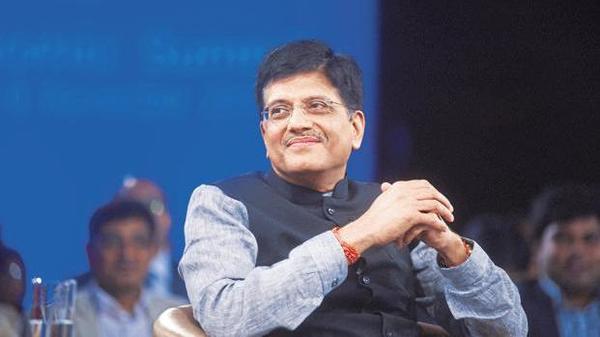

A few months ago, we at TFI, argued that Indian startups are being colonised by the foreign venture capitalists and this would lead to big issues for the Indian economy in the coming decades. These issues would not only be of data theft- as in the case of China- but of economic colonisation too. It seems that the Modi government has heard the wake-up call and the Ministry of Commerce and Industry under Piyush Goyal, is already talking about the issue.

Piyush Goyal said that India Inc. has the responsibility to ensure that Indian startups do not sell out cheap to International investors and, therefore, they should allocate a part of their wealth to fund startups. “I appeal to our Indian businesspersons to dedicate a part of their wealth to this cause, say a 10,000 crore rupees fund which is professionally run and managed with no role of government. Even if 1% of your valuation is pooled in a domestic fund, we will not sell out cheap to international funds,” Goyal said at Resurgence TiEcon Delhi – NCR, a four-day virtual event.

Goyal was in conversation with Sanjeev Bikhchandani, a serial internet entrepreneur who has founded many companies including Info Edge India, Jeevsaathi.com, and is very active in the startup arena. Bikhchandani has raised the issue of colonisation of Indian startups many times but so far, the country has not been able to create an ecosystem for the funding of startups.

“Shades of the East India Company type of situation here – Indian market, Indian customers, Indian developers, Indian workforce. However 100% foreign ownership, foreign investors. IP and data transferred overseas. Transfer pricing issues foggy,” tweeted Bikchandani a few months ago.

“Basically institutionalised transfer of wealth away from India while living off the Indian market and Indian labour somewhat like the days of the Company rule,” he added.

In the long Twitter thread, Bikchandani also explained how foreign investors are taking over the ownership of Indian startups. “You take an Indian startup and transfer ownership of all its shares to an overseas company that has been usually freshly floated just for this purpose. So now the Indian company becomes a 100% subsidiary of the overseas entity,” he revealed.

The Indian startup ecosystem is being colonised by capital-rich American and Chinese investors. A few years ago, United States-based Walmart completely purchased Flipkart which was India’s first popular internet retail startup. The major investors in almost all Indian companies like Zomato, Swiggy, Ola, Policybazaar, Paytm, and PhonePe are foreign venture capital firms.

The United States-based Tiger Global Management has an investment in almost every second or third major startup in the country. The startups in the edutech sector like BYJU’s and Unacademy have significant investment from foreign firms, and many online media startups like Inshorts too have a significant foreign investment.

The government has now become cognizant of the issue of colonisation and is trying to address the issue. A few weeks ago, the Modi government unveiled a 10,000 crore rupees fund for domestic firms but the government alone is obviously not enough.

The Indian startup ecosystem is the third-largest in the world with more than 40,000 companies and around 40 unicorns. Therefore, the startups need a huge amount of capital, which cannot be met without the entry of private players. “This is music to my ears, if we can support startups through this domestic fund,” said Piyush Goyal.

The colonisation of Indian startups is alarming because the foreign investors with their investment can squeeze the consumers, as well as the founders of the company in the future alike. The founders will be thrown out of the company just like Sachin and Binny Bansal were thrown out of Flipkart.

Moreover, in the last few years, the parent brands of Indian subsidiaries have started asking for more and more royalty from the companies listed in India. For example, companies like Suzuki (parent company of Maruti Suzuki India), Hyundai (parent company of Hyundai India), and Unilever (parent company of Hindustan Unilever limited) have increased their royalty substantially in the last few years.

In fact, the royalties have gone so high that in August this year, Commerce Minister Piyush Goyal asked these companies to cut royalties to boost investment in India.

In the near future too, the internet startups would also either transfer the whole profit to their parent companies or transfer a significant part of it in the form of royalties. Therefore, if India Inc. wants to save its turf, it must open the pocket for startups.