The Modi government has taken due cognizance in the matter of problems faced by startups regarding income tax. Many startups have complained that they received a notice from the Income Tax department regarding investment from angel investors. The investors also received notice from the IT department for a disclosure of their sources of income. Now the government is planning to exempt all the startups if they are certified by the Department for the promotion of industry and internal trade (DPIIT). The Ministry of Commerce and Industry held a series of meetings with the Central Board of Direct Taxes (CBDT) to address the issues faced by startups. “One of the considerations being thought about actively is to give complete exemption to startups from Section 56(2)(viib) of the Income Tax Act, once they are certified by the DPIIT,” said an official.

The angel tax was introduced in 2012 during the UPA government by then finance minister Pranab Mukherjee. The IT department officials have shown a pro-active stance because it was found that some people are converting the black money into white in the name of investment in startups. It was also found that investments in startups were being used for tax evasion. But many genuine startup founders and entrepreneurs had to face problems and were harassed by IT officials in the name of pro-activeness. So, in the last few months, entrepreneurs were complaining of tax terrorism of a similar kind that was prevalent in the UPA era.

Earlier, the government granted tax exemptions to the startups recognized under the Startup India initiative. The investment received from venture capital funds angel investors, or high net worth individuals was also exempted. Tax exemptions are bound to certain riders which omitted only a small part of the investment ecosystem.

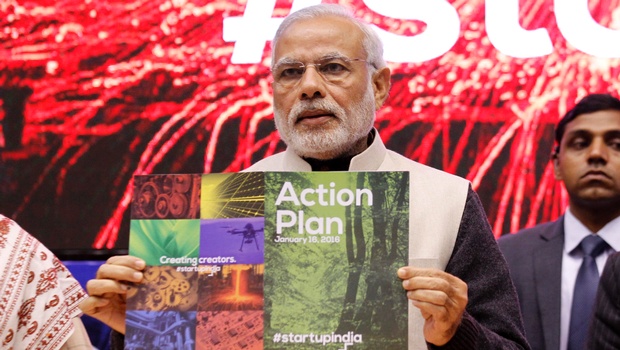

The Modi government is one of the most startup friendly governments that India has ever seen. The Modi government launched two programmes named Startup India and Standup India to encourage young entrepreneurship in the country. There are three pillars of Startup India which include simplification and hand-holding, funding support and incentives, industry-academia partnership and incubation. The government launched Pradhan Mantri Mudra Yojana to give low-interest loans to entrepreneurs from underprivileged backgrounds. The other programme, Standup India is similar to Startup India but it is more focused to support entrepreneurship among women and SC & ST communities. Startup India was launched in August 2015 while Standup India was launched in April 2016. The government also mulls to set up a mechanism called SETU (Self-utilization and Talent Utilization) to provide technical assistance and incubation to startups. Apart from this, it is planning to ease out the existing regulatory regime for startups and to extend tax incentives to them.

In terms of the total number of Startups, comprising tech and non-tech areas, India is among the five largest hosts in the world along with China and the US. The number of Startups in both India and China stand at 10,000 each. The US has the most number of total 83,000 budding entrepreneurs. In recent years, the Indian startup ecosystem has also taken off and has matured. Factors such as availability of funding, consolidation activities by a number of firms, evolving technology space and a burgeoning demand within the domestic market have led to the emergence of startups.