There has been a lot of mayhem over the price of the Rupee depreciating against the US Dollar. The Rupee hit an all-time low on Tuesday because foreign investors pulled out their money as rising crude oil prices deepened concerns about the country’s Current Account Deficit (CAD) and inflation dynamics. The rise in oil prices is a double whammy for India, because along with increases in import bills it is also responsible for the surge in inflation, which also contributes to fluctuations in the value of the Rupee. Due to rising oil prices, the CAD, which is the difference between the inflow and outflow of foreign exchange, widens and oil marketing companies like Indian Oil and Hindustan Petroleum pass the pressure of a rise in prices to the consumer which is in turn is responsible for retail inflation. There is no doubt over the fact that the rupee is devaluating very fast but the real question to ask is whether rupee is undervalued or overvalued in comparison to major currencies of the world.

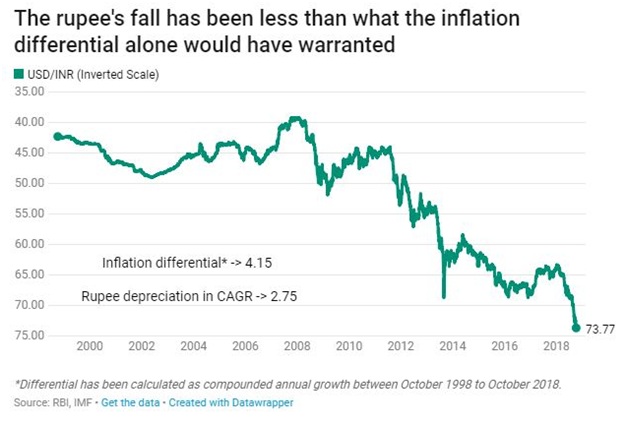

There are two major ways to access value of a currency. First being nominal exchange rate which is the most popular way. This tells relative price of two currencies which means how many dollars or Euros, a rupee could buy. Most of the countries anchor their currencies according to inflation. The logic behind this is that external value of currency should be in sync with internal value. The inflation differential while compared to rupee depreciation on Compounded Average Growth Rate (CAGR) tells us whether rupee is undervalued or overvalued.

The inflation differential between United States and India over the period of time is higher at 4.2 percent. The reason behind this is ‘fast growing India economy’ in comparison to American economy, for few months after 2007-08 financial crisis American economy actually slowed down. Therefore higher economic growth resulted in rise in inflation in India at faster pace than that of United States. The difference between rupee depreciation in CAGR and inflation differential is well above one point. Therefore rupee is actually overvalued if we compare by this method.

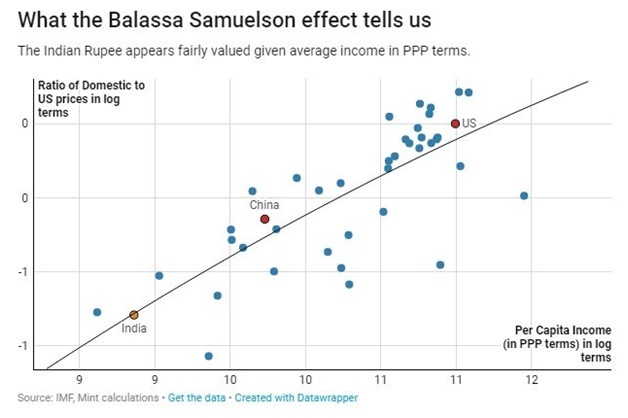

Another way of comparison of currencies is through Purchasing Power Parity (PPP) which is the amount of goods and services some amount of money could buy in a particular country. Most of the services in United States are definitely costlier than in India due to high labor cost in US and many other factors. PPP is very popular for measuring standard of living but what is lesser known is that it could be also used to compare currencies. Balassa-Samuelson effect on how price levels in any country depend on its average income level, countries with low income level have cheaper services while those with higher income levels have costlier services.

When we compare Rupee with other currencies on PPP basis, Rupee is fairly valued. Currencies of export oriented countries like China and Japan are undervalued. By one measure Rupee is overvalued and by another it is fairly valued. However, these facts offer no relief to Indian policymakers because the media has already manufactured the paranoia among public that INR is undervalued, it is depreciating very fast and the government must do something to stop this. The short sightedness of sections of media and opposition is taking a toll on well being of the country.