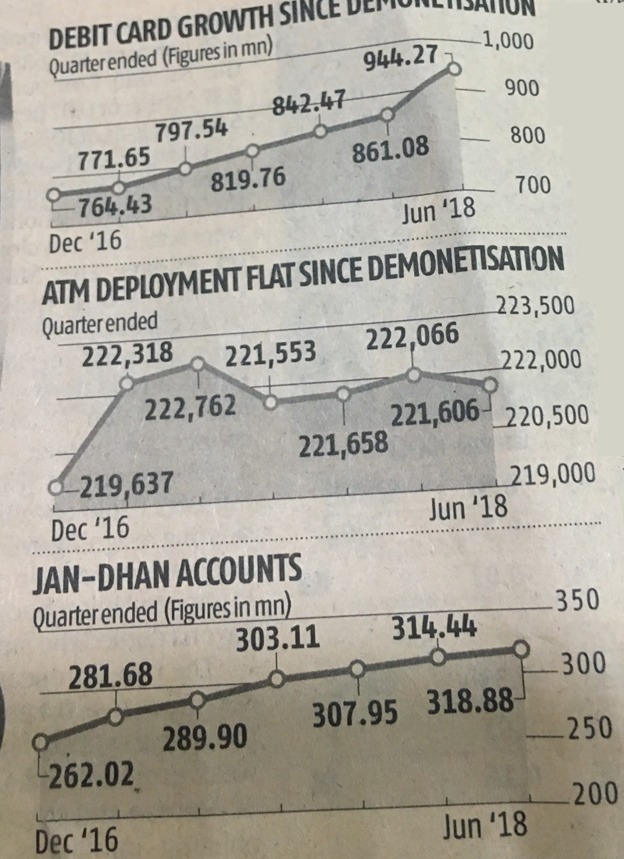

There is bad news for critics of demonetization. The empirical data has proved despite the fact that more than 99 percent of the money came back to the central bank after demonetization, it brought many substantial changes to economy. The debit cards and accounts under Pradhan Mantri Jan Dhan Yojna (PMJDY) grew by 24 percent and 26 percent respectively. The number of ATM machines across the country grew by merely 1 percent and growth in currency circulation has gone down substantially. The Modi government pushed for universal financial inclusion in the country since coming to power and it was one of major objectives of the monumental step of demonetization.

3.7 crore Jan Dhan accounts have been opened between December 2016 to June 2018- the less than two year period after demonetization. In the same period 17.9 crore debit cards were issued while the number of ATMs opened is only 2000. The data shows the scale on which demonetization and Jan Dhan changed the fundamentals of economy, when the government announced the step, majority of Indians in rural areas did not have debit cards and digital transactions were close to negligible. The drive was aimed at opening a bank account for every Indian at zero balance and give credit and debit cards to them, so as to encourage them to make UPI transactions.

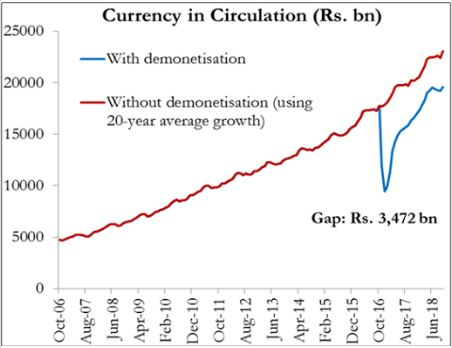

The scale of transparency after demonetization could be decided from the dip in the currency in circulation. There has been a dip of 3.47 trillion rupees in the currency in circulation if we calculate 20-year average growth rate. The naysayers are saying that the country is back to currency circulation levels of pre-demonetization era based on the data of ‘flat comparison’ rather than taking long-term average growth into account.

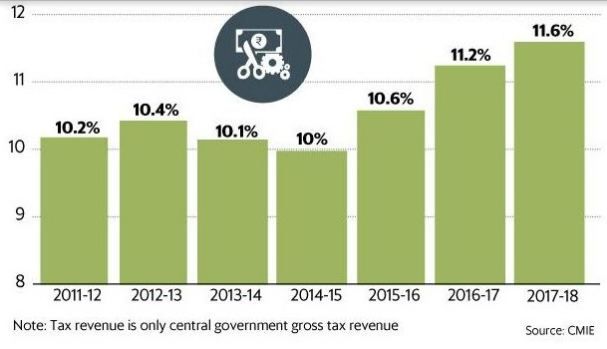

Every economist has her/his own assessment of demonetization but the one sided analysis without taking holistic view and long-term impact will definitely lead to partial results. The primary objectives of demonetization like crackdown on black money, increase in tax to GDP ratio, digitization of economy, reduction in cash circulation were has been achieved on good scale. The ratio of central government’s taxes to GDP was 10 percent in the fiscal year 2014-15. if we take a look at central government’s taxes to GDP ratio has gone up from 10 percent to 11.6 percent. This is a whopping 15 percent increase in tax to GDP ratio. According to Economic Survey 2018, 10.1 million people filed income tax returns in the year following demonetization (November 2016- November 2017), while the average for the last six years has been 6.2 million. This shows an increase of over 1.5 times the previous number of income tax returns filed.

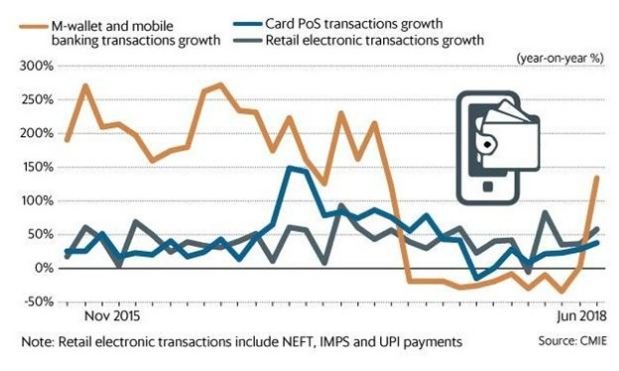

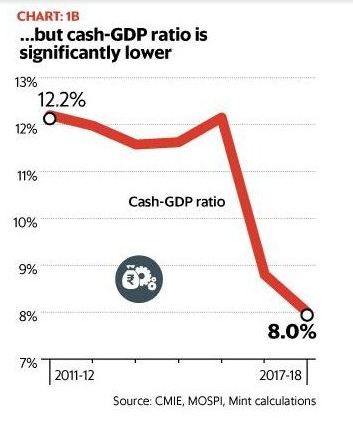

The cash to GDP ratio has come down as low as 8 percent in recent years. This simply means that that cash (which is easier for black money parking and illegal transactions) circulation in the economy is lower in the post-demonetization period. If we take a look at the rise in ‘value’ and ‘number’ of the digital transaction in post demonetization period, they have grown at an explosive rate. The critics of demonetization must go for a review of the criticism as the new data on its positive impact is coming out gradually.