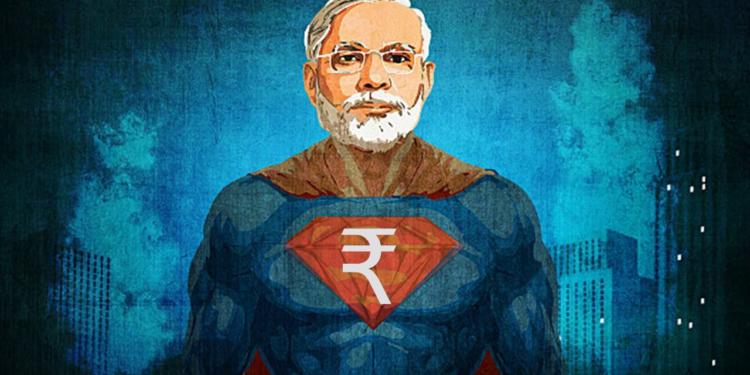

Market performance and other economic indicators are often guided by the political sentiment prevailing in a country. This is particularly true of the recent turnaround in the performance of Indian currency, Indian National Rupee (INR). The currency has transformed from the worst-performing Asian currency five weeks ago to the best performing currency in the continent. This turnaround has been powered by the growing popularity of PM Modi winning a second term and retaining power at the national level. The optimism generated by the increased popularity of PM Modi has led to local shares and debt luring robust flows, which have turned the carry-trade returns on the rupee to the highest among all the currencies in the world. Carry-trade in currency is a strategy whereby a trader uses a high-yielding currency to fund trade with a low-yielding currency.

The INR is expected to continue getting stronger if the Modi government comes to power for a second consecutive term. Gao Qi, a currency strategist at Scotiabank in Singapore believes, “The high-yielding rupee will likely advance further if Modi wins a second term.” In fact, he expects Rupee to rally further to 67 per US Dollar by June-end this year. Borrowing dollars in order to purchase rupee assets has gone up by 3.8 per cent over the last one month. Data compiled by Bloomberg show that the rupee boasts of best currency carry-trade return in the world which has made it an attractive option. According to Anindya Banerjee, an analyst at Kotak Securities Ltd. in Mumbai, “The market is pricing in a Modi victory as there are no other factors that explain the sudden change of mood.” Another strategist, Ashish Agrawal has also correlated the increased popularity of PM Modi with the turnaround in the performance of the Rupee among all currencies in the world. He said, “We expect the rupee to remain resilient in the near term, as bunched up foreign inflows limit any pressure from weakening EMFX sentiment.” He added, “a potential BJP-led coalition victory would bode well for the INR for the rest of this year.”