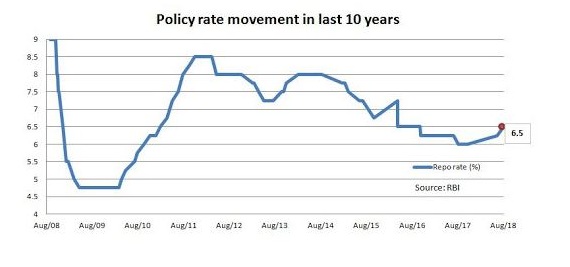

The Monetary Policy Review (MPC) by the central bank is one of most watched events among the businessmen and media of any country. The reason behind this is the direct impact of lending rates on economic growth of the country. The Reserve Bank of India (RBI) which is the central banker of the country held its third bi-monthly Monetary Policy Review (MPC) of 2018-19 today to decide a hike of 25 basis points. Now the lending rate is 6.50 which is highest in the last three years. Reverse repo – the rate at which the RBI borrows money from commercial banks within the country – was adjusted to 6.25 percent. The Committee has to deal with problems of high fuel prices, the rising inflation, and the last quarter’s economic recovery while deciding to review the repo rate (the rate at which the central bank infuses money in the banking system).

With inflation turning sticky, the central bank was widely expected to tighten the monetary policy. Consumer prices hardened to 5 percent in June, from 4.87 percent in May. With this, the pace of retail inflation climbed for the third consecutive month. Headline inflation has been well above the 4 percent target and core inflation – minus food and fuel – has remained stubborn. This, along with risks of higher raw material prices over the next few quarters, had made Kotak Institutional Equities anticipate a rate hike this time around. According to the brokerage house, MSP (minimum support price) hikes for Kharif crops and the risk of a trickledown effect on food inflation, besides a falling rupee, added to its case. “Growth remains on a stronger footing, implying that the output gap is fast closing and can lead to inflationary pressures in the medium term,” said Suvodeep Rakshit, Senior Economist, Kotak Institutional Equities.

This is the second back to back rate increase by the RBI as the rates were increased by the same amount in its last policy meeting in June. The International Monetary Fund (IMF) hailed the last policy rate increase in a statement which said “we welcome the Reserve Bank of India’s decision to increase the policy rate by 25 basis points, In the context of rising inflation and additional upside risks to the forecasts due to higher oil prices, exchange rate depreciation and other domestic factors, the IMF thinks that this was an appropriate step by the RBI on Wednesday.” The reaction is yet to come on this month’s decision. The last month’s increase came after a period of almost four and a half years which was done during the reign of previous RBI governor Raghuram Rajan who had decided to increase the rates from 7.75 to 8 percent in January 2014.

The hike in policy repo rate will have a serious implication on day to day life of ordinary citizen because this rate decides the rate of interest at which people and companies will get loans from the banks. With this, all types of loans like home loans, personal loans, and car loans will see a rise in interest rates. Despite the IMF welcoming the move, the government is not happy with the increase in policy repo rate by the RBI because higher rates will make it costlier for the government to borrow from the market to meet its spending. It will also hurt the recently picked up economic growth of the country because the costlier loans to people and the industry means fewer market activity. The government has fixed the fiscal deficit target of the country to 3.3 percent due to low collection resulting from policy rate increase. The fiscal deficit target is also under pressure due to problems in accumulating money from disinvestment as the government has not been able to disinvest its share in companies like Air India because no one is bidding for it. Therefore the rate increase has added many problems for the current government which will be facing elections in the upcoming months.