The story of Bihar over the past five years is one of transformation, from a state crippled by the COVID-19 pandemic to one that has redefined its development narrative. The year 2020 was all about desperation, fear and hopelessness because of the pandemic and lockdowns. In contrast, 2025 stands as a testimony to recovery and resilience. But this development journey has also redrawn Bihar’s political map. The Rashtriya Janata Dal (RJD), which emerged as the single largest party in 2020, now finds itself facing a vastly different political environment, where it cannot honestly hope to repeat its past performance and form the government, even if some parties change their commitment from NDA to Mahagathbandhan.

2020: The Year of Despair and Political Anger

In 2020, Bihar became the epicentre of India’s migrant crisis. As the nationwide lockdown brought life to a standstill, thousands of migrant workers from Bihar walked hundreds of kilometres back to their villages, carrying not only their belongings, but hunger, fear and humiliation. There was no vaccine in sight, and no leader, executive or scientist had a clear roadmap to survival. The images of migrant families walking on highways, sleeping by the roadside and being sprayed with disinfectants symbolised the collective trauma of a state already battling poverty and unemployment.

The enforcement measures were harsh and often dehumanising. Quarantine centres were mismanaged, the homes of COVID-positive patients were fenced, and contact tracing resembled police raids, giving infected families the feeling of being treated as criminals rather than patients. These actions, coupled with the complete suspension of livelihood, triggered widespread resentment. The public mood in 2020 was full of anger and hopelessness and it translated politically into a backlash against the ruling NDA government.

The RJD, led by Tejashwi Yadav, capitalised on this anti-government wave. Lalu-Tejashwi party successfully positioned itself as the voice of the neglected. The Left parties, particularly the CPI(ML), mobilised among migrant workers and the working class, convincing them that the government had abandoned them in their hour of need. This ground-level anger, coupled with RJD’s promise of 10 lakh jobs helped the RJD emerge as the single largest in the 2020 Assembly elections; however, Mahagathbandhan was still away from the majority in the legislative assembly.

