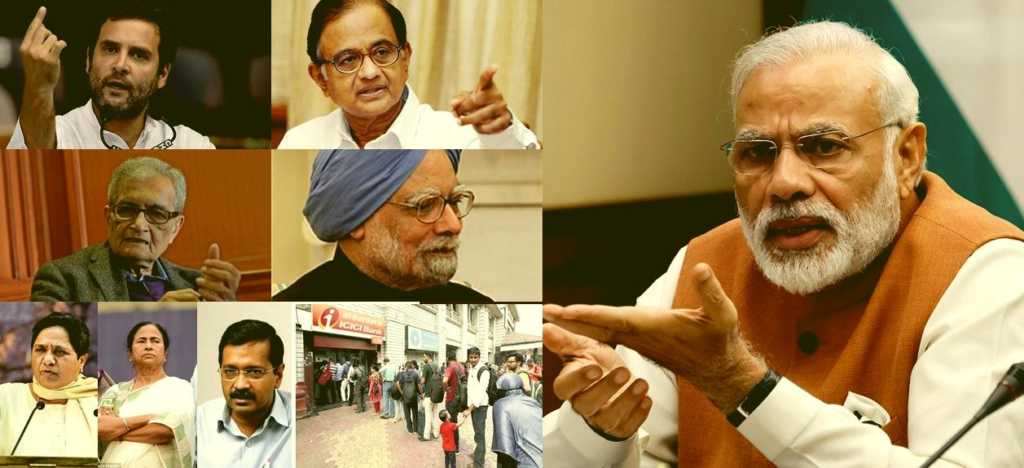

→ A few days after the demonetization was introduced, former Prime Minister Manmohan Singh mocked the exercise. Among other observations, he prophesied the growth rate to be brought down by two percent.

→ In the quarter that followed demonetization (Q3-2016), growth rate staggered from 7.3% to 7 %. Everyone with a degree in economics started explaining how Modi brand of economics had hit a running economy in its foot.

→ In Q4-2016, growth further slowed down to 6.1%. The self patting continued as the estimators of slowdown cheered in the realization of their forecasts.

→ In Q1-2017, the opposition had a field day as the growth rate went to a low of 5.7 %. Manmohan Singh was the prophet, the economic hero once again. Many media houses hailed him and his wise prediction of a downfall of two percent.

→ Q2-2017 – India’s growth rate rises to 6.3 %.

The last event in the above timeline does not need any explanation. It only proves what any economist worth his salt would know- structural reforms take time, have a short term slowing effect and then drive a growth that is sustainable.

The Goods and Services tax, aimed at transforming 29 Indian states into a single market and simplifying the taxation was largely being attacked for hitting on small businesses. The revival in the manufacturing and service sector tells a different story- both of which registered a growth rate of more than 6 percent. Private consumption expenditure has risen. The above facts coupled with India’s upgraded rating by Moody’s show that the country is on the right path with the policy measures in place and implementation.

India’s growth rate has resurged after five quarters of slowing down, two of which were prior to the demonetization drive, and four of them before the implementation of GST. To attribute the slowdown to these decisions completely and tagging them adversaries of the Indian growth story is a travesty.

Many business “leaders’, self proclaimed and even acclaimed “economists” who declared that they did not see growth bouncing back anytime soon are now searching for words.

The upward trend is still criticized by many as “only a pause in the decline.” However, nothing in the market data supports their hypothesis. Whenever a structural policy change happens, things are obviously going to come to a slowdown. But in the long run, it strengthens the core functioning of the economy and removes the inflating elements from the growth story.

For instance, the construction sector- still experiencing a slowdown in Q2 results- has long been known for cash transactions that go under the table. The shady part of the sector has been clamped down heavily by policy changes and coincident clamping down by various courts for embezzling homeowners’ money. Hence, the slowdown in this sector was anticipated- when you start to row the boat, the shallowest waters make most of the noise.

Another sector down in these numbers is agriculture– which is due to culmination of factors like patchy rainfall, floods leading to loss of crops and deficit rains in many parts as reported by the Indian Meteorological Department.

The path towards a better and sustainable growth is not a simple one, but one that has been undertaken very carefully by this government. Cleaning up of an entire economy cannot be done in a day and it surely cannot be done without disruptions. The key, as we have come to see, is to manage expectations as well as results. The spurt in growth indicates that the connection between the dots is now being seen as we look in retrospect. The growth story is only going to improve as we go ahead and reap the benefits of a better economy. Manufacturing sector is on its way to the top again, services if following suite and agriculture will overcome seasonal factors hopefully. As for the sectors going through a cleanup, the growth will be reflected in the numbers to follow in the next quarter.