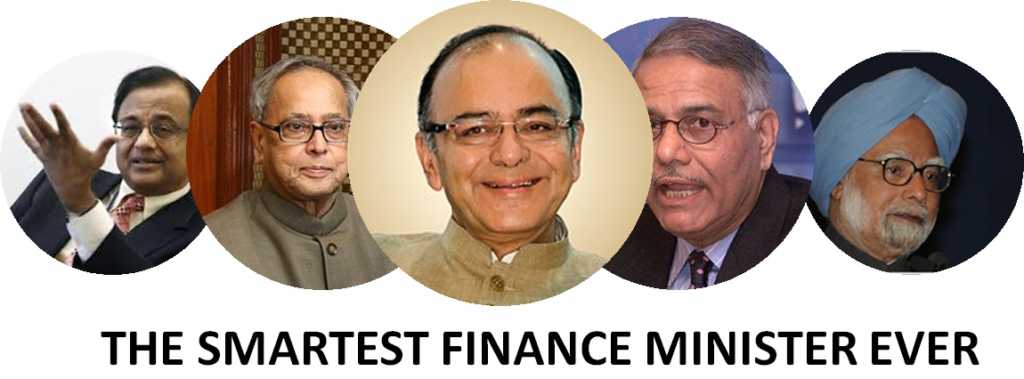

Arun Jaitley is the smartest Finance Minister India has ever had. He combines his grasp on the economic behavior of Indian people with economic theory to produce and implement good policies. His tenure as finance minister has been one of the most successful ever in the public finance of the country. He was involved in bringing GST, the single indirect tax regime which was stuck for almost a decade due to lack of political willpower in the Congress party. The bold decision of demonetization which helped the country to formalize its economy and crack down on black money transactions was implemented under his guidance. The Insolvency and Bankruptcy Code (IBC) was implemented to solve this problem and ensure a quick exit for loss-making units.

Indian economy was slowing down when he took over, the inflation rate was very close to the double-digit and fiscal deficit was 4.5 percent. Overall, the macroeconomic stability of country was in shambles when he took over and now after four years of his tenure, the stable macroeconomic conditions in the country are being appreciated by people and institutions across the world. The inflation rate is down to 3.08 percent and fiscal deficit is at 3.6 percent of GDP. Ease of doing business ranking of the country is all-time best, and the Indian market is being hailed as the best investment destination in the world by global investors. The important question here is how Jaitley has been able to achieve this miraculous reduction in fiscal deficit despite a reduction in corporate taxes by the government.

The fiscal deficit could be reduced through two instruments- by increasing the collection and by reducing the expenditure, Jaitley used both. The center’s gross tax to GDP ratio increased from 10.1% in FY14 to 11.6% in FY18 in spite of a lower corporate tax/GDP ratio. Part of it was due to a rise in income-tax collections. Taxes on income as a proportion of GDP went up from 2.1% in FY14 to 2.6% in FY18. The government imposed surcharges on higher income tax slabs and worked widen the tax bracket to achieve this. Even so, the improvement in income tax, as a proportion of GDP, is not much. The big gains have come from “other taxes”, predominantly indirect taxes such as excise and service tax, and now the goods and services tax (GST). These went up from 4.5% of GDP in FY14 to 5.7% of GDP by FY18.

So, where did the extra taxes (the increase of 1.5 % of GDP) go? The central government has to share some part of with the states due to finance commission decision to increase the states share from 32 percent to 42 percent. Therefore the rise in net tax revenues for the center, after sharing with the states, was much more modest—from 7.3% of GDP in FY14 to 7.6% of GDP in FY18, although the hope is for a big jump this year. Since the extra amount collected by the center has gone to the states, how did the center managed to bring down the fiscal deficit by 0.9 percent? Well, the 0.3 percent is from the increase in net tax revenues and the rest is managed through the reduction in expenditure. But a question again rises is that if the government reduced expenditure then how did it invest huge money in building roads and bridges, and other public works. This money came from optimization of subsidies, which came down from 2.3 percent of GDP in FY14 to 1.6 percent of GDP in FY18, thanks largely to the withdrawal of subsidies on petrol and diesel. So the pattern of expenditure changed. The fall in oil prices provided the government space to reduce subsidies and invest money in infrastructure.

So in the last four years people paid more taxes, their subsidies were reduced and the government has been able to trim the fiscal deficit, shared more money with states, and increased spending on infrastructure. These positive developments were made by Jaitley despite the shocks of demonetization and GST. Hence, the data proves that Arun Jaitley is the best finance minister India has ever had and his contributions will be remembered by generations.