With the increase in furor about going cashless, it is imperative that we understand what entails going that route.

Migrating towards a cashless economy will bring about many tangible benefits to both emerging as well as developed countries. However, as in any other case, it’s also best to exercise caution.

How will an increase in electronic payments affect the economy?

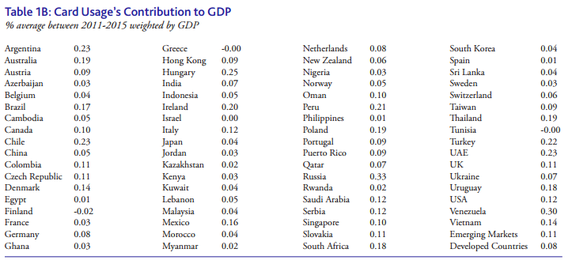

- Increase in GDP growth: According to the study conducted by Moody’s on 70 countries between the years 2011 to 1015, a percent increase in card usage in every country produced:

- About $104 billion, or 0.06% increase in consumption between 2011 and 2015

- This comes up to 0.04% increase in GDP between 2011 and 2015.

- Electronic payments have added $296 billion in real (U.S.) dollars to GDP in the 70 countries studied in the period. That is equivalent to 2.6 million jobs on average per year over the 5 year period.

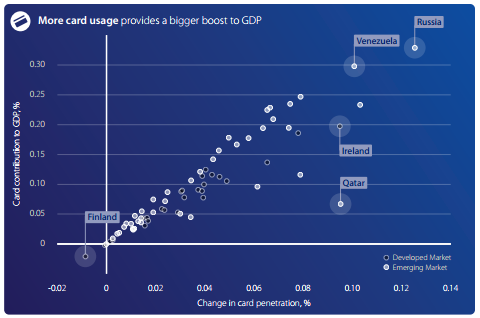

- It was found that countries with the largest increases in card usage experienced the biggest contributions to growth.

On plotting, it can be seen that there is strong correlation between card usage and GDP growth.

- Countries with the largest increases in card usage experienced the biggest contributions to growth. Example, Hungary saw a 0.25% increase in growth, Chile – 0.23%, Poland – 0.19%. In most cases, save Finland, Greece and Tunisia, card usage increased regardless of economic performance.

- The study also found that a rise in electronic payment methods such as credit, debit and prepaid cards in the UAE added US$3.7 billion to the GDP, and created an average of 14,750 jobs per year in the economy during the years 2011-2015. UAE also saw a six-percentage point increase in card usage with the economy placed 6th in terms of economic impact on GDP amongst the 70 countries studied.

- Convenience: It is more convenient for both merchants and consumers. Consumers are saved from the trouble of visiting an ATM to obtain cash or from having to count the cash at the time of payment.

- Even merchants are benefited as it lowers labor costs for them. For example: In self-service gas stations where consumers can use their own cards.

- Even startups are benefited. Especially the ones that are into delivery of goods. About 70% of the consumers choose Cash on Delivery for payment. And Cash on Delivery cost the company about 5 times more. This way going cashless drive down costs for companies.

- Increase in Transparency: Electronic payments bring down the cost incurred by the central bank in providing currency.

- While cash transactions are costly for businesses, they are costlier for banks. Cash requires elaborate security for its transportation and disbursement. It also a task tracking it bill by bill. Thus, financial institutions can make more money from card transactions and account maintenance while cash for all its importance, has questionable returns and a growing air of obsolescence.

- They also reduce the gray economy by a substantial amount. They create an audit trail that brings down unreported transactions, thus raising tax revenues.

- Electronic payments provide consumers with a safe and secure access to funds, reduce cash and check handling for merchants, and expand the pool of customers who are guaranteed to pay.

- More importantly, as a side effect they also promote more financial inclusion, giving those without access to the formal banking system an introduction to formal financial services.

This way, electronic transactions reduce friction in the economy, which results in an increase in spending on goods and services. This in turn creates a virtuous economic cycle where increase in consumption translates into increase in production, more jobs, higher income, and greater economic prosperity.

How is Sweden doing after going cashless?

Sweden, which is hailed for being the first cashless society, has nearly 80% of all transactions made electronically. Digital payments through cards or apps are so widely accepted that most Swedes don’t carry cash anymore. Even the children are supposedly let to pay through debit cards.

In 2013, Sweden eliminated its largest denomination bill, and demand for its second largest bill, the five hundred krona note too fell off soon after. By 2014, only a fifth of Swedish retail transactions were being conducted in cash. Ticket machines for trains and buses in Sweden accept only cards; and cafes and restaurants are increasingly moving away from accepting cash too.

Sweden underwent this transformation after three overriding causes that pushed it in this direction. Several high-profile bank robberies made the public distrust the security of paper money. The Swedish financial industry also realized that fee-inclusive transaction technologies would be more profitable than cash transactions. And lastly, being a small country, Sweden has been a leader in developing transaction apps and tools to aid this transformation.

Therefore, especially for the young and technologically adventurous, cash serves as an inhibition to the freedom of exchange. This line of thinking has driven the success and popularity of cashless-ness in Sweden. Swish, the most popular mobile cash-transfer app in Sweden runs on this notion. It was not developed by a visionary tech entrepreneur, but by Swedish banks which conceived the idea and funded its development. This peer to peer service moves money instantly requiring only the telephone number of the concerned person. Within four years of its launch, this popular app is used by nearly half of the Swedes and over 90% of the Swedish population under the age of 30. In fact, as of today, some Swedish banks have more Swish transactions than ATM withdrawals. Interestingly, Sweden even experienced it’s first Swish mugging last summer. Two thugs beat up a man and forced him to swish them. However, the criminals were soon identified by their account.

Street salesmen, from hotdog vendors to homeless magazine sellers have adopted another app called iZettle, a cheap and easy Swedish system that allows sole traders and small businesses to take card payments via an app and mini card-reader plugged into their phones. Many of them have since reported a 30% increase in sales.

Cards are now the main form of payment amongst Swedes with a study by Visa stating that an average Swede uses a card three times as often as an average European.

While Sweden seems to have made the most head way in stamping out paper currency, there are many more inching closer such as Denmark and Norway. 93% of consumer transactions in Belgium are now cashless. Many European countries have even capped the amount that can be legally paid in cash. Australia has also seen its cash use fall by a third. Even sub-Saharan Africa is seeing a jump in online payments.

However, there a lot of concerns yet to be addressed regarding a cashless economy.

Cases of electronic fraud have more than doubled in the past decade.

Privacy is another concern. For electronic transactions to take place, one must submit his account details online, thereby compromising privacy. Every transaction one makes is traceable. The jury is out on whether it is okay for governments (which are not always benevolent), banks or payment processors to have potential access to this information.

Major sections of rural populations, poor and the elderly are left behind. Rural population with scant access to banking institutions are worst hit because they would be heavily dependent on cash for doing everyday business. Elderly people are usually reluctant to change and end up fumbling with smartphones and often forgetting their pin numbers. Going completely cashless only adds to their misery.

That said, a lot of economists vouch for a cashless economy to drive growth and bring down the inelasticity caused by hard cash. However, the right implementation and gradual but steady transformation is required to ensure the disruption by the transformation doesn’t do more harm than good.

– Written by : Rakshita Kaulgud

Mailed to us by Aditya Ashok