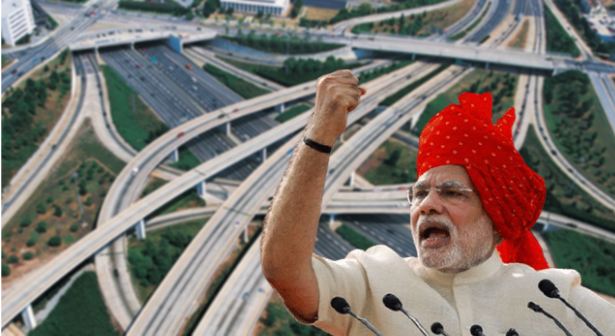

The government of India has planned investments worth Rs 7 trillion in the infrastructure sector, to be spent in the next 2-3 years, according to an Indian Express report. To remove the major bottleneck of hefty bank guarantees that often discourage the small and medium contractors to bid for major projects – the Modi government, in close cooperation with the Insurance Regulatory and Development Authority of India (IRDAI) has come up with a novel solution.

IRDAI on Tuesday, issued guidelines for insurance companies to launch the much-anticipated surety bonds. The regulator remarked that the IRDAI (Surety Insurance Contracts) Guidelines, 2022 will come into effect from April 1, 2022. The decision to launch the guidelines comes on the heels of the Ministry of Road Transport and Highways and its Minister Nitin Gadkari requesting IRDAI to look into the proposal, last year.

What is a surety bond?

To explain it in a perfectly layman way, a surety bond is a legal contract that ensures that all obligations regarding the completion of a project are met. Moreover, if the project gets delayed, postponed or tangled in a legal web, the surety bond ensures that compensation is paid to the party infusing its precious capital.

It assures the project owner (typically a government entity) that the assigned contractor will perform the task as per the contract clause. Usually, there are three parties involved in a surety bond:

- The principal, who makes good on the obligation, meaning the company taking on the project.

- The Obligee, or in this case, the government seeking a guarantee that aforementioned ‘Principal’ will perform or complete the project

- The Surety, who issues the surety bond. In this case, IRDAI or the numerous insurance companies that will act as the mediator

Premium paid by the principal and IRDAI’s caveat

To obtain a surety bond, the principal pays a premium to the ‘Surety’ (an insurance company). Usually, the principal pledges the company and its assets to reimburse the surety if a claim occurs. However, even then, if the assets cannot make up for the project costs, the surety pays its own money to satisfy the claim.

Regarding the premium, IRDAI has come up with a caveat. The regulator has remarked that the premium charged for all surety insurance policies underwritten in a financial year, including all installments due in subsequent years for those policies, should not exceed 10 per cent of the total gross written premium of that year, subject to a maximum of Rs 500 crore.

According to domain experts, the surety Bond system can replace the system of bank guarantee, issued by banks for projects, and help reduce risks due to cost overrun, project delays and poor contract performance.

Surety Bonds are a smarter alternative to Bank guarantees and can eventually help in catapulting India’s growth story in the infrastructure sector. If India is to realise its ambitious dreams of infusing Rs 7 trillion in the coming years, it needs a hands-on-deck approach. Having small and medium companies pitching in with their efforts in the cutthroat infrastructure sector is the best way to go about things.