Indian fintech sector: It has been more than half a decade since we started paying through our mobile phones. Most of us would not even pause to think how we went from not having proper electricity connection to 24-hour online payment system. That is the beauty of Indian fintech sector. Its rise has been unprecedented in history.

India Stack going export route

Rajeev Chandrasekhar, Minister of State for Electronics and IT is quite optimistic of India’s fintech making it big. At the India Stack Developer Conference, he said that India has decided to export its technology platform. “I expect that by February-March, about 5-7 countries around the world to sign up (for adopting platforms),” said Chandrashekhar. After signing up, it will become easy for these countries to develop technologies like India’s Aadhaar, UPI, Digi Locker, Co-Win, GeM and GSTN among others.

For this, India will offer them a technology stack called “India Stack”. It is application programming interface (API) which is the foundational software pillar behind the miraculous rise of India in transparency and digital infrastructure. It is the largest open API in the world and combines processes such as identity verification, OTP verification and beneficiary authentication under one single umbrella.

Also read: Global Big Tech wants to take over India’s FinTech but RBI has a plan

Changed the face of India

All of it happened in a phase-wise manner. First came Aadhar with biometric, then eKYC, e-Sign, UPI, Digi locker and many more registered their presence. Demonetisation leading to increase in digital payments was possibly the biggest catalysts in the rise of reputation for India Stack. The main reason behind it is its role in setting the foundation for Indian fintech sector.

Aforementioned facilities helped the Modi government make banking accessible to masses with JAM trinity. As of January 18 this year, Rs 1,85,641 crores have been deposited in Jan Dhan Yojana accounts. Within a few months, the number of accounts opened under the scheme will cross 50 crore. This became the base on which the fintech sector has increased its penetration in India.

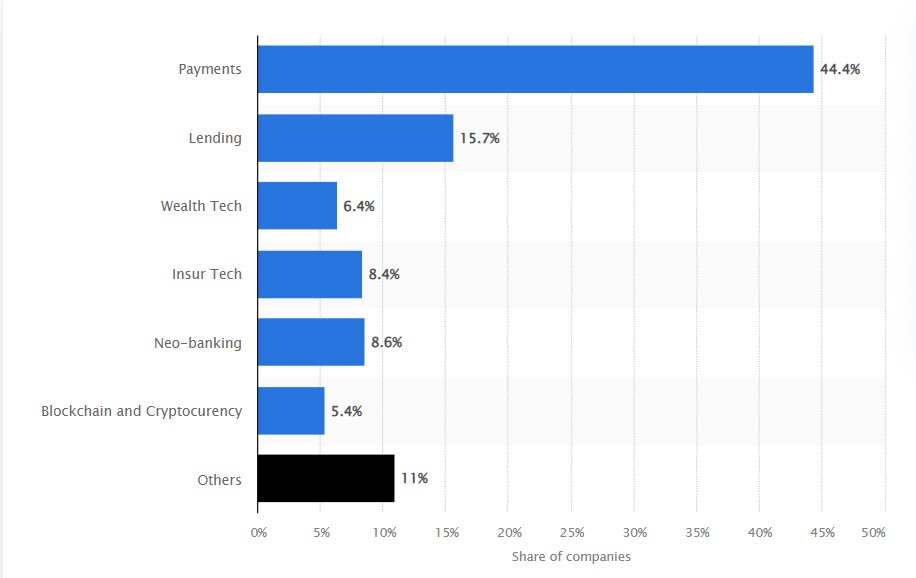

Today, Indians are using fintech for payments, lending, insurance, wealth generation, blockchain and even cryptocurrency. Currently, Payment is dominating the chart with bill payments, tickets being done primarily from cell phones. Payment fintech accounts for 20 per cent of Indian fintech sector.

Apart from payments, lending platforms, co-lending platforms, instant loans, and short term loans are some of the other segments quickly emerging on the horizon. Digital lending is in fact so much popular that even nefarious elements have entered the Indian fintech sector, something which the government is trying to weed out.

Also read: Number one remittance receiving country gets a UPI boost

India’s Fintech in numbers

Over the last 4-5 years, fintech grew at a CAGR of 26 per cent per annum. It grabbed 14 per cent of total funding grabbed by global fintech companies. Resultantly, the number of fintech companies in India has crossed the mark of 7,500. Out of these, 23 have already bagged Unicorn status, which is quite remarkable given that the total number of unicorns in India run in triple digits.

They have been quite aggressive about their dreams. Up until now, these companies have raised more than $30 billion from Venture capitalists. Initially, payment fintech dominated the investment chart, but now the gap between payment and other sub-sectors is subsidising. Out of $30 billion, $9 billion has been invested in lending fintechs. In 2021, the funding witnessed a 300 per cent jump. In terms of total deal, Indian fintech sector stands at second position.

Also read: FinTech startups – The sector that is producing Indian Unicorns on an assembly line

The number is only slated to rise in upcoming years. Estimates suggest that by 2030, Indian Fintech will have $1 trillion assets under management. Their role in agriculture and real estate is something which we can bank on. Agriculture has been an underdog for way too long while Real Estate vouches for radical change in transparency norms, something which fintechs can provide along with the government.

Despite so much accolades, challenges are there. Our Fintech adoption rate at 87 per cent is way above global average, making them accessible to the last mile is still a challenge. But India still has more than 150 million population not under the ambit of banking. Until that wall is penetrated, fintechs can’t sit content, no matter how big a headlines they make.

Support TFI:

Support us to strengthen the ‘Right’ ideology of cultural nationalism by purchasing the best quality garments from TFI-STORE.COM