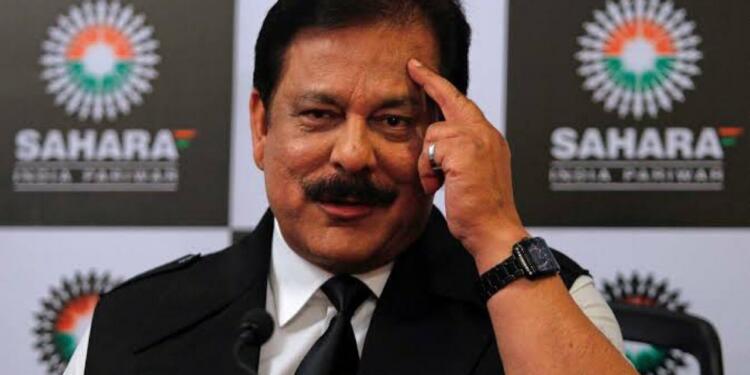

Subrata Roy, the founder and chief of Sahara Group, passed away at 75 in a Mumbai hospital due to cardiorespiratory arrest, a culmination of his prolonged battle with metastatic malignancy, hypertension, and diabetes. His journey from modest beginnings to becoming a business magnate is a tale of ambition, controversy, and eventual legal battles.

Early Years and Genesis of Sahara India Pariwar

Born in 1948, Subrata Roy established Sahara India Pariwar in 1978 with a meager capital of Rs 2000. Over the decades, he transformed this small venture into a massive conglomerate. The Group, as per its website, boasts a staggering 9 crore investors and customers, a networth of Rs 259,900 crore, encompassing over 5,000 establishments and a substantial land bank.

Roy’s business model primarily revolved around mobilizing deposits from millions of rural and poor Indians who were mostly outside the formal banking system. This approach enabled the Sahara Group to amass a vast customer base, a strategy that later became the focal point of its legal troubles.

Diverse Ventures and Roy’s Controversial Stint in Business

Roy’s ventures spanned across diverse sectors. He owned Air Sahara, a prominent airline, which he later sold to Jet Airways. His interests extended to sports as well, owning a Formula One team and an IPL cricket team, besides holding stakes in plush hotels in London and New York and running financial companies.

Despite his business acumen, Roy’s methods often raised eyebrows. He was known for his lavish lifestyle and high-profile connections across the political spectrum. His close association with film stars and politicians became a hallmark of his events. Notably, his relationship with Mulayam Singh Yadav and the Samajwadi Party played a significant role in his life, especially during Yadav’s tenure as the Chief Minister of Uttar Pradesh. Roy’s connection with Amar Singh, a key figure in the Samajwadi Party, was also well-publicized.

Legal Troubles Commence: SEBI’s Allegations Unveiled

Roy’s legal troubles began when the Securities and Exchange Board of India (SEBI) accused him of irregularities in collecting investments. The crux of the issue was the collection of over Rs 24,000 crore from three crore individuals, which SEBI deemed illegal. The regulator ordered Sahara to refund this massive amount to the investors, leading to a protracted legal battle.

Also Read: What prompted the downfall of Subrata Roy’s Sahara empire?

Arrest, Imprisonment, and Conditions for Release: The Saga Unfolds

In 2014, the situation escalated when Subrata Roy was arrested for failing to comply with the Supreme Court’s order to refund the money. He was imprisoned after failing to pay an outstanding amount of Rs 10,000 crore. The court’s condition for his release was the arrangement of Rs 5,000 crore in cash and a similar amount as a bank guarantee.

The legal proceedings took a bizarre turn when Sahara, in an attempt to prove its compliance, sent 127 trucks containing millions of documents to SEBI. This move, while demonstrating the company’s scale of operations, also highlighted the complexity and opacity of its financial dealings.

Roy’s time in jail lasted over two years, with intermittent periods of parole. His release was contingent on various conditions related to his assets and the repayment plan. However, his troubles were far from over. Most of the properties listed for auction to recover dues were attached by the Income Tax Department, complicating the repayment process.

In 2020, SEBI moved the Supreme Court to cancel Roy’s parole, demanding he pay Rs 62,600 crore. This was a significant escalation in the financial demands from the market regulator, indicating the gravity of the alleged financial irregularities.

Roy’s battle with SEBI primarily concerned the Optionally Fully Convertible Debentures issued by two Sahara companies. In 2010, SEBI banned these companies and Subrata Roy from raising funds from the public. This ban was a major blow to Roy’s financial empire, significantly impacting its operations and credibility.

One of the most puzzling aspects of this case was the apparent lack of traceability of the investors. In 2014, reports emerged that only a fraction of the investors came forward to claim refunds, raising questions about the authenticity of the investors and the investments.

End of an Era

Roy’s death marks the end of an era in Indian business and politics. He was a figure who symbolized the rise of entrepreneurial spirit post-liberalization, yet his story is also a cautionary tale about the perils of unregulated financial practices. His legacy is a complex blend of ambition, innovation, controversy, and legal battles.

In their statement following his death, Sahara India described Subrata Roy as an inspirational leader and visionary. They highlighted his battle with health issues leading to his demise on November 14, 2023. Roy’s death has left behind a mixed legacy, characterized by his rise from humble beginnings to becoming a household name in India, and his subsequent legal troubles that overshadowed his entrepreneurial achievements.