The Modi government is planning to launch Jan Dhan 2.0 to address several issues of financial inclusion, including the opening of bank accounts for the 12 crore unbanked population in more than 48,000 villages that is yet to be covered under the flagship of financial inclusion scheme. Once all the eligible population is covered then the government will launch next phase which will include the insurance and pension schemes. The government wants to cover the entire population under social security benefit schemes to make the country a truly welfare state as promised in the constitution. The previous government despite all their lip service about social security were not able to make the country a welfare state with basic services.

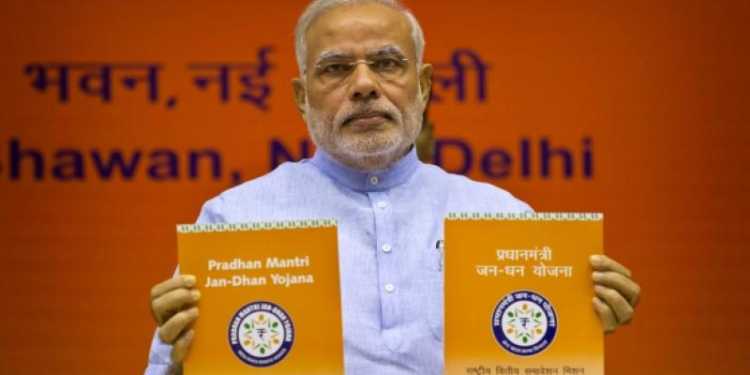

The financial inclusion programme of the Government of India was launched on August 15, 2014, and now has become a vehicle for many government schemes with 32.25-crore beneficiaries. As on August 1, 2018, the total balance in Jan Dhan accounts stood at ₹80,675 crore, of which public sector banks have deposits worth ₹64,388 crore with them.

Of the total beneficiaries, 24.7 crore have been issued RuPay cards by the National Payments Corporation of India (NPCI). A notable aspect is the large percentage of women beneficiaries at 17 crores. Now under the Jan Dhan 2.0, the push will be towards encouraging digital payments, providing easy credit from formal financial institutions to spur the job growth and economy. “The government now wants us to reach out to 10 to 12 crore unbanked individuals to bring them into the gamut of banking through PMJDY accounts. However, I am not sure if this could be done speedily, given the issues being faced by banks now due to the high cost involved”, the executive director of a public sector bank told BusinessLine.

Many bank accounts opened under the Jan Dhan schemes are inactive because in many Jan Dhan accounts transactions did not take place. So an encouragement through some financial incentives is needed to make people actively use the bank accounts. “While this is a big number, most of them have not been brought under the banking credit system, which needs to be done”, said CVR Rajendran, Managing Director and CEO of Catholic Syrian Bank. The bank accounts are important for implementing low-cost insurance schemes under Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY) at a large scale. These schemes did not reach out to uninsured person due to unawareness but now the government is making people aware of social security schemes during Gram Swarajya Abhiyan.

The Modi government has launched many schemes like Pradhan Mantri Ujjwala Yojana, Saubhagya, Atal Pension Yojana, Ujala scheme, Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Fasal Bima Yojana, Pradhan Mantri Suraksha Bima Yojana and Mission Indradhanush to provide social security to people on the lower spectrum of social strata. This is probably the reason behind the success of the party in state after state. According to analysts, the social security benefits played crucial roles bringing the marginalized caste in BJP’s vote bank. These castes have traditionally voted parties like SP and BSP which played lip service about social justice and social security. But with Modi government’s tremendous track record of providing social security benefits, these people moved to BJP. If the party continues to be popular among lower strata of the country the upcoming general elections will not be a big hurdle for the Modi government.