Income tax collection rose by 18 percent in the fiscal year 2017-2018, as a result of the implementation of demonetization and GST. For the last fiscal year, government had set an ambitious target to cross the 10 lakh crore mark through indirect tax collections which has been achieved, the total tax collections stood at 10.03 lakh crore. The number of total Income tax Return (ITR) filers has gone up to 6.92 crores compared to 5.61 crores in 2016-2017, which indicates whopping growth by 26%. “The I-T Department added 1.06 crore new returns during 2017-18 and aims to add 1.25 crore new returns for the current year. In the North East region, this number was 189,000”, said Shabri Bhattasali, member of Central Board of Direct Taxation (CBDT).

Income tax collection and the number of new income tax filers are growing exponentially since the structural reforms of demonetization and implementation of GST. According to Economic Survey 2018, 10.1 million people filed income tax returns in the year following demonetization (November 2016- November 2017), while the average for the last six years has been 6.2 million. This shows an increase of over 1.5 times the previous number of income tax returns filed. To curb black money the government took steps like the closing of shell companies, demonetization, and amendment in Benami properties act- RERA to give it more teeth, proved helpful in increasing the net tax base. These steps together in an integrated environment proved much effective in the crackdown on black money. Independently, these reforms were not as effective as they have been after all the above enactments have come into force. Therefore, a fair evaluation of the impact of these steps can only be done in a post-GST environment to determine the effectiveness of the policies. And going by the exponential increase in tax base and tax collection we can conclude that these steps succeeded in their goals.

The income tax collection in the country is highly undemocratic and largely limited to people from major cosmopolitans. According to government data released last year, people from the state of Maharashtra and Delhi contributed 40% and 13% respectively to the total income tax generated. So, more than half of total income tax was collected just from Maharashtra and Delhi. The government took steps to democratize tax collections by opening offices throughout the length and breadth of India. The tax collections in the northeast too have gone up to 7,097 crores in 2017-18.

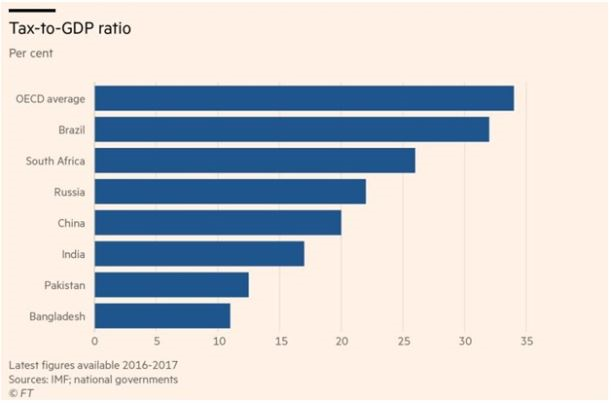

India has the lowest Tax to GDP ratio among BRICS countries. As we can see from the data given above, most of the developing countries have low ‘tax to GDP ratio’. In order to move from a developing nation to a developed one, a nation has to increase its citizens’ tax compliance. If Tax to GDP ratio is low, a country cannot afford to provide basic amenities like health and education to its citizens. Universal access to these primary needs is required to build human capital and improve the standard of living. India is planning to introduce Universal Healthcare through the National Health Protection Scheme (popularly known as “Modicare”). The increased ‘tax to GDP ratio’ means that more money goes directly into government coffers. This money can greatly help to make India a welfare state of the kind that Deen Dayal Upadhyay had dreamt of.