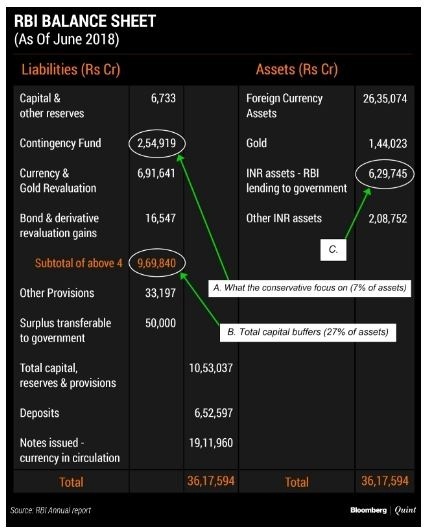

The former chief economic advisor, Arvind Subramanian has argued that RBI holds excess reserve of 5.7-7.9 lakh crore rupees. In a paper published in India’s premier journal Economic and Political Weekly (EPW), Subramanian reasoned that “The RBI has an unusually high level of capital. If the choices made by other central banks are used as a benchmark, the RBI appears to have a minimum of Rs 5 lakh crore in excess capital.” The paper was titled as ‘Paranoia or Prudence? How much capital is enough for the RBI?’ and was published on December 8. Abhishek Anand, a research officer, Economic Division, Ministry of Finance Josh Felman, Director, JH Consulting, Navneeraj Sharma an independent researcher were other contributors to the research paper.

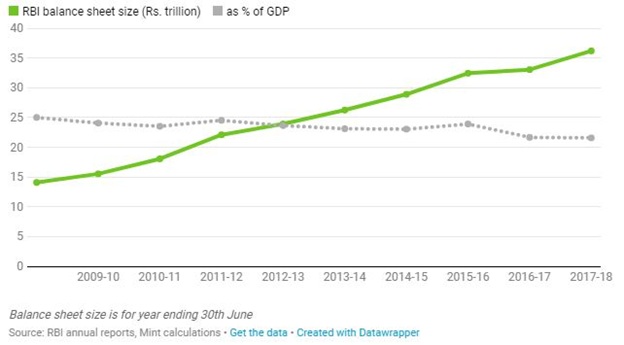

The research paper suggested that alternative analysis could suggest even greater excess reserve. “An alternative cross-country econometric analysis suggests that the excess capital is even greater, between Rs 5.7 lakh crore and Rs 7.9 lakh crore,” read the paper. The paper argued that RBI’s capital to assets ratio is substantially higher in comparison to central banks across the world. The global media for a central bank’s capital to asset ratio is 8.4 percent while RBI has kept 28 percent in its pocket.

Subramanian is not the first to argue that the RBI is holding excess capital. Earlier Christopher Wood, chief strategist at the investment group CLSA compared RBI’s holding to Federal Reserve System, the central bank of United States and argued that RBI’s holding is 30 percent in comparison to 1 percent of Fed. “The RBI balance-sheet is as overcapitalized as the [US central bank] Federal Reserve’s is undercapitalized” said Wood.

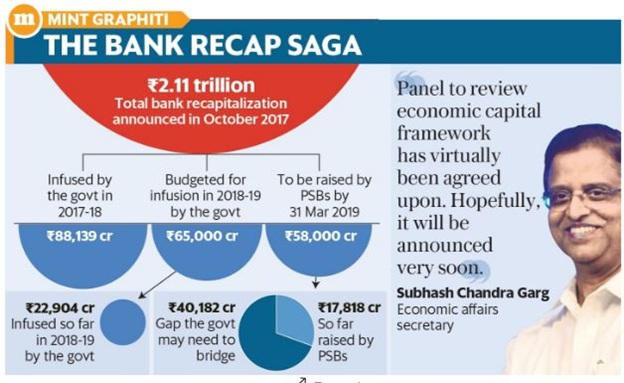

The excess capital with RBI has practically no productive use except risk management. If RBI transfers this money to public sector banks, they will reach to capital adequacy limits suggested in Basel III banking norms. RBI is wasting too much capital for hedging and this money could be transferred to weak banks which are struggling for capital. If RBI transfers the money, lending by these banks will increase which will result in increased economic activity and hence GDP growth. The research paper argued that high reserves can create opportunity cost. “Maintaining excess capital in the central bank can create an opportunity cost for society,” the study said, “This cost can be measured as the difference between the average return on the central bank’s assets and the social return from deploying that capital elsewhere. A very conservative proxy for this social return is the average debt servicing cost for the general government,” it added.

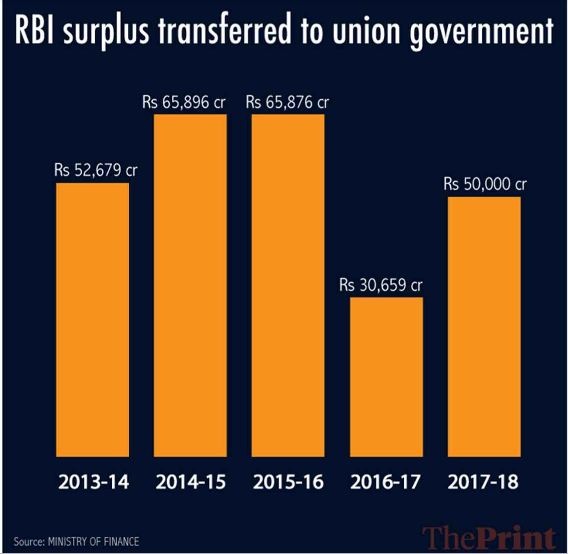

The government is already struggling for money as the recent hike in crude oil prices has raised public spending and stressed the fiscal deficit target. The government also needs money to bridge the gap created due to subsumed market funding for recapitalization of public sector banks. “Given that the RBI governor has changed, it is quite possible that some additional money could be brought in from the central bank in the form of dividend. Given the tightly packed budget and the government’s stand to maintain its expenditure commitments, it is not in a position to cut down on capital expenditure,” said economic affairs secretary Subhash Chandra Garg.

As the research paper has estimated over 5 trillion rupees of excess capital, it proves the thesis that RBI under Raghuram Rajan and Urjit Patel has been extremely conservative in transfer of funds. This was one of the two major contention points between the government and RBI, the other being liquidity crisis. The newly appointed RBI governor Shaktikanta Das is expected to take relatively liberal stance on fund transfers and liquidity.