As the government released data on GDP for April to June quarter on Monday, the social media flooded with economists who were giving expert opinions on the state of the Indian economy. These ‘experts’, whose field of interest and expertise change with every passing day, argued that Indian economy has been the worst hit due to the pandemic among the major economies around the world and the recovery will be very tough.

So, to examine whether the economy is severely hit and what are the prospects of growth in the near future, let us go back to the definition of GDP. GDP is the monetary value of the goods and services produced in a specific period of time, and therefore, the GDP for April to June would be the monetary value of the goods and services produced during this period.

Between April to June, the country was locked down for most of the time and therefore, very little economic activity was taking place. Except for the essential items, the factories, as well as shops, were closed, and therefore, neither the production nor the consumption was happening.

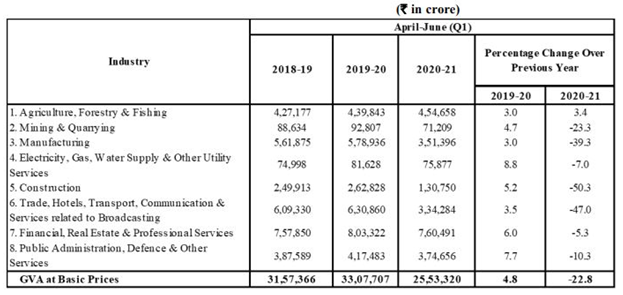

From March 25 to May 31, the country was under a complete lockdown for 68 days. In these 68 days, no economic activity apart from essential activities was taking place. The only month in the April-June quarter which was open for economic activity was June when the Modi government implemented Unlock 1. In June, economic activities started picking up after a jolt of 68 days and therefore, the gross value added (GVA) declined by 23.9 per cent only. Had it been another month of lockdown, the decline in GVA would have been more than 50 per cent probably.

So, the Coronavirus pandemic and induced lockdown is an extraordinary situation and any data regarding this period must be put in context. For example, RBI kept on reducing policy rates despite the rise in inflation as per data gathered and has an accommodative stance for the coming MPC meeting, because no policy analysts took the inflation of above 6 per cent seriously due to several problems in data reporting during the lockdown. If we forget the context of Coronavirus and lockdown, data of macroeconomic indicators which are volatile and reflect a short term trend would look extraordinary.

Therefore, to analyze what are the long term prospects of the economy we need to look at the sentiments around the Indian and global economy. In the last few months, the investor sentiment about the Indian economy has been highly positive and Indian companies received investments worth billions of dollars. The total investment during Covid-19 induced lockdown has been 22 billion dollars.

“Our FDI regime is the most liberal in the world. We have continued to attract a huge amount of investments. During the pandemic itself, India attracted over 22 billion worth of direct investments into India,” as per NITI Aayog report.

Moreover, the net inflow of Foreign Portfolio Investment (FPI) in August has been 47,334 crore rupees with investors pouring billions of dollars in equities, although debt instruments have negative net inflow.

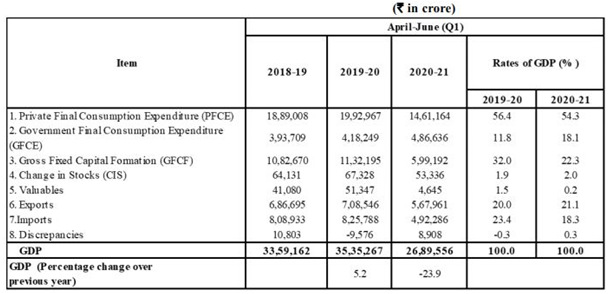

For the first time in many years, India registered positive net export with exports of 5.67 lakh crores while imports being 4.92 lakh crores. The net exports of 75 thousand crores added 10 billion dollars in foreign exchange of the country and investments worth billions of dollars took the forex to around 550 billion dollars- an all-time high. In the September quarter, too, the net exports are expected to be positive and this means the country will build on forex, and domestic manufacturers would benefit from the country’s large consumer base- the Chinese manufacturers.

Although this is a short term trend, if India can sustain export surplus through Atmanirbhar scheme, this would help the country to become the manufacturing and export powerhouse as well as amass a huge amount of foreign exchange reserves.

Therefore, all the long-term sentiments around the economy look positive and one must not be taken by mushrooming economy experts on social media.