Indian Express Newspaper Vs Union of India: Pricing newspapers have also been contentious for the publishers. On one hand, they have to spend a lot on quality, while on the other hand; they have to ensure information dissemination to the last mile. Any kind of surprise tax by the government could drastically reduce the saleability. This was the concern expressed by Indian Express in a famous Court battle.

Import duty and newspapers’ contention

In the early 1980s, the Union government imposed import duty on newsprint. Government used its powers under Customs Tariff Act 1975 and the auxiliary duty under the Finance Act 1981 and Customs Act 1962 to bring the change. Before the notification dated 1st March 1981, newsprints enjoyed freedom from the custom duty. Additionally, the government had also classified newspapers into small, medium and large.

The notification was challenged in the Supreme Court through a writ petition. Representing companies, employees, shareholders and trusts engaged in the publication of newspapers, Indian Express argued that notification violated free speech provision of the fundamental rights.

According to them, new duty would lead to rise in cost, which would ultimately lead to fewer copies available in the market. This harmed free speech under Article 19(1)(a). They also contended that it restricted their constitutional right to free trade under Article 19(1)(g).

Regarding the division of newspapers into categories, Indian Express contended that the decision was arbitrary and violated Right to Equality under Article 14 of the Constitution.

Indian Express also alleged that the Indian government was taxing newspapers in order to stifle the criticism. In other words, in their view, taxing newspapers was not financial decision, but a political one. They cited sufficient Forex Reserve at that time to substantiate their point.

To support its point about curtailment of Freedom of Speech, Indian Express cited decisions in Sakal case and the Bennett Coleman case.

Tax was Constitutional

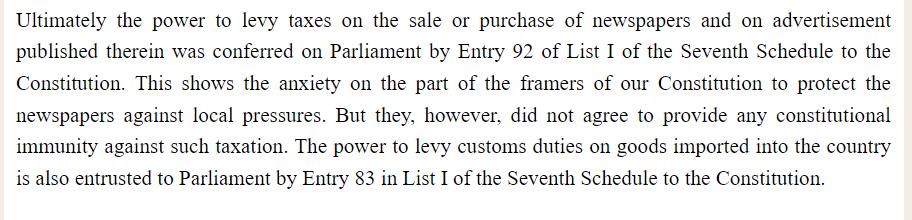

Both these cases were found to be almost irrelevant to the subject matter at hand by the judges. Apex Court also referred to Constitutional Assembly debates on the issue of taxation possibly taking a toll on Free Speech.The Court found no unconstitutionality in levying tax because they have vindications under Entry 83 and 92 of Seventh Schedule of the Constitution.

![]()

The Apex Court also asked big newspapers to be appreciative of the government’s efforts to subsidise them. It asked them to keep a check on their privilege by bearing fiscal burden like other small players were bearing.

Indian Express and their friends were educated that the exemption from tax which they were receiving was not their legal right, and but rather an attempt by the government to encourage freedom of speech. The taxation is not justified under freedom of speech segment, but it is justified on occupation, trade or business under Article 19(1)(g).

Also Read: 1980, Bachan Singh vs State Of Punjab: When Judiciary clearly defined ‘Rarest of the Rare’ case

Difference between Free speech in the USA and India

The Judges then distinguished between the American concept of free speech and its Indian adaptation. It was pointed out that in the American scheme of theme; free speech is almost absolute, solidified by their first amendment to the Constitution.

While in India, freedom under Article 19(1)(a) and 19(1)(g) are subject to checks and balances. Both the aforementioned articles have been balanced by Articles 19(2) and 19(6) respectively. Despite pointing out the difference, honourable SC also noted that even in America, taxation on Newspapers in Constitutionally legitimate act.

Then the Court drew the boundary line for taxation. The Apex Court asked the government to keep these duties under a reasonable limit. The test of reasonableness is that it should not contravene Article 19(2) of the Constitution. It told the government to not single out the newspaper industry for harsher treatment.

Indian Express was not prepared

Based on these observations, the Court established that tax can be questioned only when there is a clear and distinct link between decrease in sales and tax imposed in newsprint. Unfortunately, Indian Express could not satisfy this criteria.

In its Judgement Apex Court vindicated Centre’s position, but told them to reconsider the levy within six months.

Support TFI:

Support us to strengthen the ‘Right’ ideology of cultural nationalism by purchasing the best quality garments from TFI-STORE.COM

Also Watch:

https://www.youtube.com/watch?v=76muz7j6cKQ