Former Minister of Commerce and Congress leader Anand Sharma today claimed that Rupee is the worst performing currency in Asia. Admittedly, Rupee has seen considerable slide in the last few months against a stronger dollar and in part due to rising oil import bills. However, Anand Sharma is way off the mark in stating that the Rupee is ‘worst performing currency’ in Asia. The statement is not only factually incorrect but also misses the larger picture regarding Rupee’s depreciation.

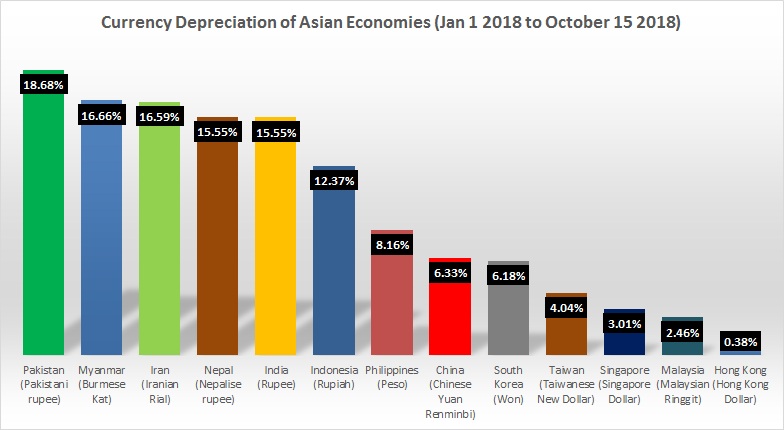

In order to ascertain the true nature of the Rupee’s performance, it would only be fair to compare it with the performance of the currencies of other emerging economies, preferably some of India’s neighbors. In the period of January 2018 to October 10 in the same year, the Pakistani Rupee has depreciated by 18.68% against the USD, with the Burmese Kat depreciating by a rate of 16.66%. In the same period, Iranian Rial has depreciated by 16. 59%. Rate of depreciation of Nepalese Rupee was similar to the depreciation of INR in the same period, 15.55%. Some of the Asian currencies did perform better than Rupee but the general trend of considerable depreciation against USD was visible on almost all the currencies. For example, Indonesian Rupiah saw a rate of depreciation of 12.37% while South Korean Won depreciated by a rate of 6.18%.

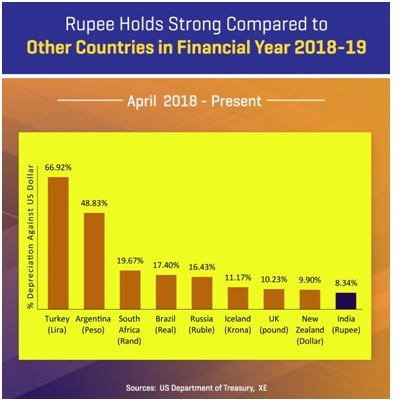

2018-19 was a tumultuous year for currencies weak and strong, with strong currencies like the UK Pound and the New Zealand Dollar hitting depreciation levels of 10.23% and 9.9% respectively. Amongst emerging economies, fellow BRICS members South Africa (19.67%), Brazil (17.4%) and Russia (16.43%) also witnessed high levels of depreciation of their respective currencies. India on the other hand, also an emerging economy, saw the lowest rate of depreciation at 8.34% against the US Dollar, despite a rocky international scenario.

It seems the man who sought to redefine the meaning of the English word ‘scam’ in a Clintonian manner in the wake of multiple corruption scandals during his party’s rule, cannot help but mislead the people on the issue of INR’s performance and the reasons behind it. It is unfortunate that the man who once led India’s Commerce Ministry is either ignorant about facts or willfully wishes to manipulate them.

In the wake of Anand Sharma’s questionable knowledge about Rupee depreciation and factually incorrect statement, the question arises whether the deals negotiated by Anand Sharma (for example, the deal with WTO) in his capacity as the Commerce Minister were really in India’s best interest?

It is the era of alt-facts, where events are either blown out of proportion with sensational headlines, or facts are selectively chosen and distorted to present a misleading narrative to the common man. The recent depreciation of the Rupee served that very purpose for media outlets and opposition leaders like Anand Sharma, who saw it as an opportunity to peddle half baked facts while concealing the reality of the Rupee’s terrible performance under the UPA government and its subsequent recovery 2014 onwards under the NDA government.

Sensational headlines with phrases like “nosedive”, “free fall”, “touching all time low”, “tanks” etc try to signal pessimism about the “weak rupee”. These wordings would naturally present an entirely different scenario to the common man. Morphing facts is a disservice to the nation. The reality is that against a stronger dollar and rising oil prices and hence ballooning import bills, INR has remained relatively steady in comparison to many currencies including some Asian ones as well as many emerging countries around the world.