Their role in welfarism is the reason why governments own certain banks also known as Public Sector Banks (PSBs). In India, these banks had become the epitome of everything wrong with checks and balances. However, the Modi-Sitharaman duo has changed the scenario.

PSBs churning out profits

In her latest tweet, Finance Minister Nirmala Sitharam has informed the nation that PSBs are ready to drive investment in the economy. According to the latest numbers, all 12 PSBs have declared net profit in the second quarter of FY23. Their total profit in Q2 of FY23 is Rs 25,685 cr.

It is a remarkable 50 per cent jump in Year-on-Year (YoY) terms. The same figure for Q1 of this financial year was Rs 15,306 crore. Overall, in the first 6 months of FY23, PSBs declared net profit of Rs 40,991, a 31.6 per cent jump over the last year.

The continuous efforts of our govt for reducing the NPAs & further strengthening the health of PSBs are now showing tangible results. All 12 PSBs declared net profit of Rs 25,685 cr in Q2FY23 & total Rs 40,991 cr in H1FY23, up by 50% & 31.6%, respectively (y-o-y).(1/2)

— Nirmala Sitharaman (Modi Ka Parivar) (@nsitharaman) November 7, 2022

One of the reasons behind these astronomical numbers is intra-PSBs competition for improvement in efficiency. In percentage terms, UCO Bank turned out to be the top performer with a 145 per cent jump in net profitability. Canara Bank with 89 per cent increase was a distant second. In terms of pure numbers, SBI topped the chart with profit worth Rs 13,265 crore. Notably, profits of SBI alone comprise more than 50 per cent of overall profits of PSBs.

In Q2 of FY23 (year-on-year)

✅ SBI reports 74 % jump in profit to Rs 13,265 cr

✅ Canara Bank reports 89% jump in profit to Rs 2,525 cr

✅ UCO Bank reports 145% jump in profit to Rs 504 cr

✅ Bank of Baroda reports 58.70% profit of Rs 3,312.42 cr (2/2) pic.twitter.com/YiaspDnhws— Nirmala Sitharaman (Modi Ka Parivar) (@nsitharaman) November 7, 2022

Modi government inherited foggy state of affairs

The worst economic problem inherited by the Modi government in 2014 was the poor state of PSBs. Between FY 2009 and FY 2014, the loan portfolio of public sector banks had almost tripled from Rs 18,19,074 crore to Rs. 52,15,920 crores. Mind you, most of the projects run by this money were not yielding results since policy paralysis had tanked the economic activity. Despite that there was little regulatory pressure to declare them as NPAs.

The scenario changed only after PM Modi took oath. His Cabinet took it on mission mode to clean the dirt. The Modi government launched an ASSET QUALITY REVIEW (AQR) to find out the depth of dirt.

Quoting Press Information Bureau, “As a result of AQR and subsequent transparent recognition by banks, stressed accounts were reclassified as NPAs and expected losses on stressed loans, not provided for earlier under flexibility given to restructured loans, were provided for. Further, all such schemes for restructuring stressed loans were withdrawn.” The percentage under NPAs increased from 4.28 in FY 2014 to 11.8 by the end of FY 2017.

Reforms introduced to improve banking sector

Simultaneously, efforts were put in to clean up the mess. On the financial institution front, banks were made efficient by empowering them to seize collaterals and other items of NPA holders. Scheduled Commercial Banks (SCBs) have recovered Rs 8,19,892 crore during the last seven financial years.

To cater to demands of the business community, various initiatives were put in place to stop the rise of NPAs. Insolvency and Bankruptcy Code was introduced and NCLTs were established. Through them the government made it easier for businesses to exit loss making enterprises with very little penalty. It made it easy to establish and do business as well.

GST turned out to be a game changer as an easier tax structure pushed people to participate in the formal economy. In 2021, the share of informal economy in India’s gross economy had dropped to 15-20 per cent from 52 per cent in 2018.

Also Read: How Modi govt. turned the fortunes of NPA laden PSBs

PSBs profits: Everything has changed

No wonder NPAs have declined dramatically in the last 3-4 years. Gross NPAs of Banks had fallen to 5.9 per cent in March this year. The Bad Bank initiative of the Modi government took care of the rest. Banks have now restarted lending with more freedom. The check and balance to the lending process is being provided by the increased efficiency due to the government’s willingness to privatise poorly managed PSBs.

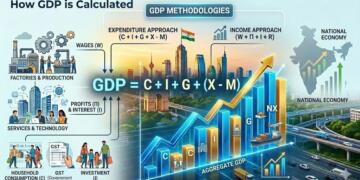

Banks are drivers of modern economies. It is these banks that drive investments resulting in GDP growth, job creation and much more. This is the single biggest lesson from every recession of the last 150 years. The Modi govt understands this, which is now reflected in numbers.

Support TFI:

Support us to strengthen the ‘Right’ ideology of cultural nationalism by purchasing the best quality garments from TFI-STORE.COM