2025: A State Rebuilt on Roads, Homes and Hope

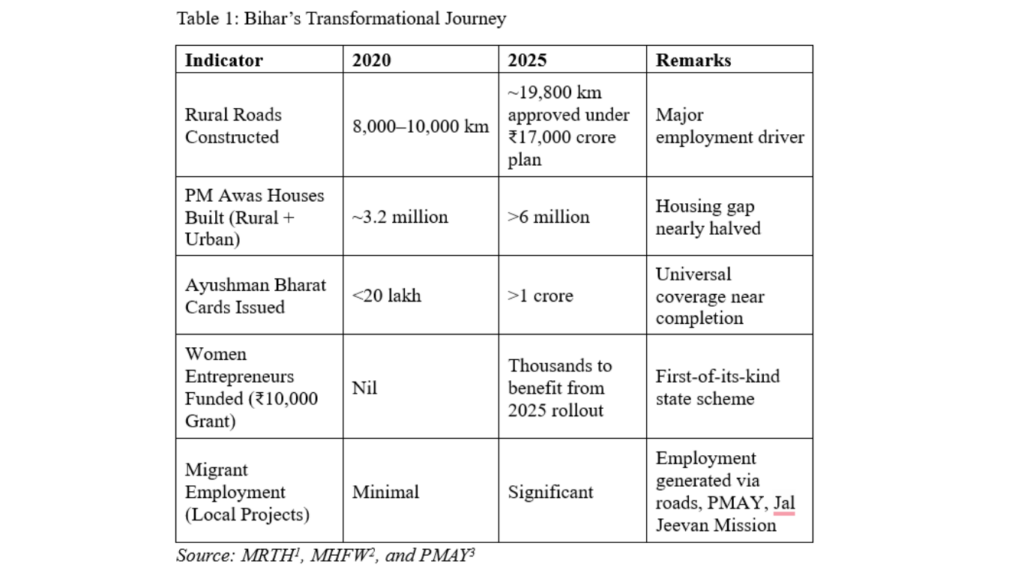

Fast forward to 2025, the economic, infrastructural and welfare landscape of Bihar has changed significantly. The roads that once witnessed the hopeless march of migrant labourers are now being rebuilt as veins of progress. Under the ongoing rural road projects worth over INR 17,000 crore, more than 19,800 km of new roads are being constructed across the state. Bihar’s total road network has almost doubled over the past two decades, with a sharp rise after 2020. These developments have created thousands of local jobs and reduced the distress-driven migration that had defined the state’s labour market.

The Pradhan Mantri Awas Yojana (PMAY) has noticeably transformed rural housing. Over six million pucca houses have been built in Bihar, giving a tangible sense of security and dignity to families that once lived in kutcha shelters. More than 2.5 lakh houses have been approved under PMAY (Urban) and nearly 64% have been completed. Such visible outcomes have asserted the credibility of the NDA’s welfare governance model.

The Ayushman Bharat scheme is positively changing lives in Bihar too. than 1 crore Ayushman Bharat cards have been issued in Bihar, and now every ration card holder has access to Ayushman healthcare. For families who were once forced to sell their land or were deep in debt due to hospital expenses, this scheme provides a much-needed relief. These are not just policy claims; they are visible in villages, where people now carry health cards with a sense of empowerment.

The ration delivery system, which was heavily impacted during the lockdown, has been completely streamlined over the last five years through digitalisation and doorstep delivery in rural areas. Where ration queues symbolised neglect in 2020, they now represent one of Bihar’s most improved welfare systems.

Women as Drivers of Bihar’s Local Economy

Women have consistently voted for Prime Minister Narendra Modi and Chief Minister Nitish Kumar. A recent major policy breakthrough is ‘Mukhyamantri Mahila Rozgar Yojana’ under which women receive a direct cash transfer of INR 10,000. This initiative targets rural women and aims to empower them to manage local businesses like tailoring, dairies, or food processing and even provides additional assistance of INR 2 lakh after 6 months of successful operations.

For a state like Bihar, where women’s workforce participation has historically been low, this initiative is not just a welfare measure; it brings an economic and socio-cultural change. Women across the districts are now able to form micro-enterprises, earn an income, and gain economic independence and confidence. This scheme’s success adds a layer of political capital for the ruling NDA alliance. They have successfully transformed welfare into self-reliance.

Why RJD’s 2020 Formula Won’t Work in 2025

RJD’s 2020 success stemmed from politics driven by crisis, fuelled by anger, fear, and uncertainty. In contrast, 2025 is characterised by stability, welfare, and infrastructure. The same slogans that attracted the public in 2020 now sound dated against the backdrop of visible development.

The NDA’s governance strategy in Bihar has shifted from rhetoric to tangible benefits. Roads, homes, toilets and health insurance have reached even remote panchayats. The earlier anti-incumbency, driven by grievance and neglect, has been replaced by a narrative of continuity and delivery. Beneficiaries who have received a house, a toilet, or an Ayushman card have no reason to gamble on a party having a dark past and translucent vision.

In 2020, the angry migrant labourers were a major political force for the opposition. But today, road construction, housing projects and rural entrepreneurship have created significant local employment. The same unskilled workers who once walked home from other states are now earning wages building roads or houses in their own districts. This reduces RJD’s emotional appeal among the working class, a constituency that once powered its rise to become the single largest party, gaining 23.11% votes, the highest among the top three parties.

The CPI(ML) and other Left allies are still aligned with RJD, but their grassroots influence has faded. Their traditional base, consisting of workers and farmers, now benefits from government welfare programs. Anger has been replaced by cautious optimism, and slogans of resistance have lost resonance in the face of tangible improvements. In 2020, the Left was able to mobilise its cadre towards RJD, making it win seats where it had a traditional presence. Constituencies having significant left presence, such as Sandesh, Bodh Gaya, Goh, Obra, Nabinagar, Rafiganj, Sheikhpura, etc, RJD managed to win because of the successful transfer of left votes to the RJD. However, in 2025, their capacity to do so has diminished considerably.

