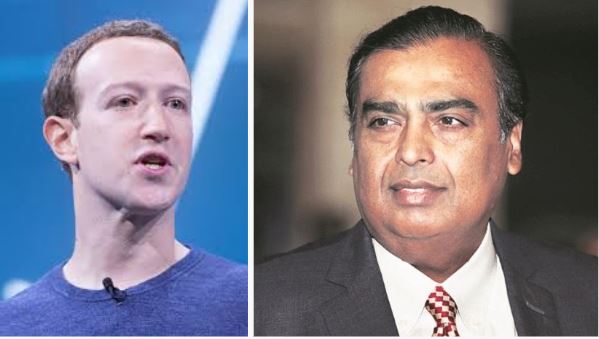

Facebook, the world’s largest social media company which owns Instagram and WhatsApp, is seeking a multi-billion dollar investment in Reliance Jio, India’s telecommunication behemoth with subscriber base of more than 37 crore.

As per a report by Financial Times, Facebook was close to signing deal with Reliance Industries Limited, the oil to telecom conglomerate, by the end of ongoing financial year. But given the worldwide lockdown due to Coronavirus, the deal got delayed. “If it proceeds, the deal would give Facebook a key foothold in the Indian market, where its WhatsApp chat service has 400m (40 crore) users and is about to launch a payments service,” wrote Financial Times, a London based financial newspaper, which includes global who’s who in its reader list.

Mukesh Ambani has promised investors to make RIL debt free by the end of next financial year, and that is why the different entities of the group are seeking investment from domestic as well as foreign investors.

Previously the company signed a deal with Saudi Aramco, the state owned Oil Company of Saudi Arabia, for investment of 15 billion dollars in its oil business. Moreover, RIL has also signed 3.3 billion dollars investment deal with Brookfield in its tower business.

As of now, almost the segments of the Reliance Industries Limited, from digital to retail, refining to petrochemical, are performing well and posting double digit growth in revenue as well as profits. But majority of the businesses are under heavy debt, especially the telecommunication business where the company offered freebies to attract new consumers. Now Ambani is planning to make the company ‘debt-free’ by selling minor stakes in various entities.

Reliance could easily knock out the 45 billion dollars debt by selling minor stakes, as the entities are valued multi-billion dollars. Bernstein valued Jio alone at more than 60 billion dollars, and Facebook is planning to pick up 10 percent stake, which will translate into investment of 6 billion dollars.

Last year, Mukesh Ambani said that RIL is planning to make Reliance Jio a separate entity before listing it in stock market. Many American telecom and Internet technology giants including Microsoft, Google, and Facebook have shown interest in investment and collaboration with Jio.

Microsoft collaborated with Reliance Jio to offer cloud computing and Google has also collaborated with the company in minor projects. Google is also seeking to invest in the company; however, it declined to comment to mail by Financial Times.

In the last few years, the number of smartphone users and number of Internet users have grown exponentially in India. As per PwC, the country would have more than 85 crore Internet users by 2022. Data prices in India are one of the lowest in the world, and the number of house spent on social media is growing exponentially given the young demography of the country.

Almost all the variables of the growth of telecommunication, social media, and Internet business are favorable in and that is why the domestic as well as foreign entities are looking to tap this huge investor base.

Reliance’s transition from refining and petrochemical business to consumer business is clearly visible in quarterly results. The consumer and retail businesses of the company have registered profit and grown exponentially over the last few years. “Now consumer businesses account for almost 25% of RIL’s Ebitda (earnings before interest, tax, depreciation and amortization),” said Srikanth, Joint Chief Financial Officer, after the release of last financial year’s result.

Mukesh Ambani is known to work for monopoly in the markets, similar to his father. In the early days of the business his father monopolized thread-making business, and now he is himself doing the same in the refining and petrochemical business. Now the company is trying to monopolize telecommunication market and retailing business.