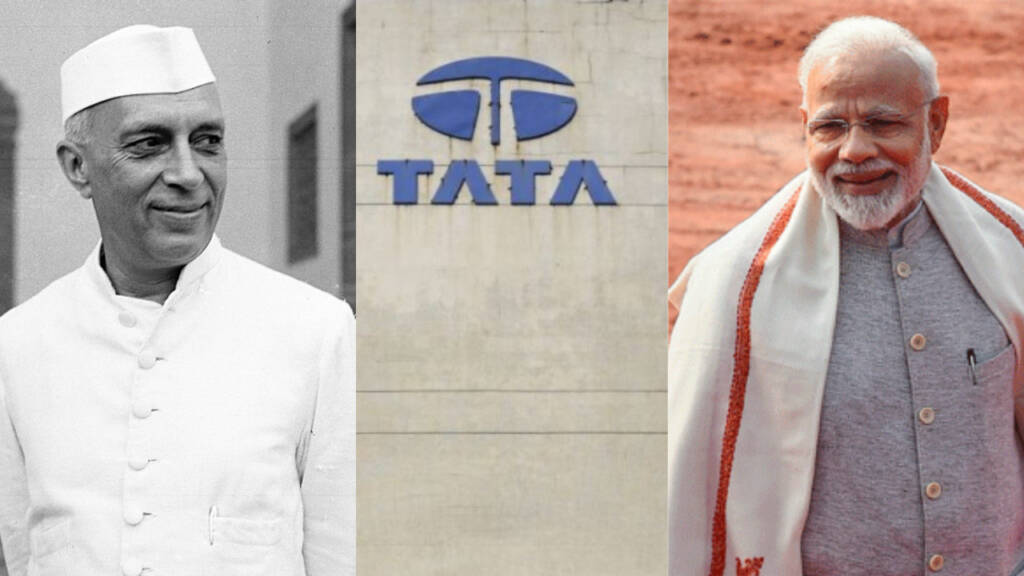

Tata Group – one of the largest conglomerates in India, has overtaken the Union government of India as the most valued promoter of the companies listed in the stock market. This is a tectonic shift in the history of Indian political economy, and, in a sense, the end of the era of Nehruvian socialism in India.

The companies promoted by Tata Group have valued 9.34 lakh crore rupees on the last day of the previous calendar year with 34.4 per cent growth in year-on-year basis. On the other hand, the government’s stake in listed PSUs is valued at 9.24 lakh crore rupees, a decline of 19.7 per cent compared to the last day of the previous calendar year.

When India gained independence, there was broad consensus among the political and intellectual class (with very dissenters like Rajaji, B R Shenoy) that India should pursue socialism as a model for political economy. The PSUs were called the pillars of modern India and the spirit of entrepreneurs was crushed by the bureaucrats.

The ‘intellectual class’, with very little intuitive knowledge or skills of running a business, were placed in management of the PSUs and all the national resources were pumped by these ‘pillars of modern India’. However, these pillars could not sustain the aspirations of millions of Indians. Under the reign of Indira Gandhi, the population growth of the country was more than the income growth, which means that the per capita income was actually declining.

By the late 1970s, Indian ruling class had realised that the socialist model is not going to work in the country and the political economy started moving towards a capitalist direction. 1991 became the watershed moment for the political economy when the newly elected Rao government started implementing reforms. And today, almost 30 years after the reforms, a privately owned group – the Tata Group has taken over the government promoted companies in terms of market valuation.

Last year, Tata Group added more than 3 lakh crore rupees in market valuation while Government promoted companies lost more than 2 lakh crore rupees. As per the report by Business Standard, “The 15 Tata group companies had a combined market capitalisation of Rs 15.6 trillion on Thursday, up from Rs 11.6 trillion a year ago on December 31, 2019. In comparison, the 60 listed PSUs, where Government of India is a promoter, had a combined market capitalisation of Rs 15.3 trillion on Thursday, down from Rs 18.6 trillion a year ago.”

In the last decade, the value of the government stake in the companies grew very little- from 7.4 lakh crore rupees to 9.2 lakh crore rupees, while the value of the shares of Tata Group rose almost 15 times to reach 9.3 lakh crore rupees from 0.7 lakh crore rupees.

Tata Consultancy Service (TCS), the crown jewel of Tata Group, is alone valued at more than 10 lakh crore rupees, second largest in India after Reliance Industries Limited (RIL) Group, which is valued at around 13 lakh crore rupees. A few years ago, the state-owned oil and energy majors like ONGC, NTPC, PowerGrid, Coal India used to be the most valued Indian companies but today, none of them are even in the top 20.

SBI, the most valued government-owned company, is at 14th position with a market valuation of 2.5 lakh crore rupees, 4 times less than TCS and 5 times less than RIL.

In the last three decades, India has had a tremendous record on the economic growth front, thanks to economic liberalization by the Rao government which was later taken forward by Atal Bihari Vajpayee. The Manmohan Singh government (read Sonia Gandhi government) did not implement any reforms because it was dependent on the leftist parties for a majority and Sonia Gandhi herself subscribes to the left of centre ideology.

Also Read: Now Tatas, Birlas, Ambanis can set up their own banks. RBI all set to liberalise bank licensing

In the last six and a half years, the Modi government has implemented many path-breaking reforms like GST, IBC, and agri-liberalisation to name a few. The effect of these reforms on economic growth will be visible in the next few years and the country will again grow at a double-digit pace very soon.