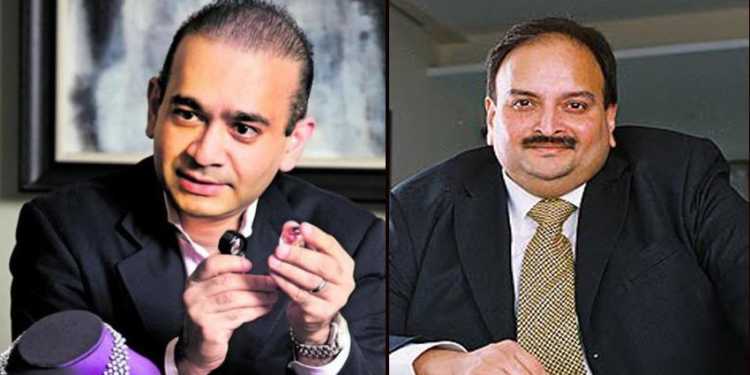

The Enforcement Directorate will use the newly brought Fugitive Economic Offenders Ordinance to confiscate the properties of Nirav Modi and Mehul Choksi. Enforcement Directorate (ED), the law enforcement agency and economic intelligence agency responsible for enforcing economic laws and fighting economic crimes had already moved to special court for “immediate confiscation” of attached assets valued at over Rs 12,400 crore of Kingfisher owner Vijay Mallya under this new legislation. The Fugitive Economic Offenders ordinance was approved by cabinet in April this year to address the issue of economic offenders like Vijay Mallya and Nirav Modi avoiding criminal prosecution. The ordinance defines a fugitive economic offender as a person who has an arrest warrant issued in respect of a scheduled offense and who leaves or has left India so as to avoid criminal prosecution, or refuses to return to India to face criminal prosecution. This is the second case under the new ordinance after the Vijay Mallya case. Once the ED moves to the court, Nirav Modi and Mehul Choksi will be given six weeks time to present themselves before Indian authorities and if they fail to do so their properties could be confiscated. The confiscated properties could be sold to return the money of banks even before a criminal trial begins against them in the court.

Mehul Choksi and Nirav Modi are wanted by multiple criminal agencies of India for cheating of Rs 13,600 crore through fraudulent letters of undertaking (LoU) and foreign letters of credit. Their company, Gitanjali Gems Ltd, got a letter of undertaking, or LoU (essentially a bank guarantee against which another lender gives a foreign currency loan), from Brady House PNB branch without any collateral with help of its senior official who is also charged in the case. When the senior official retired, the person from Gitanjali jems again came to get LoU from some other bank official who refused to give it without collateral. Later on, an internal investigation in PNB revealed that many LoUs were issued to Gitanjali Gems without any collateral. According to investigation agencies, both of them have inflated the value of diamonds, pearls, and jewelry which they have in their stores. ED found the value of the stock inflated three times in case of Modi’s firms and about 10 times in the case of Choksi’s firms.

Nirav Modi and Mehul Choksi left the country in January, a few weeks before the scam broke in media. Nirav Modi is likely to be in Belgium or United Kingdom while Choski is in the United States. The ED will file extradition requests to both Belgium and the US this week and it has already filed an extradition request to the UK in connection with the case. Vijay Mallya is also facing a case in extradition in the United Kingdom in which the Indian government has been on winning side till now. The case against Modi and Choksi is registered under the Prevention of Money Laundering Act, 2002 (PMLA) which allows for the confiscation and seizure of properties obtained from the laundered money. The probe agency has so far attached assets worth Rs 1,175 crore of Modi and Rs 2,400 crore of Choksi in India. This includes movable and immovable assets, diamonds, gold, and jewelry.

Nirav Modi and Mehul Choski were also found to be involved in money laundering. Hundreds of ‘shell companies’ were found to be registered under the names of wife and relatives of Nirav Modi. The scale of fraud raises serious questions about vulnerability of public sector banks because their employees could be bribed to take decisions in individual interest rather than banks interest. People of the country have to pay for these frauds through their taxes because ultimately government is liable to profit or losses of any public sector bank. There should be some serious debate about privatization of banks, so that people do not have to pay for the economic crimes by people like Nirav Modi.