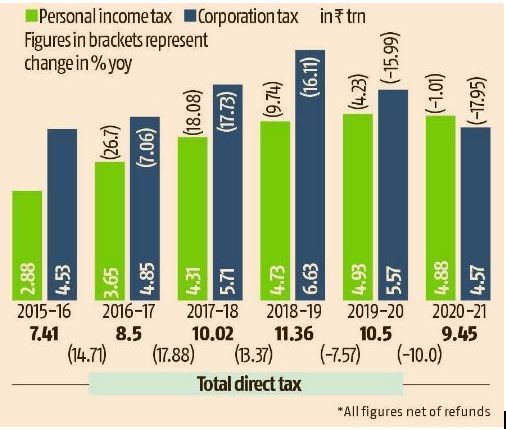

In the wake of the Wuhan-originated coronavirus, the nation had to undergo an intense lockdown in 2020 which brought in an economic contraction in the economy. Though one would expect the tax collection to fall sharply, the income tax collection in FY21 was 4.88 lakh crore rupees despite the fact that the government increased the refunds by 42.1 per cent, from 1.83 lakh crore rupees to 2.61 lakh crore rupees.

However, it is to be noted that the total direct tax collection declined by 10 per cent, from 10.5 lakh crore rupees to 9.45 lakh crore rupees. The decline was primarily due to lower corporate tax collection this year, which declined from 5.57 lakh crore rupees in the last fiscal year to 4.57 lakh crore rupees.

“The net direct tax collections for the FY 2020-21 have shown an upswing, despite the inherent challenges brought on by the COVID-19 pandemic on the economy,” the Finance Ministry revealed in its statement.

The increase in income tax collection reflects the higher formal job creation and an increase in the income of the people with formal jobs. Those who could save their jobs actually saw an increase in their incomes as many of them earned a good amount from stocks and part-time jobs. So, the net income of these people actually increased and thus, they paid higher income tax as well as securities transaction tax.

Moreover, the job creation in sectors like Information Technology (largest formal sector employer in the country), pharmaceutical, and media that employ a chunk of India’s formal workforce and pay a good salary also contributed to this rise in the income tax collection.

Since the phased lifting of lockdown started, the formal job creation has been higher compared to last year, every month. Therefore, it might sound counterintuitive, but India actually created a larger number of formal jobs, and the income of the people employed in the formal sector also witnessed an increase amid the coronavirus pandemic.

A large number of employees and millennials, especially those employed in the informal sector, lost their jobs and went back to their villages from cities like Delhi, Mumbai, and Bengaluru. This led to a sharp contraction in the economy, which was expected to post a negative expansion of around 7 per cent in FY 21.

However, the economic recovery has been unprecedented and the higher GST collection in successive months evidently proves the same. If the government can handle the second wave of the coronavirus well, the country is all set for a long-term expansion of the economy and witness a huge boost in job creation in the sectors that employ the formal workforce.