Tejashwi Yadav entered 2020 as the young face of change; articulate, energetic and free from the baggage of his father’s era. It was an open secret that the first Mahagathbandhan government in 2015 was being run by Lalu Prasad and the advisors of Nitish Kumar, and Tejashwi had a limited role to play. So, even in 2020, his face as the leader was fresh. But when he got a significant share of control in the second Mahagathbandhan government in 2022 as the Deputy CM, his limited capability in governance and leadership was exposed. He could not convert his slogans into delivery and failed to demonstrate administrative acumen. What once appeared as a generational shift now seems like a missed opportunity. It’s a popular belief that Tejashwi is yet to come out of his party’s past Chief Ministers’ shadow; in fact, some believe that he is just carrying forward the dark legacy of the RJD.

Adding to RJD’s troubles is the internal discord within the Yadav family. Tej Pratap Yadav’s open rebellion against his brother and expulsion from the party have not only embarrassed the RJD but also fractured its support base in a few constituencies. His own and his newly formed party’s candidature may cost RJD on two to three seats, potentially decisive in a close election. This visible family feud reinforces the perception of chaos and weak leadership within the RJD camp. The so-called friendly fight among the Mahagathbandhan allies on more than ten seats may also potentially impact the CM dream of Tejashwi.

Perhaps the most unpredictable factor in the 2025 election is Prashant Kishor, the former advisor of Nitish Kumar, whose Jan Suraaj Party has gained traction, especially among young migrant working-class and minority voters. The two segments that played a crucial role in RJD’s success in becoming the party having the highest vote share and seats. His presence could fragment the Muslim vote that has been RJD’s traditional anchor. Even a small shift of 3-5% in this bloc could significantly alter seat arithmetic in several constituencies.

Unlike 2020, when emotions ran high, the elections in 2025 appear more pragmatic. People are evaluating governments not just on promises but on delivery. For many, political loyalty is now transactional; linked to welfare benefits, employment and stability. The RJD’s strategy of invoking nostalgia or victimhood no longer resonates with an electorate that can see visible development in their villages and towns.

Can the RJD Form the Government in 2025? Highly Unlikely.

Even in the best-case scenario, RJD’s path to power looks blocked. The party may retain its core Yadav-Muslim vote base, but internal divisions, left ineffectiveness and emerging competition are likely to cut into its margins. Even if smaller NDA partners were to break away, the combined opposition lacks the organisational strength and leadership clarity to challenge the Modi-Nitish-led NDA juggernaut.

Moreover, Nitish Kumar’s governance model, combining the Centre’s handholding, ensures continued public confidence. The combined effect of the BJP’s strong organisational network, intact NDA force and Nitish Kumar’s welfare penetration makes a repeat of 2020’s close contest improbable.

Conclusion: From Survival to Stability

The Bihar of 2025 is no longer the Bihar of 2020. In just five years, the state has moved from queues for rations to women-led enterprises, from despair to delivery, and from crisis to confidence. Roads, homes, healthcare, and livelihoods have reshaped public sentiment. The politics of survival that once favoured the RJD has been replaced by the politics of stability that benefits the NDA.

Tejashwi Yadav’s RJD, weighed down by internal rifts and a fading narrative, finds itself on the wrong side of a changing Bihar. Even with the Left by its side, even if it attracts a few defectors, the arithmetic and the mood are not in its favour.

The road from 2020’s chaos to 2025’s confidence may have been long, but it has also redefined the voter’s journey, from anger to aspiration. And in that journey, there seems to be little room for a return to the old order.

Article written by:

Ashutosh Kashyap, Finance and Public Policy Professional

Abhinav Prakash, Policy Analyst