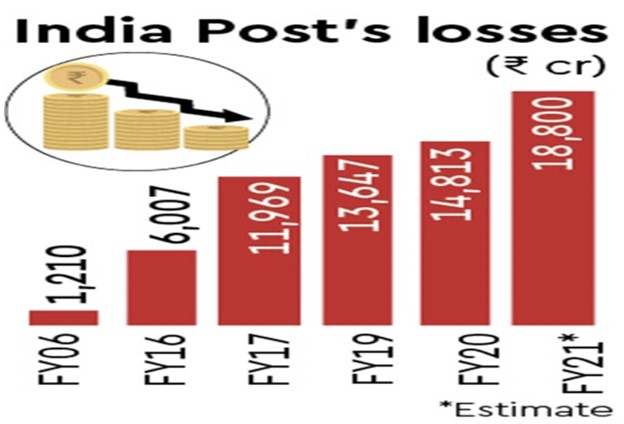

- India has a vast network of 1.5 lakh post offices across the nooks and corners of the country. However, these post offices are not being utilized very efficiently and the losses in the department are widening in the last few years.

- Therefore, the Modi government is pushing for banking operations at India Post branches in order to make a turnaround.

- Currently, India Post has a subsidiary — India Post Payments Bank (IPPB). Payment banks can accept deposits up to Rs 2 lakh, but they can’t lend.

- It is well known that the country is underbanked, especially in the rural areas. The density of bank branches is very low.

India has a vast network of 1.5 lakh post offices across the nooks and corners of the country. However, these post offices are not being utilized very efficiently and the losses in the department are widening in the last few years. Sending letters and money, which used to be a big part of India post’s business, have lost the market to digitization. The Department now focuses on e-commerce deliveries – especially in rural areas – but that is not enough to pay the salary of more than 4 lakh employees.

Therefore, the Modi government is pushing for banking operations at India post branches in order to make a turnaround. The posts already offer some banking operations such as savings schemes, but the core banking solution, which is lending, is not done at these branches. But very soon, every post office will also be a bank.

“There are more post offices than bank branches (1.2 lakh) in the country. So, the objective is to turn around loss-making infrastructure to a universal bank over a period of time,” said an official.

Currently, India Post has a subsidiary — India Post Payments Bank (IPPB). Payment banks can accept deposits up to Rs 2 lakh, but they can’t lend. Like other loss-making public sector enterprises, India Post’s finances are weighed down by high pay-and-allowance costs for its 4.16 lakh staff.

On the revenue front, India Post is largely dependent on National Savings Schemes and Saving Certificates, which contributed over 70% of its Rs 11,385-crore revenues in FY21. Postal services generated only 23% of revenues.

Previously, in 2018, the Union government approved the long-standing demand of around 2.6 lakh rural postmen, known as Gramin Dak Sevaks (GDS), by raising the basic pay by over three-fold. Gramin Dak Sevaks, who were getting Rs 2,295 per month, will get Rs 10,000. Those who are getting Rs 2,745 will get Rs 12,000. GDSs who are paid Rs 4,115 will get Rs 14,500 per month. The decision by the Modi government will increase the minimum wage of a postman to 10,000 per month and the maximum to 35,480 per month.

But this decision also increased the losses and now the Department must come up with innovative solutions to ensure that finances can be improved. Under the leadership of Ashwini Vaishnaw, the department is considering banking services for a turnaround. Around 70% of the revenue already comes from banking operations like savings certificates, if the department starts core banking solutions like lending, the revenues can be ramped up and losses be trimmed.

It is well known that the country is underbanked, especially in the rural areas. The density of branches is very low. Although the Pradhan Mantri Jan Dhan Yojana brought every person in the country under the ambit of banks, the usage of banks in the country is limited to the transfer of money – by the government through DBT and by migrant labourers to send money back home. Very few people in the country have acquired the credit culture because a few years ago most of them did not have bank accounts.

However, in the coming years, the banking needs are expected to rise exponentially, and this is where India Post aims to capitalize. The banking operations like lending, deposit, insurance may become a boon for 1.5 lakh post offices of the country. If executed properly, the new business might make India Post a profitable entity within a decade.