Bimal Jalan, former governor of Reserve Bank of India (1997-2003) said that if there is irreconcilable differences in opinion between the government and the regulator, then “Whoever is heading the agency should step down.” Jalan was governor of RBI at the time of Asian financial crisis, one of the most turbulent times for economy of the country and the continent and Jalan is known for sailing the country out of it.

One of the most reputed public servants of the country, Jalan has held many high positions in several governments across the political spectrum with major of them being the roles of Finance secretary (January 1991- September 1992) and chairman of the Economic Advisory Council to the Prime Minister. Bimal Jalan has also been a writer of many books with the latest one being India Ahead: 2025 and Beyond.

In the light of recent tussle between RBI and the Finance Ministry, he suggested that head of any regulator should step down. Bimal says in an interview to business newspaper Livemint “Why not? Ultimately, your duty is to perform and do what you have promised to do in people’s interest. Now, supposing you feel I should give much more weightage to growth or inflation and the government is not listening and you are very particular about it. Then you should move and somebody else should come. What’s the harm?”

The Reserve Bank of India and the government have differences over some issues including separate payment regulation, Prompt Corrective Action (PCA) and capital infusion. The matter became public after deputy governor of RBI, Viral Acharya argued for institutional autonomy and warned that any interference from government will have catastrophic consequences. Bimal Jalan is not only the public official to suggest that RBI’s independence in not absolute while former RBI governor, Y V Reddy has also said “There is no such thing as blanket independence. RBI is independent; within the limits set by government.” The primary contention point between the RBI and government is about providing liquidity to MSME sector which has been hurt due to various reasons.

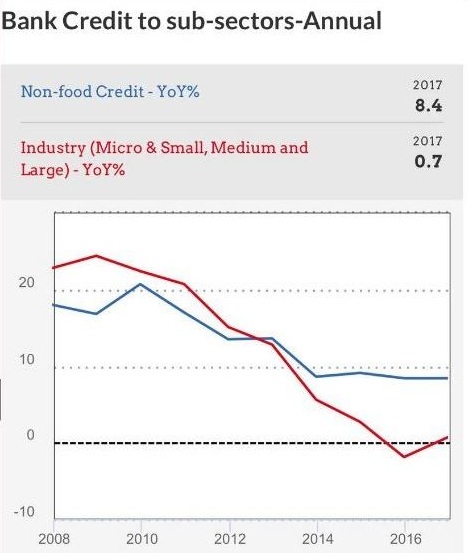

RBI is a regulatory body for banking and payments system and its lackluster attitude in 2008-14 has created NPAs of around 10 lakh crore. When the NPA issue became huge, RBI suddenly put 11 worst performing public sector banks (Dena Bank, Central Bank of India, Bank of Maharashtra, UCO Bank, IDBI Bank, Oriental Bank of Commerce, Indian Overseas Bank, Corporation Bank, Bank of India, Allahabad Bank and United Bank of India) on Prompt Corrective Action (PCA) list. These banks could no longer issue credit until their financial health improves and this ultimately, dried up credit for the MSME sector. Therefore, MSME seems to be paying for RBI’s own mistakes.

Now, the government will have to pay the price for RBI’s blunder because with economic growth slowing down and employment getting hurt due to slowdown in activity of the MSME sector, the people eventually hold the government responsible for it. The accountability of the RBI is limited and it takes recourse to a linear direction of controlling inflation only, rather than having a holistic view of the matter. But the government is accountable to stand up to the promises it made and perform for the development of the nation. The rigid attitude of RBI hindrances many governmental decisions. The government no doubt, is accountable to the people but not the RBI. The statement by former RBI governor should be a lesson for the RBI and the people at the helm of it.