus.

The Finance Ministers of African countries met on Tuesday, and immediately called for debt relief and financial stimulus to shore up the economy of the continent’s battered countries.

The continent’s Finance Ministers also issued a statement after the meeting, which called for a “waiver of all interest payments on bilateral and multilateral debt, and extension of the waiver to the medium term”. This, the African countries say will help them in focusing their energies on tackling the Coronavirus Pandemic.

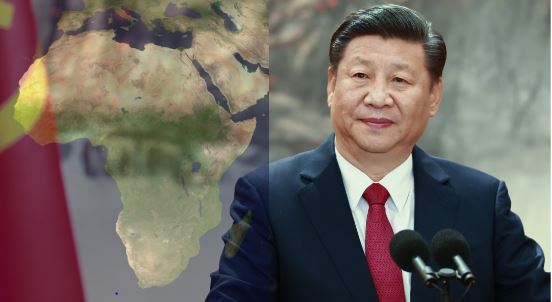

China has invested heavily in African countries, amongst other parts of the world, as a part of its Belt and Road Initiative (BRI)- Beijing’s flagship “debt trap” diplomacy project.

In fact, seven of the 35 low income Sub-Saharan African countries are going through a phase of debt distress, and another nine are facing an imminent risk of slipping into debt distress. Beijing happens to be the largest lender to the African countries.

As the global supply chains have been disrupted after the outbreak of the Coronavirus Pandemic, the Economic Commission for Africa (ECA), an agency of the United Nations (UN) in the region has predicted that the GDP growth rate of the African continent would drop from 3.2 per cent to 2 per cent.

In fact, according to the London-based Jubilee Debt Campaign, an organisation pushing for waiving debts to the poorest of countries, China is estimated to hold one-fifth of the total debt in the continent.

Under its BRI initiative, Beijing has several billions of investments in Africa in the infrastructure sector. It is building highways, ports, dams and laying down rail lines in the African Continent.

Between 2000 and 2017, China has invested a mammoth US$143 in Africa, according to the China Africa Research Initiative at the Johns Hopkins School of Advanced International Studies in Washington.

Like everywhere else, China is accused of luring infrastructure deficient countries in Africa with its investments and loans which generally carry exorbitant commercial rates of interest that debilitate weak economies.

What this does is create unsustainable debts and while China dismisses these claims as groundless, there has been a backlash in countries like Sierra Leone where governments have either looked for renegotiations or have completely backed out of Chinese projects.

The debt crisis in Africa has only worsened with the Coronavirus Pandemic that owes its origins to the unsanitary wet markets in China’s Hubei province.

But given the track record of China, there is not much that the weakening economies of the African Continent can expect from the Dragon. The fact remains that China has a chequered history when it comes to countries that fail to discharge their debt obligations.

And there can be no better case in point than the ‘Hambantota’ port in Sri Lanka. The port had come up in Sri Lanka during the Mahinda Rajapaksa regime when Colombo made an open request for funding it, and Beijing was the only one to respond.

China had kept investing even though the port fared poorly. At one point, Sri Lanka was diverting 90 per cent of its revenue towards servicing Chinese debt. Ultimately, the Sri Lankan government had to handover the port on a 99-year lease to the China Merchsnts Group, a Chinese State-owned company.

Till date, Hambantota remains an example of China’s economic colonialization. This is what happens when a low-income country fails ro service Chinese debt. It pays in terms of infraction of its sovereignty. Sri Lanka had to go this way, and now as Africa stands further weakened, many of its countries won’t be able to serve Chinese debt.

With this, Beijing wouldn’t simply waive off debt, but it will look to take over African highways, ports, rail lines- every infrastructure project built, or being built on Chines loans.

This would remind Africa of the era of European colonialization when epidemics were introduced, deliberately or accidentally, by the colonial powers absolutely ravaging the Continent. Now, the Chinese virus has hit the continent’s economy badly. Beijing suddenly sits in a position from where it can easily exploit the African economies to the extent of developing its own colonies.