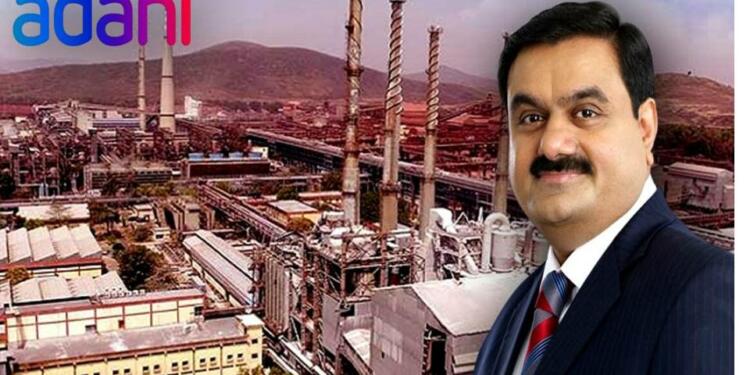

India as a nation is currently at the peak of development, with its top billionaires continuously investing in different sectors. One such billionaire, Gautam Adani, is on a spree of strengthening the Indian economy in almost every aspect. From green energy to now the aluminum sector, Adani’s sway of business management can be seen as a success in almost every sector.

The welcoming of Adani in the aluminum sector

With the gradual stretching of Adani’s footprints, it has a new knocked the aluminum sector for further development. In a recent development, Adani Enterprises Ltd. has planned to invest worth $5.2 billion in setting up an alumina refinery in the eastern Indian state of Odisha. It’s just another milestone marking the growth in an already expanding empire of the Indian billionaire.

According to a recent Twitter post by the office of the state’s Chief Minister, Naveen Patnaik, the flagship company of the Adani Group got the approval to build the refinery and a captive power plant in Rayagada for an investment of Rs. 416.53 billion. Moreover, as per the local government, the refinery will have an annual capacity of 4 million tons.

Interestingly, it’s not the first entry of Adani in the aluminum sector. Earlier in December, he had set up a wholly owned subsidiary “Mundra Aluminum Ltd.”, which posed a challenge to the already dominating Aditya Birla Group and the London-based Vedanta Resources Ltd.

Apart from this, Gautam Adani has contributed immensely in various other sectors as well. Whether it’s surpassing the Ambani empire or boosting the Indian economy through renewable energy, we at TFI have time and again presented his factual growth upsurge.

Read more: As predicted by TFI, Gautam Adani has left Mukesh Ambani miles behind

Adani’s incessant growth

As reported by TFI in July this year, the Chairman of Adani Group announced an investment of worth $70 billion in green energy transition and infrastructure projects. And this further made an inclination of “reshaping India’s energy footprint in an extraordinary way.”

In July 2022, the Adani Group announced a plan to boost the real estate projects alongside its airports in the country, along with its aeronautical and non-aeronautical terminal operations. Adani airports planned to develop around 70 million square feet on over 500 acres of land across all its airports.

Interestingly, Gautam Adani is not just strengthening India as a whole, but is dedicated to uplifting various states of the country as well. As reported by TFI in June 2022, Adani announced the investment of worth Rs. 70,000 crores in the state of Uttar Pradesh, which further up scaled the already invested projects of transmission, green energy, water, agri-logistics.

Through all this, it is imperative to note that Gautam Adani is gradually becoming an asset for the entire Indian economy. His group’s incessant investments in varying sectors are an economic boon to the economy, while a bane for various hegemonic companies dominating the market. Additionally, Adani’s recent investment in aluminum will prove to be a cherry on top of his $130.8 billion net worth, as per the Forbes real time data.

Read more: Adani’s Rs. 70000 crore investment is going to transform UP forever

Why is aluminum alluring to Adani?

As said by Gautam Adani himself, “Metals are critical commodities in which our nation must be self-reliant, and these projects are aligned with our vision of Atmanirbharta.” The Indian aluminum market is growing at a rapid pace. With over 7 percent growth per annum, one of the highest in the world, the Indian aluminum market is booming.

Aluminum is used in almost everything from window frames, cans to auto parts, thus causing a jump to a record above $4,000 a ton on fears of a deepening shortage following Russia’s war against Ukraine.

On the other hand, India’s Aluminum demand is estimated to double by the year 2025 with the current resilient GDP growth rate driven by increasing urbanization and push for boosting domestic infrastructure, automotive, aviation, defense, and power sectors. Keeping this scenario in light, it is significant for the world’s largest democracy to be self reliant, especially in the age, where the dragon is rigorously trying to harness the Indian civilisation.

Thus, the Indian billionaire Gautam Adani recognised the looming opportunity in the aluminum sector. Through his recent investment in the sector, the Adani Group has caused a huge jolt to the existing dominion of Tata, Aditya Birla and Vedanta group.

Adani giving a tough run to existing groups

Currently, there are few consortiums who are immensely dominating the aluminum market. Billionaire Kumar Mangalam Birla owned Mumbai based Hindalco Industries is rapidly expanding its primary aluminum capacity in India.

Apart from this, Vedanta is the largest aluminum producer in India with 40 percent of market share. Its Bharat Aluminum Company Limited (BALCO) is incessantly working towards expanding itself further in the industry. Additionally, the Tata Aluminum Limited also holds a significant contribution in further boosting the sector.

Though all the three above-mentioned groups are performing incredibly well in the industry, the Adani group is all set to pose a challenge and compete with the already ahead companies. Gautam Adani is one by one ticking the boxes of backfiring various rival companies in the aluminum sector.

With history proving Adani to be a success in almost every sector, his recent investment will insanely jolt Tata and Birla economically.

Support TFI:

Support us to strengthen the ‘Right’ ideology of cultural nationalism by purchasing the best quality garments from TFI-STORE.COM