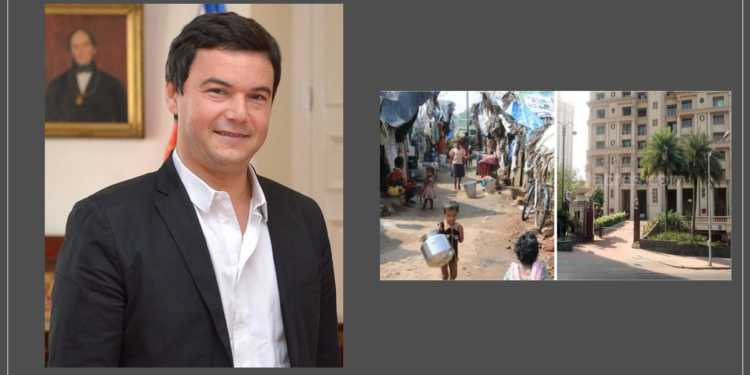

Last month, Thomas Piketty’s research paper titled ‘ Indian income inequality, 1922-2014, from British Raj to Billionaire Raj ’ co-authored with Lucas Chancel of the Paris School of Economics became the talk of town in intellectual circles. According to him, the share of the top 1% in India’s income pie is higher than ever before. Those who do not know about Piketty let me give brief introduction. Thomas Piketty is a French economist, who has often been hailed as the Karl Marx of the 21st century, for his work on inequality. In his magnum Opus, Capital in the 21st Century, Piketty states that inequality is increasing again as old wealth accumulated over the years yield higher returns than the overall rate of economic growth. In other words, the root cause of inequality is a simple equation r>g, where r is the return on capital and g is the rate of economic growth. If r is greater than g then inequality will rise.

Thomas Piketty and Chancel use a complex cobweb of income tax, national accounts and household surveys to conclude that the top 1 per cent of earners in 2014 earned 22 per cent of Indian national income when income tax was introduced. Important point to note is that it is the highest share of 1% since 1922. Their share declined sharply between 1951 and 1980, and then rose again in the period 1980-2014.It was in 1991 when economic reforms took place .Piketty uses best of his ability in trying to persuade us that the socialist era was fairer than the liberalization era. To make their point they make various faulty arguments:

- By using a combination of survey and tax data to estimate India’s income distribution Piketty assumes that for the bottom 90% of the population the survey data reflect actual income levels. For the richest 5%, he uses income data extracted from tax filings. Between the 90th and the 95th percentile, he uses a combination of tax and survey sources. The upper percentile threshold changes slightly across years which mean that the income estimates of the top end of the income distribution are different from the estimates for the rest of the population. It also means that Piketty does not consider and underreporting of incomes by the bottom 90% of the population. Even applying little common sense would falsify this.

- The report does not take into account any changes in tax administration that may have led to change in assessment of top-income groups. It may have led to an exaggeration of the income estimates of top earners for the recent past. Piketty also reports 54 variations in assumptions while reporting his results. It’s unfortunate that all of those variations in estimation strategy suffer from this fundamental problem. Piketty-Chancel duo simply under-estimate the incomes of the non-rich and over-estimate the incomes of the rich. Both these effects result in the exaggeration of the inequality estimation.

- The use of tax data to judge income is problematic because the tax authorities consider capital gains as income. The interesting part is that the capital gains do not add any value and so are excluded from gross domestic product. So, the income to GDP ratio used by Piketty should not include capital gains but it’s quite the opposite.

- As per Piketty, during the period of nationalization and inspector raj inequality shrank. But did it reap any benefits to the common people? No, the poverty ratio remained same even after three decades because the population doubled and so the poor doubled. Its true inequality rose after 2000 but at the same time 138 million citizens were lifted above the poverty line between 2004 and 2014.The situation of scheduled castes which were considered ‘untouchables’ by the society has also improved significantly. After liberalization of economy and advent of new business opportunities some 3,000 dalits became millionaires. Piketty clearly ignores the benefits of liberalization of economy.

Piketty’s definition of inequality is not the Gini coefficient which is a statistical measure of income inequality (a measure of equality in which 0 is complete equality and 1 complete inequality) in population. According to 2010 economic survey, the urban gini coefficient for all states was higher than rural gini coefficient. Yet, all migration was from relatively egalitarian villages to in egalitarian cities signifying that people chose opportunity over equality.

Many times inequality is often confused with poverty. Inequality in empirical sense simply means the existence of a gap between those who are at the top in ‘earning’ table and those who are at the bottom. The existence of an income gap, even though if it’s widening implies nothing about the actual income levels of those who are at the bottom of the table. In simple words, an income gap does not necessarily mean that those who earn the lowest income are poor. Attempts to close inequality through standard welfare-state policies such as redistributive taxes, subsidies, minimum wage laws and price controls have slowed down economic growth all over the world. Today’s India is much better than India of Nehru-Gandhi when economy grew at ridiculed ‘Hindu rate of growth’, businesses required licenses to start manufacturing and ‘additional’ license to produce more what they were licensed for. The India of past was uniformly bleak but today it’s not the case. Today the ‘Rich India’ motivates the ‘poor India’ to become rich. When there is competition then only society reaps the benefit of innovation. The welfare policies have failed completely and must be disbanded but due to state of Indian politics it can’t be done.

No country’s leaders can be set as example apart from Singapore’s as they managed to identify the difference between inequality and poverty. Instead of pursuing social-welfare policies Lee Kuan Yew preferred growth-oriented policies even at the expense of the income gap.

In 2013, Prime Minister Lee Hsien Loong said “If I can get another ten billionaires to move to Singapore, my Gini coefficient will get worse, but I think Singaporeans will be better off because they will bring in business, bring in opportunities, open new doors, and create new jobs.”

On the other hand economists on the left side of the political spectrum argue against such policies. Piketty in his book ‘Capital in 21 century’ suggests implementing global wealth tax on the rich to bridge the inequality gap. However, implementing this idea is next to impossible and Piketty himself admits this.

In India there is little doubt that the super-low contribution of the bottom 50 per cent of the population presents very disturbing picture of low literacy.

Instead of subsidizing IITs and engineering colleges the government must invest in primary, secondary and skill based vocal institution. Investment equivalent to that invested in MGNREGA (about Rs 50,000 crore every year) if invested for skill up gradation can probably yield better dividends. It is the skill gap that widens inequality among citizens. Also, one of the biggest drivers of inequality is inheritance. Most of the time wealth is passed on from one generation to another which has done nothing to create it.

In the end, I would say inequality in India is not that big issue it’s made out to be. Yes, it’s harsh but truth is always bitter no matter how much you try to coat it with sweetness of falsehoods.

It’s the irrational response to inequality that gives rise to real problems. Implementing flawed policies such as redistributing the wealth and suppressing the creation of wealth is major cause of concern. The socialist policies of our country have already done the damage of ensuring the poor remain poor. Any economic system that promotes entrepreneurship will necessarily generate both wealth and inequality and the country that does not follow this won’t survive in the long run.

References:

https://www.ft.com/content/157022e0-a39f-11e7-8d56-98a09be71849

https://swarajyamag.com/economics/in-defence-of-ineuality-in-inia)