Since the Modi govt. came to power economy and GDP are the talk of the town. One more area of interest for people is the Forex reserve of India, as it is rising continuously since PM Modi came took oath. Since 2014, the central government is also trying to cut down on imports and raise exports, and initiatives like Make in India, Aatmanirbhar Bharat, and One District One Product among others are steps in that direction. But one sector in which India is still dependent on others is the crude oil sector, But, Modi government is taking drastic measures to change that scenario.

The Cabinet Committee on Economic Affairs (CCEA) chaired by Prime Minister decided on Wednesday(29 June) to deregulate the sale of crude oil that is produced domestically, which will give companies autonomy to sell their produce in any market they deem fit. Experts believe that this decision will play the same role for the oil sector in India, as India’s 1991 decision to deregulate the economy played in the liberalisation of Indian market. This decision will attract many companies to explore and produce oil in India from both National and International arenas.

India’s energy demands

After the economic liberalisation, the engines of industrialisation and development started to run at full throttle and with this, the demand of oil in India skyrocketed. But India’s oil import bill was a huge toll on the Forex reserve. In the past, Saudi Arabia denied India for a lesser price on crude despite of India helping them during Covid induced crash in oil market.

As this fact is well known that Russia is the third-largest producer in the world only after United States and Saudi Arabia, but sometimes this order shifts. Russia produces nearly 11 million oil barrels per day, most of it is used for internal consumption approx. 4-6 million barrels (currently increased due to war scenario) and the rest is exported.

So when India recently got a chance of getting cheaper oil from Russia (due to Ukraine-Russia conflict), it hopped on the opportunity to ensure its energy security at a lesser price. The availability of oil decreased for India after the sanctions on Iranian and Venezuelan oil and also USA stopped production of oil which ignited the artificial rise in the price of crude oil. The West tried to pressurise India but got slammed in return and also Russia became India’s largest oil supplier according to the recent developments.

In Kochi (January), PM Modi while dedicating an integrated refinery expansion complex to the nation said “To cut down on import of Crude oil, government has taken decisive steps towards reducing imports by 10 per cent and saving precious foreign exchange,…”

This indicates that the Central Government is working aggressively on reducing oil import bills and developing alternates on a war footing.

India’s options against OPEC oil

As per Economic Survey 2021-22, India’s import bill for crude oil reached USD 73.3 billion in 2021. As we also reported before, India saved a staggering ₹ 41000 crores of import bills with blending Ethanol in petrol. Recently Union Minister Nitin Gadkari also unveiled hydrogen-powered cars and with Adani group’s efforts towards producing blue hydrogen will lead to abundant hydrogen availability all over the country for internal consumption as well as for export.

The EV sector in India is also expanding its horizon, currently, approx 40 per cent of two-wheelers are powered by electricity and it is estimated that it will account for more than 80 per cent by the year 2030.

The car sector currently stands at The GOI has also set an ambitious target, which pegs EV sales penetration in India at 70 percent for commercial cars, 30 percent for private cars, 40 percent for buses, and 80 percent for two- and three- wheelers by 2030.

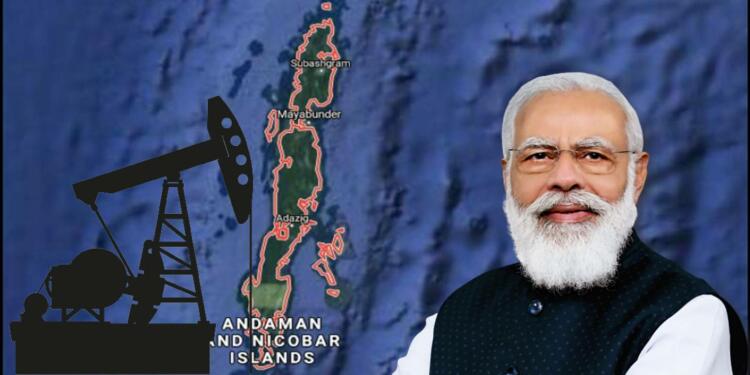

Before this decision, it was Central Government which decided which oil refinery gets how much crude from each producer but after this historic decision, India may enter into the international game of crude oil. The probability of finding oil in the region is very high and liberalisation of oil exploration and production (E&P) will lead to multiple players investing in finding oil in the Andaman region. India currently imports 85% of its oil needs and 53% of its gas requirements.

The central government’s decision of investing Rs 7.5 trillion in next 5 years for developing oil and gas infra also indicates that Central Government is very much inclined towards cutting its dependence on other countries for oil.

Support TFI:

Support us to strengthen the ‘Right’ ideology of cultural nationalism by purchasing the best quality garments from TFI-STORE.COM