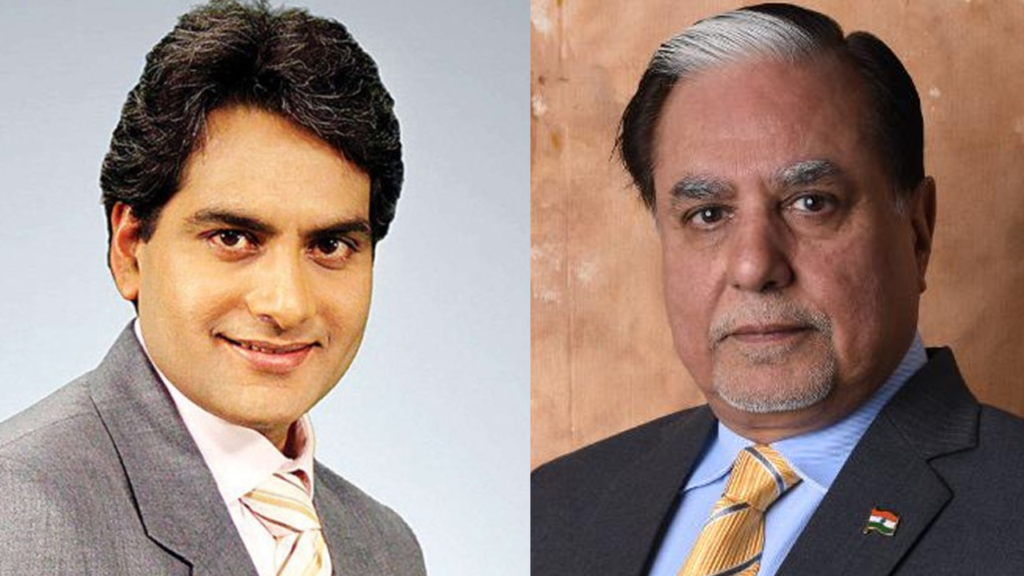

Zee Entertainment Enterprises Ltd (ZEEL) led by veteran entrepreneur Subhash Chandra might sell half of the promoters’ stake to a group of companies led by US media giant Comcast. According to a report by Economic Times, US cable major Comcast, which owns the American worldwide mass media conglomerate, NBCUniversal, and Atairos, a $4-billion investment company led by former Comcast CFO Michael Angelakis, may team up with PE fund Blackstone and James Murdoch’s family office Lupa Systems to bid for Zee Entertainment Enterprises (ZEE).

The promoters of ZEE group control almost 40 percent stake in the group. Last year, Goel announced the plan to sell half of the promoters’ stake in the company to repay the debt of mutual fund companies. At current prices, half of the promoters would fetch around 6,603 crore rupees. The Mutual Funds industry has a total exposure of 7,500 crore rupees against the Zee group. The total debt of the Subhash Chandra’s Zee group is 13,500 crore rupees and the lenders’ money is backed by equity shares of firms like Zee Entertainment and Dish TV.

“We are progressing well and with political uncertainty behind us, we hope to sign a binary agreement by July,” said group’s director Punit Goenka. September 30 has been set as deadline for the repayment of debt to mutual fund companies. In April this year, Subhash Chandra said that “the objective is to pay everyone’s money and that too happily” in an interview with Economic Times. The key issues in the deal is expected to be managerial control of the company as Essel group wishes to remain on the management even when the half of the promoters’ share is sold to investors. The other prominent issues might be valuation mismatch as promoters seek ‘significant premium’ over the current valuation.

The major lenders from Mutual Funds industry to Zee group include Aditya Birla Sun Life MF, HDFC MF, Franklin Templeton, and ICICI Prudential MF. Previously, Subhash Chandra Goel had given a personal guarantee to mutual fund companies when the prospects of defaulting were looming over the group. The investors have been wary of the falling share prices and the prospect for default as far as the future of Zee Entertainment Enterprises Ltd is concerned. To save the share prices from plummeting further, Subhash Chandra had given personal guarantee for payment to mutual funds on an “irrevocable and unconditional” basis.

The group was and is among the most profitable and professionally run companies. However, the investments of the Zee group in the infrastructure market has gone wrong due to the collapse of IL&FS. The banks tightened lending norms since the collapse of the IL&FS Group and this has led to a massive crisis in the NBFC market. As the investment of Zee group is exposed to NBFCs, this led to a sharp decline in the share prices of the Zee group. However, Subhash Chandra gave a personal guarantee to the lenders to soothe the investors.

Zee group has been a highly profitable company and therefore, Subhash Chandra is not likely to face problems in offloading his shares for the ‘strategic sale’. The MF officials expect ‘fair value’ from strategic sale on shares. “Invoking and liquidation of pledged shares would have caused the shares to tumble further. At the same time, holding on to the shares would have raised the risk of default.