The Reserve Bank of India (RBI) had taken a very conservative approach on regulations under former governor, Raghuram Rajan and later under his protégé Urjit Patel. The bankers were not happy with the stringent approach but officials of RBI were not ready to hear them.

India has one of the highest ‘effective lending rates’ in the world. As the central banks around the world are flooding the economy with cheap capital, the Reserve Bank of India has kept lending rates high. The central bank has taken a ‘very conservative’ stance of monetary policy and this hurt the economic growth of the country. The unavailability of cheap capital stalls economic activity and hurts economic growth.

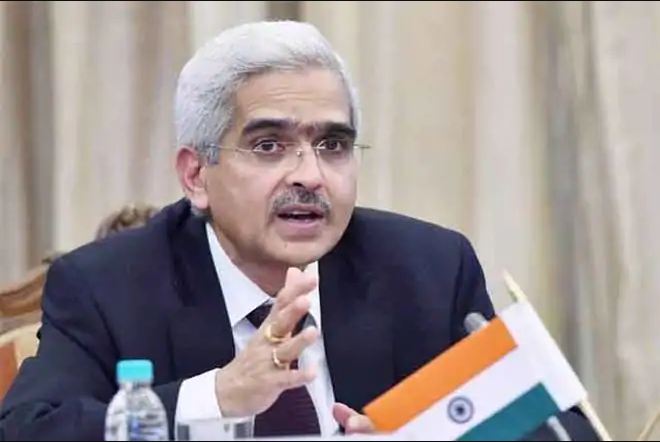

The appointment of Shaktikanta Das, former Economic Affairs Secretary as governor brought much-needed relief to the banking industry. It has been six months since the appointment of Das on Dec.11, 2018. Two top public sector bankers spoke to BloomberQuint and praised the tenure of Das and called him friendlier regulator. According to bankers, if the regulator listens to their views on various matters, the regulation is more ‘practical’.

The few important steps taken by RBI under Das are as following:

The most important step of Shaktikanta Das has been ‘dovish’ monetary policy which India requires due to benign inflation and slow economic growth. The central banks cut the policy rates for three consecutive terms under his leadership.

The MSME sector was under huge stress due to strict norms introduced by RBI regarding lending. The first step taken by Das was to ease out the NPA declaration rules for MSMEs with loans up to 25 crore rupees. Under Rajan and Patel, lending to MSME sector dried up. The sector is the second largest employer and backbone and backbone of the informal economy.

Under Shaktikanta Das, the Prompt Corrective Action (PCA) framework which was at the centre of a tussle between some public sector banks and RBI has been eased out. RBI put 11 public sector banks under PCA and asked them to stop lending until their balance sheet is healthy. The credit by these banks dried up, the banks improved the balance sheet but the regulator was not ready to release them from PCA till the entry of Das.

RBI eased down the ‘resolution’ guidelines for banks. The new resolution allows to write back the provisions of Insolvency and Bankruptcy Code (IBC) admitted cases. “The revised prudential framework for resolution of stressed assets announced on Friday strikes a fine balance between tight regulatory timelines mandated previously for resolving stressed assets, and inordinate delays that occurred in the past when resolving and provisioning for such assets,” said rating agency CRISIL on new RBI circular.

Earlier former RBI governor Urjit Patel had resigned due to tussle with the government and critics predicted that central bank’s autonomy was under threat. However, the markets and bankers responded positively after the appointment of Shaktikanta Das as the new RBI governor.

Das is also ready for the transfer of funds which was one of the major issues among government and its banker. Reserve Bank of India under Raghuram Rajan and Urjit Patel has been extremely conservative in the transfer of funds.

In the last six months, it turned out that the government and the bankers both are happy with actions of Shaktikanta Das as RBI governor. His appointment was seen as a threat to the autonomy of RBI by the left-liberal establishment. But his tenure has been helpful in the larger public good.