Since it stormed to power, the Modi government has been serious about making the country a tax-compliant society. In the last four and half years, tax to GDP ratio increased from 10 percent to 11.5 percent. The corporate tax collection this year grew at a rate of 18.3 percent, the fastest rate in the last five years. The corporate tax collection got a boost from various initiatives aimed at ending tax evasion. The initiatives include interlinking and digitization of various government departments. The two-thirds of the overall indirect tax collection came from unlisted companies, earlier these companies were seen at the forefront of tax evasion but Modi government closed most of the avenues for the same. “Apart from GST, the steps taken by other government departments, including the completely online systems deployed by both the tax departments, have instilled a heightened sense of fear of apprehension among promoter-driven and unlisted firms to disclose income closer to real income,” said Amit Agarwal, partner, Nangia Advisors.

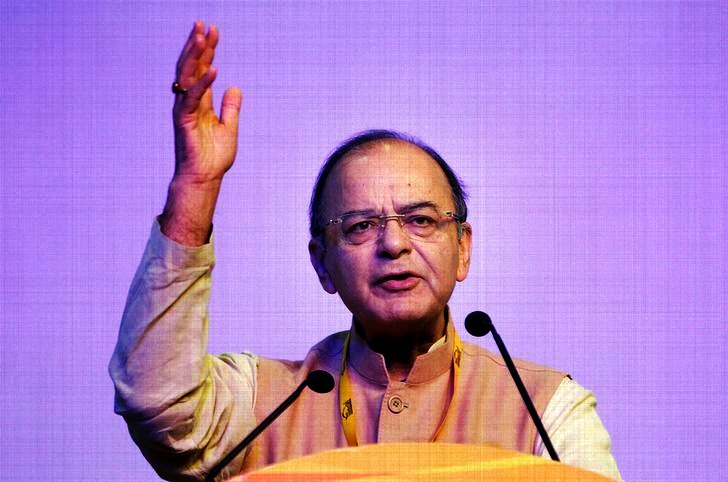

The implementation of GST by the Modi government also helped in increasing direct tax compliance as expected by policymakers. Finance minister wrote in a Facebook post “The implementation of GST as a single consolidated tax has had a significant impact even on direct taxes. Those who have disclosed a business turnover for the GST now find it difficult not to disclose their net income for the purposes of income tax. Last year, the impact of GST on direct tax collection was not visible. Since GST had been imposed in the middle of the year, it will be more apparent this year.” The prophecy of Jaitley came true as corporate tax collection and overall direct tax collection has been growing at a good pace since the implementation of GST. The direct tax department is now able to access GST payments of companies and tally it with personal and corporate tax paid by the promoters. This has significantly reduced chances for companies to cheat the government. Therefore, the taxes paid by the unlisted companies have increased exponentially since the implementation of the GST.

The total direct tax collection in the last eight months of this fiscal year registered a jump of 15.7 percent amounting to 6.75 trillion rupees, almost half of the targeted amount of 11.5 trillion rupees for the fiscal year. The refunds amounted to 1.23 trillion rupees in the first 8 months which is 20.8 percent more than the previous fiscal year for the same period. Therefore, net direct tax collection rose to 5.51 trillion rupees, a 14.7 percent jump on year to year basis for the same period. The growth in direct tax collection is set to cover up for the decline in the indirect tax collection which went down due to rate rationalization. The Modi government has moved on the path of fiscal consolidation since it came to power in 2014. The fiscal deficit target for FY 19 is 3.3 percent of GDP and it could be achieved only if direct tax collections support the slippage on the indirect tax front.

Tax to GDP ratio has grown at a steady pace but the country still lags behind BRICS and ASEAN countries in this respect. India has the lowest tax to GDP ratio among BRICS countries. Sanjay Kumar, Senior Director, Deloitte India said that “Indonesia, for example, has 11.8% tax collection to GDP ratio. On the widening of the taxpayer base, we are still below a general estimate that taxpayers’ base should be about 10 crores.”

If Tax to GDP ratio is low, a country finds itself unable to afford basic amenities like health and education for its citizens. Universal access to these primary needs is required to build human capital and improve the standard of living. India has recently introduced Universal Healthcare through the National Health Protection Scheme (Popularly known as “Modicare”). The increased ‘tax to GDP ratio’ means more money going directly into government coffers and ultimately percolating down to citizens. This money would go a long way in making India a welfare state, the kind that Deen Dayal Upadhyay had envisioned.