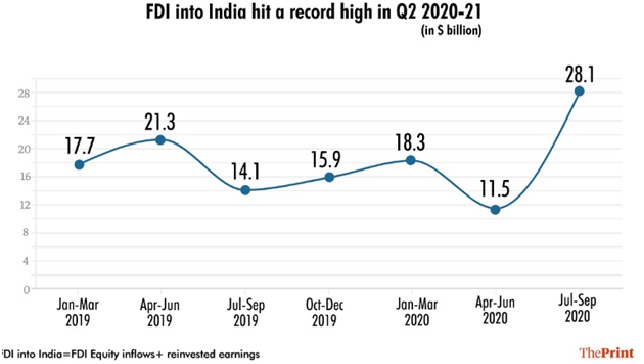

As per the data released by the Department of Promotion of Industry and Internal Trade (DPIIT), India has broken all records of Foreign Direct Investment in the first half of the ongoing fiscal year with a total investment of 39.6 billion dollars. The country has received an FDI of 11.5 billion dollars in the first quarter (April-June) of FY 21 and 28.1 billion dollars in the second quarter (July-September).

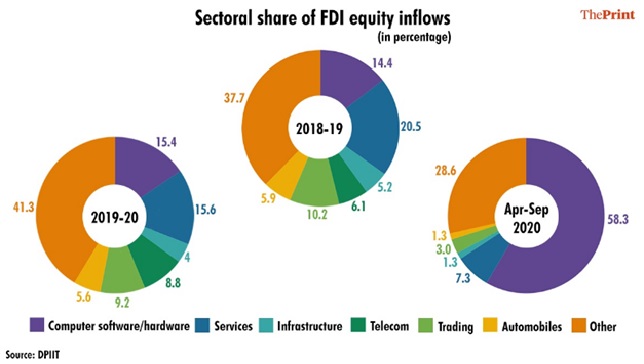

The sectors which drove the country’s FDI are computer software/hardware, services, infrastructure, and telecom along with a few other sectors like Automobile, tourism and hospitality, and manufacturing, which were traditionally strong in receiving.

Though the lack of FDI flow would definitely hurt the sectors like automobile, tourism and hospitality, and manufacturing, this is also in sync with Modi government’s Aatmanirbhar Bharat scheme, under which it wants the domestic players to remain dominant in the essential sectors.

“The investments are coming into creating digital assets rather than real assets. They are not coming into manufacturing. They are not coming into sectors where the government would want it to come,” said Mahendra Swarup, Managing Partner, Avocado Ventures.

In the coming quarters, the government expects an increase in FDI in the fintech, health and defence sectors. While fintech and health sectors are growing exponentially in India, foreign investors are prioritising these sectors. On the defence front, even the government is very keen on investment and building the sector.

“Fintech and healthcare are some of the other sectors that are seeing investor interest. Going ahead, with the opening up of the defence sector, there could be substantial foreign investments into the sector in the next few years. Many joint ventures between big Indian firms and foreign companies have already been announced,” said DPIIT Secretary Guruprasad Mohapatra.

India is receiving huge FDI despite the anti-globalisation wave around the world. At a time, when the American investment in China has touched a record low due to the anti-globalisation wave, the investment in India is touching new ranks, thanks to the confidence of investors in the Indian economy and the recent incremental reforms of the Modi government.

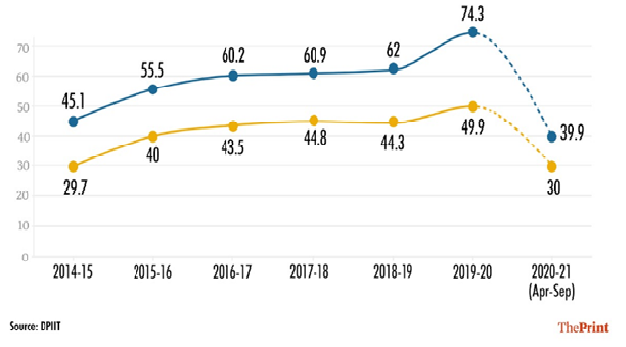

In the last six years of the Modi government, the FDI in India has grown consistently, and, this year, it is expected to touch a new high. In the first half of the year, the tech companies were on a bull run with Reliance Jio and BYJU’s leading the market.

In the second half, the energy companies are now receiving record investments. A few weeks ago, French energy giant poured 2 billion dollars in Adani Green for a 20 per cent stake. The Adani group is exploring investment from other companies in its other energy and infrastructure businesses, too. At the same time, Saudi Aramco is set to finalise investment of more than 15 billion dollars in Reliance Industries Limited’s oil business this year.

Comparing the relation between FDI growth rate and the GDP, one realises that ‘Every 1% increase in ‘Foreign Direct Investment’ results in about 0.4-0.5% increase in GDP, though it depends on the country’s development stage heavily’. Thus, huge investment from capital-rich countries is vital to attain double-digit economic growth in the coming years.